- United States

- /

- REITS

- /

- NYSE:PINE

Can Alpine Income Property Trust’s (PINE) Investment-Grade Tenant Focus Redefine Its Income Stability?

Reviewed by Sasha Jovanovic

- Earlier this month, Alpine Income Property Trust announced the US$20.7 million acquisition of three fully leased retail properties in Richmond, Virginia, anchored by investment-grade tenants such as Walmart and TJ Maxx, and also completed the purchase of a Sam's Club-leased property in Houston, Texas.

- With these acquisitions, approximately half of Alpine Income Property Trust's annualized base rent is now attributable to investment-grade rated tenants, marking a shift toward greater income stability in its portfolio.

- We'll now explore how Alpine's expanded investment-grade tenant base could influence its long-term investment narrative and risk profile.

We've found 14 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Alpine Income Property Trust Investment Narrative Recap

To be a shareholder in Alpine Income Property Trust, you need to believe in the potential for income stability by expanding its exposure to investment-grade tenants, especially as retail sector disruption persists. The recent acquisitions anchored by Walmart and Sam’s Club strengthen this narrative by boosting the share of high-credit tenants, but they do not materially change the biggest short-term catalyst, profitable growth, nor address the most immediate risk stemming from Alpine’s high leverage and sensitivity to interest rates.

Among recent announcements, the fourth-quarter common stock dividend declaration of US$0.285 per share, reflecting an annualized yield of 6.9%, is particularly relevant, as it signals ongoing commitment to shareholder returns even as portfolio quality improves with these new acquisitions. Consistency in dividend payments may attract income-focused investors, but its sustainability remains tied to Alpine’s progress in balancing growth with elevated debt levels.

However, before shifting focus to future opportunities, it’s important to recognize that the risk posed by Alpine’s sizable debt load and exposure to tightening capital markets is information every investor should...

Read the full narrative on Alpine Income Property Trust (it's free!)

Alpine Income Property Trust's narrative projects $63.2 million revenue and $12.5 million earnings by 2028. This requires 3.9% yearly revenue growth and a $13.2 million increase in earnings from the current -$698.0 thousand.

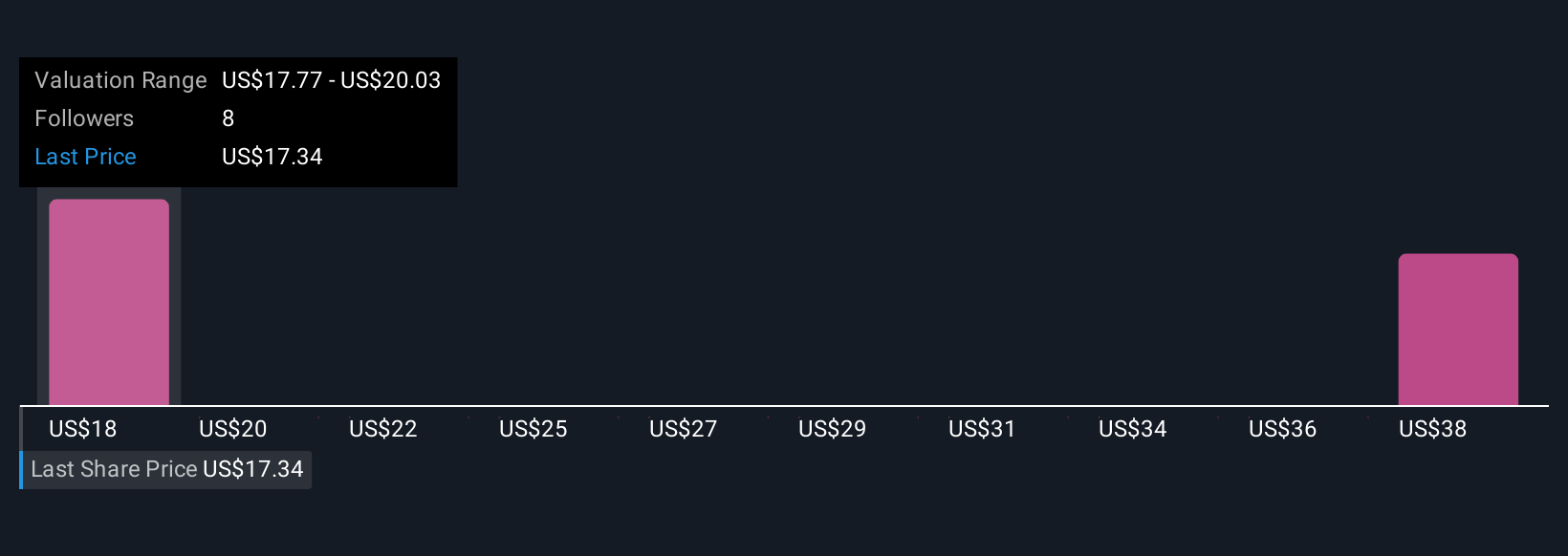

Uncover how Alpine Income Property Trust's forecasts yield a $17.77 fair value, in line with its current price.

Exploring Other Perspectives

Three members of the Simply Wall St Community provided fair value estimates ranging from US$17.77 to US$40.07 per share. While optimism surrounds the boost in investment-grade tenant exposure, high leverage remains critical for Alpine’s long-term resilience, consider how others may view these trade-offs as you form your perspective.

Explore 3 other fair value estimates on Alpine Income Property Trust - why the stock might be worth over 2x more than the current price!

Build Your Own Alpine Income Property Trust Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Alpine Income Property Trust research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Alpine Income Property Trust research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Alpine Income Property Trust's overall financial health at a glance.

Seeking Other Investments?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PINE

Alpine Income Property Trust

Alpine Income Property Trust, Inc. (the “Company” or “PINE”) is a real estate investment trust (“REIT”) that owns and operates a high-quality portfolio of commercial net lease properties.

Average dividend payer with moderate growth potential.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success