- United States

- /

- Hotel and Resort REITs

- /

- NYSE:PK

Park Hotels & Resorts (PK): Assessing Valuation as Shares Trade Sideways and Long-Term Trends Diverge

Reviewed by Simply Wall St

See our latest analysis for Park Hotels & Resorts.

Taking a step back, Park Hotels & Resorts’ share price has slipped nearly 20% so far this year. However, the longer-term view shows a much brighter picture with a 51% total return over five years. While recent momentum has cooled, that longer arc highlights pockets of resilience and renewed optimism around recovery in hospitality real estate.

If today's price action has you curious about opportunities beyond the sector, now's a smart time to broaden your perspective and discover fast growing stocks with high insider ownership

With shares trading at a notable discount to both analyst estimates and intrinsic value, Park Hotels & Resorts presents an intriguing crossroads. This situation invites investors to consider whether this is a genuine buying opportunity or if the market has already priced in the company’s growth potential.

Most Popular Narrative: 12.9% Undervalued

Park Hotels & Resorts’ most-followed narrative puts its fair value at $12.69, notably higher than the recent close at $11.05. The difference highlights analysts’ conviction that there is more upside than the market currently reflects.

Strategic asset sales and portfolio reshaping, particularly the disposal of 18 non-core or underperforming hotels, are set to improve portfolio quality, lift average RevPAR, and expand net margins. This approach is expected to drive higher long-term earnings and reduce revenue volatility as the company shifts focus to premium, high-growth properties.

Wonder what’s fueling this bullish comparison to the market? The underlying story is a bold reset in revenue growth and profit margins, anchoring a premium valuation far above today’s price. Find out what financial levers and forecasts justify this upside. There is a crucial long-term assumption you may not expect.

Result: Fair Value of $12.69 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent weak travel demand or rising refinancing risks could challenge the recovery narrative and lead to slower earnings growth than analysts anticipate.

Find out about the key risks to this Park Hotels & Resorts narrative.

Another View: Are Shares Really a Bargain?

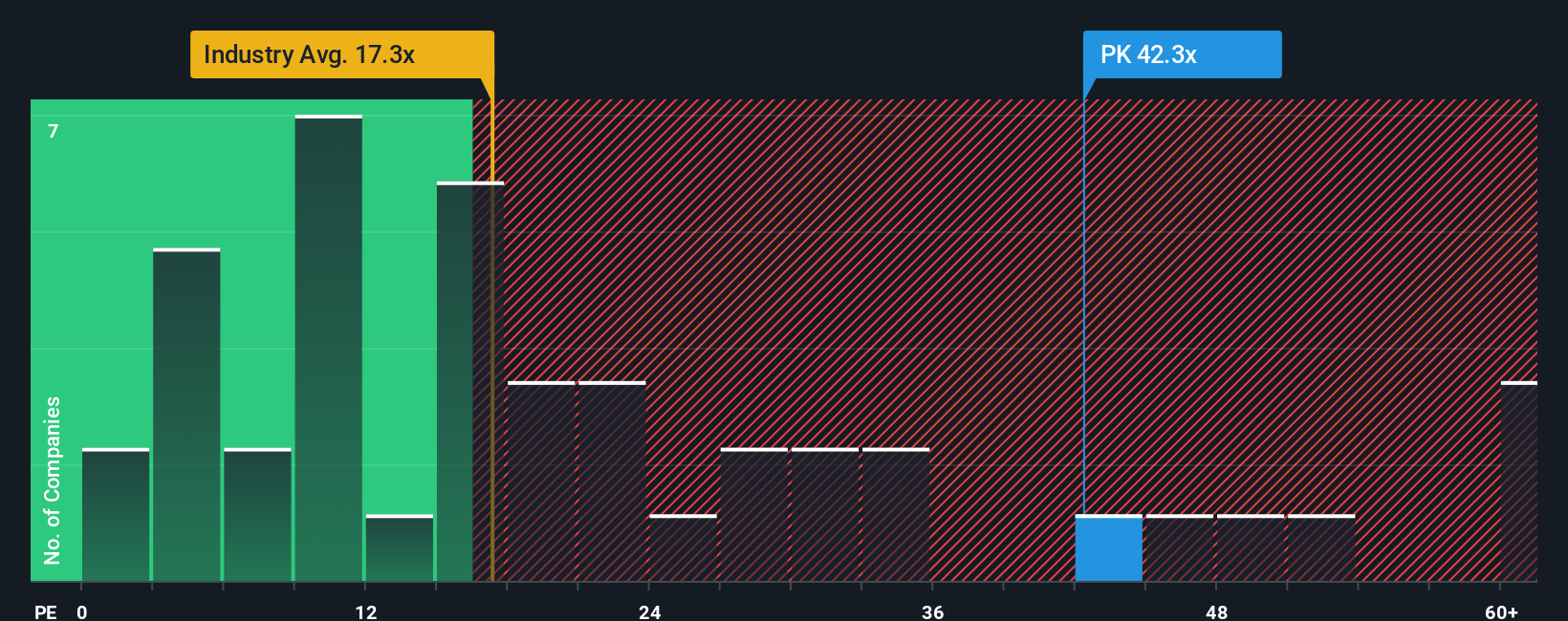

Looking at valuation through conventional market ratios tells a different story. Park’s price-to-earnings ratio is 38.8x, far above both its peer average of 23.9x and the global industry average of 16.6x. Even its current ratio is below the “fair ratio” the market could eventually move toward, creating potential valuation risk for investors. Does this gap hint at caution or just misunderstood opportunity?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Park Hotels & Resorts Narrative

If you see the numbers differently or want to uncover your own insights, you can assemble a narrative in just a few minutes. Do it your way

A great starting point for your Park Hotels & Resorts research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Don’t miss out on standout opportunities. The right screener could help you spot tomorrow’s leaders before the crowd. Let Simply Wall Street’s tools give you the edge to find what others overlook.

- Capitalize on surging high-yield opportunities by tapping into these 17 dividend stocks with yields > 3% with solid financials and generous income streams.

- Ride the momentum of breakthrough automation and smart technology by zeroing in on these 27 AI penny stocks positioned to transform the AI landscape.

- Maximize your investment potential with these 872 undervalued stocks based on cash flows offering attractive valuations and strong cash flow fundamentals for long-term growth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PK

Park Hotels & Resorts

Park is one of the largest publicly-traded lodging real estate investment trusts (“REIT”) with a diverse portfolio of iconic and market-leading hotels and resorts with significant underlying real estate value.

Average dividend payer with slight risk.

Market Insights

Community Narratives