- United States

- /

- Specialized REITs

- /

- NYSE:OUT

OUTFRONT Media (OUT): Assessing Valuation After Stacy Minero’s Appointment Spurs Investor Interest

Reviewed by Simply Wall St

The appointment of Stacy Minero as Chief Marketing & Experience Officer at OUTFRONT Media (OUT) is attracting fresh interest from investors. Minero brings an impressive track record in creative campaigns and brand strategy across major tech and media firms.

See our latest analysis for OUTFRONT Media.

OUTFRONT Media's latest C-suite addition builds on a period of strong momentum. After announcing leadership changes and presenting at a major industry conference, OUTFRONT's share price has climbed 31.7% over the past month. This has contributed to a robust 26.1% total shareholder return over the last year and a notable 69.8% total return for shareholders over three years. While near-term gains suggest renewed optimism, the longer-term track record shows the company has delivered for patient investors.

If you’re interested in finding other companies with impressive growth stories and dynamic leadership, now’s a great time to discover fast growing stocks with high insider ownership

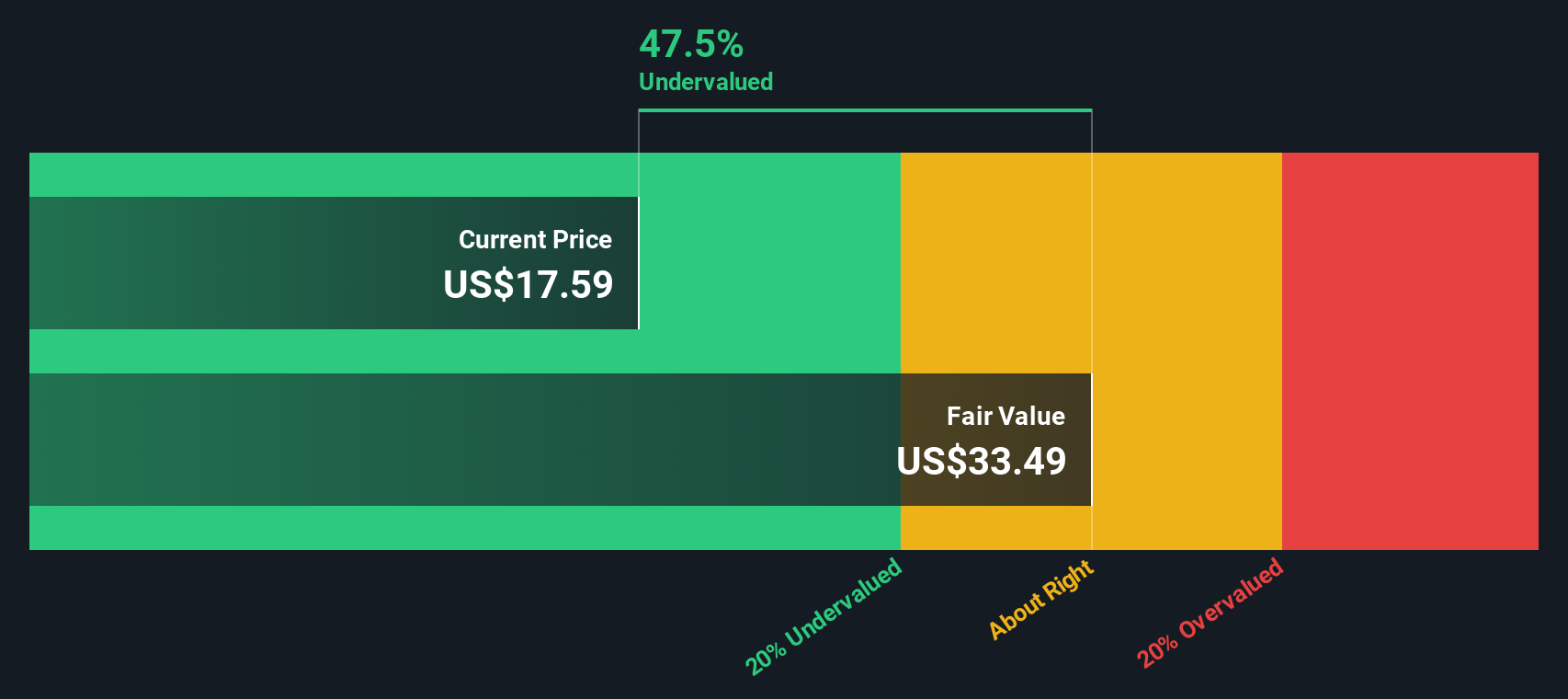

With the stock rallying sharply over the past month, investors may be wondering whether OUTFRONT Media’s intrinsic value still offers a margin of safety or if recent optimism means the market has already priced in the company’s renewed growth trajectory.

Most Popular Narrative: 9.2% Overvalued

OUTFRONT Media’s widely followed narrative now assigns a fair value of $21.33 per share versus a recent closing price of $23.30. This suggests a modest disconnect as investors bid the stock higher. The narrative describes significant technological and creative reinvention that could reshape OUTFRONT’s near-term fortunes.

The company's enhanced focus on data analytics, programmatic buying, and improved audience measurement (via investment in ad tech and centralized operations) positions it to capture more digital ad budgets, driving higher occupancy rates and increased revenue per asset.

Behind this pricing is an ambitious plan to pursue digital dominance, future-proof margins, and rapidly expand high-value ad inventory. Want to know which future-facing numbers form the foundation of this outlook and why the valuation might change direction fast? The details might surprise you.

Result: Fair Value of $21.33 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing shifts in advertiser budgets toward digital channels and challenges from declining static billboard demand could create pressure on OUTFRONT Media's future growth.

Find out about the key risks to this OUTFRONT Media narrative.

Another View: Discounted Cash Flow Tells a Different Story

While traditional analyst price targets currently point to OUTFRONT Media trading slightly above fair value, our DCF model presents a more optimistic outlook. The DCF methodology estimates OUTFRONT's fair value at $40.55 per share, which is well above its recent price. This approach suggests there may be untapped value that the market is overlooking. Which narrative will win out as performance unfolds?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out OUTFRONT Media for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 928 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own OUTFRONT Media Narrative

If you want to see the full picture, take a look at the numbers yourself. Building your own perspective takes just a few minutes. Do it your way

A great starting point for your OUTFRONT Media research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Don’t let the next big opportunity pass you by. Use the Simply Wall Street Screener to find stocks matching your strategy and outperform the crowd.

- Boost your portfolio’s income with attractive yields when you check out these 14 dividend stocks with yields > 3% offering stable returns above 3%.

- Catch the early movers in artificial intelligence by scanning these 25 AI penny stocks which is packed with innovation and rapid growth potential.

- Take advantage of overlooked value by examining these 928 undervalued stocks based on cash flows selected for strong cash flow fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:OUT

OUTFRONT Media

OUTFRONT is one of the largest and most trusted out-of-home media companies in the U.S., helping brands connect with audiences in the moments and environments that matter most.

Reasonable growth potential average dividend payer.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Not a Bubble, But the "Industrial Revolution 4.0" Engine

The "David vs. Goliath" AI Trade – Why Second Place is Worth Billions

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026