- United States

- /

- Office REITs

- /

- NYSE:PGRE

Paramount Group (PGRE): Assessing Valuation After Strong 2024 Shareholder Returns

Reviewed by Simply Wall St

Paramount Group (PGRE) has been getting more attention from investors lately as its year-to-date total return reaches 32%. The real estate company is seeing mixed performance across different time spans, which invites questions about its valuation.

See our latest analysis for Paramount Group.

Paramount Group’s year-to-date total shareholder return of nearly 36% stands out, especially when you consider the muted moves in the past quarter. This recent jump comes despite continued challenges in the office real estate sector, which suggests that investors are beginning to see some upside or a shift in sentiment. However, the longer-term five-year total return remains negative. In short, while there is clear momentum this year, the stock’s long-term performance is still working to catch up.

If you’re looking for other interesting opportunities with above-average growth, now is the perfect time to broaden your sights and discover fast growing stocks with high insider ownership

That raises the key question: is Paramount Group’s recent surge a sign that the stock is undervalued, or are investors already pricing in any potential rebound in the office real estate market?

Price-to-Sales Ratio of 2.1x: Is it justified?

Paramount Group is currently trading at a price-to-sales (P/S) ratio of 2.1x, which puts its valuation at about the same level as the US Office REITs industry average but slightly higher than its direct peers. With a last close of $6.55, the stock does not show signs of being undervalued on this metric alone.

The price-to-sales ratio measures how much investors are willing to pay for every dollar of the company’s revenue. For office REITs, this multiple helps gauge market expectations, especially in a sector facing uncertainty about demand and occupancy rates.

Paramount Group’s P/S ratio aligns with the broader US Office REIT industry average of 2.1x but comes in above the peer average of 1.9x. That suggests the market is assigning a slight premium relative to direct competitors, perhaps seeing the company’s portfolio or management as more resilient. However, when compared to the estimated Fair Price-to-Sales Ratio of 2.4x, the current valuation may have some room to move.

Explore the SWS fair ratio for Paramount Group

Result: Price-to-Sales of 2.1x (ABOUT RIGHT)

However, declining annual revenue and net income growth remain key risks that could challenge Paramount Group’s recent momentum and investor optimism.

Find out about the key risks to this Paramount Group narrative.

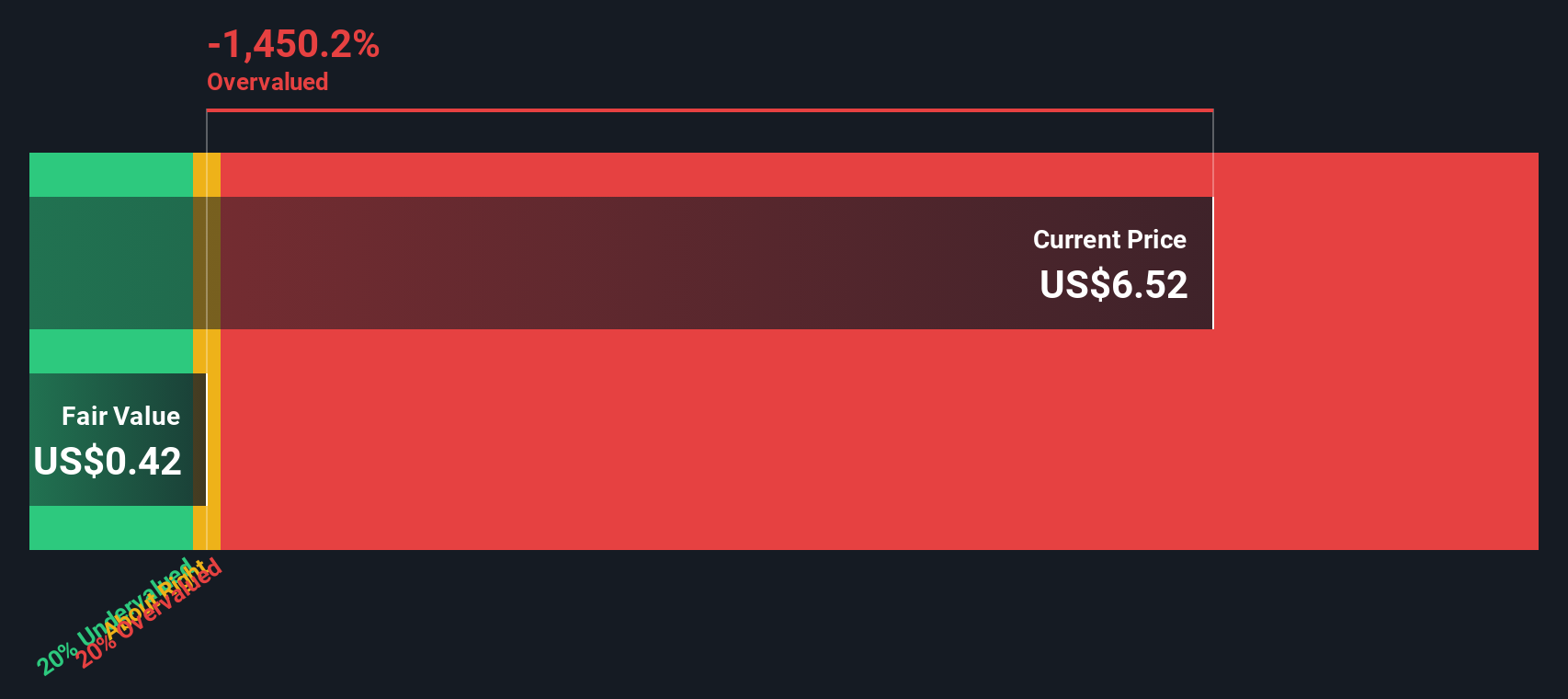

Another View: Discounted Cash Flow Tells a Different Story

While the price-to-sales ratio suggests Paramount Group is reasonably valued, our DCF model presents a much less optimistic picture. According to this approach, the shares trade well above their estimated fair value, which may indicate the market is overlooking significant downside risks. Does this model reveal something that the multiples miss?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Paramount Group for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 879 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Paramount Group Narrative

If you have a different perspective or want to dig deeper into the numbers yourself, you can easily build your own view in just a few minutes. Do it your way

A great starting point for your Paramount Group research is our analysis highlighting 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t let your next great investment opportunity pass you by. Give yourself an edge by using Simply Wall Street’s advanced screeners that reveal what others might be missing.

- Boost your income strategy by targeting stocks with reliable yields. these 16 dividend stocks with yields > 3% offers more than 3% annual returns and solid track records.

- Catch early-stage innovators who are shaping tomorrow’s markets by building your watchlist with these 3593 penny stocks with strong financials, which combine robust financials and growth potential.

- Tap into the high-growth world of artificial intelligence by uncovering these 25 AI penny stocks, which are positioned to benefit from major technological breakthroughs and real-world adoption.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PGRE

Mediocre balance sheet with very low risk.

Similar Companies

Market Insights

Community Narratives