- United States

- /

- Specialized REITs

- /

- NYSE:OUT

Does OUTFRONT Media’s 5% Rise Signal Room for More Gains in 2025?

Reviewed by Bailey Pemberton

- Thinking of adding OUTFRONT Media to your portfolio and wondering if it's really worth the price you see on your screen? You're not alone, and we’re about to break down exactly where its true value might lie.

- Despite a mix of ups and downs, the stock has gained 5.2% over the past year, even as short-term moves like a decline of 0.9% over the week and 2.6% over the month might have tested investors' nerves.

- Recent headlines have put the spotlight on the outdoor advertising sector’s resilience to shifting consumer habits and changes in urban mobility. This has fueled conversations about OUTFRONT Media’s adaptability, and industry watchers are debating whether these trends signal new opportunities for growth or just more volatility ahead.

- On our 6-point valuation check, OUTFRONT Media scores 3 out of 6 for being undervalued, putting it right in the middle of the pack. However, as you'll see, there are smarter ways to judge value that we'll dig into by the end of this article.

Approach 1: OUTFRONT Media Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's value by projecting its future adjusted funds from operations, then discounting those anticipated cash flows back to a present value. This approach helps investors see whether the current share price truly reflects the business's financial potential.

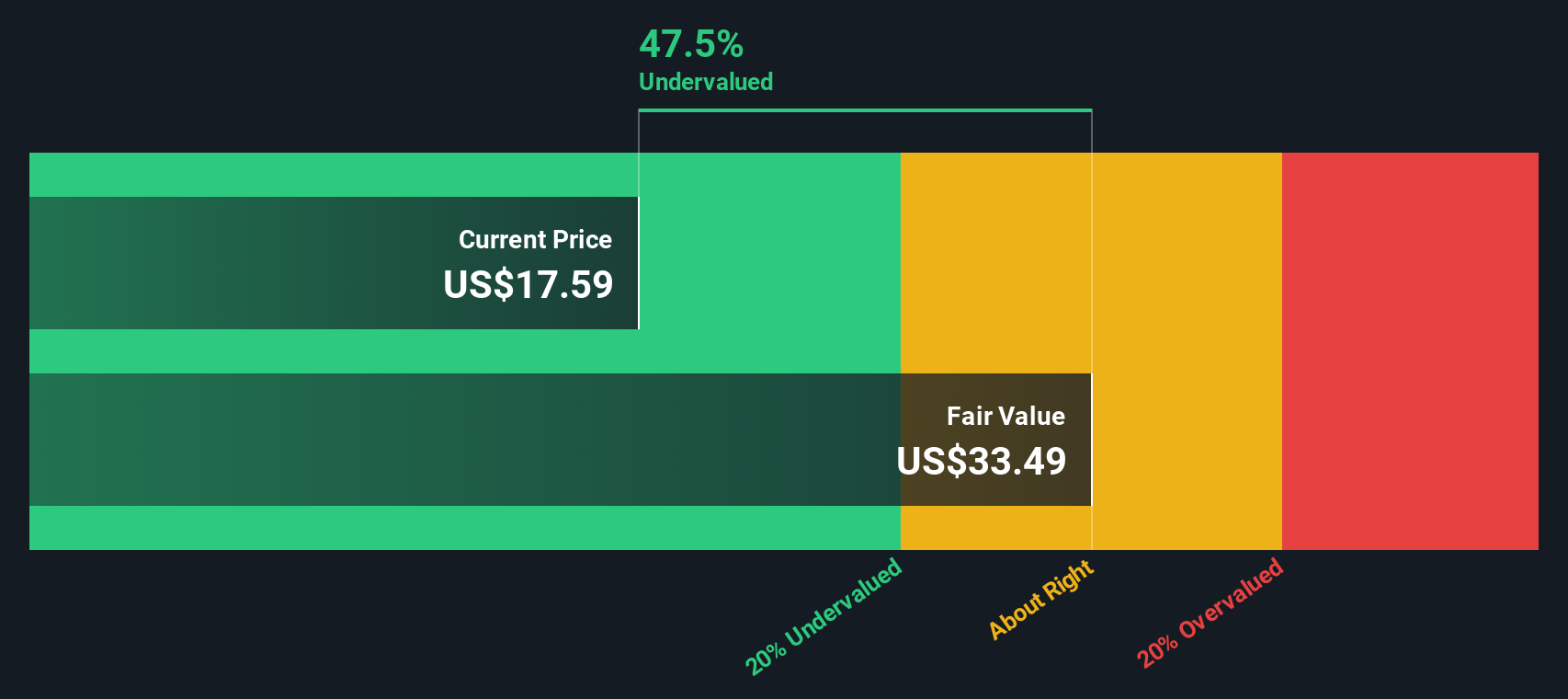

For OUTFRONT Media, the most recent full-year Free Cash Flow reported was $307.5 million. Analyst estimates predict this will rise steadily, reaching $341.7 million by the end of 2026. Beyond these analyst forecasts, Simply Wall St extrapolates growth, suggesting Free Cash Flow could grow to $487.5 million by 2035. These projections use a 2 Stage Free Cash Flow to Equity model, incorporating both near-term analyst expectations and longer-term, modest growth rates.

When these projected cash flows are discounted back into today’s dollars, the DCF analysis arrives at a fair value estimate of $34.56 per share. This implies the stock is trading at a 48.9% discount to its intrinsic value, meaning it is significantly undervalued according to this model. The DCF suggests the market may be underestimating OUTFRONT Media’s future earning power.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests OUTFRONT Media is undervalued by 48.9%. Track this in your watchlist or portfolio, or discover 843 more undervalued stocks based on cash flows.

Approach 2: OUTFRONT Media Price vs Earnings

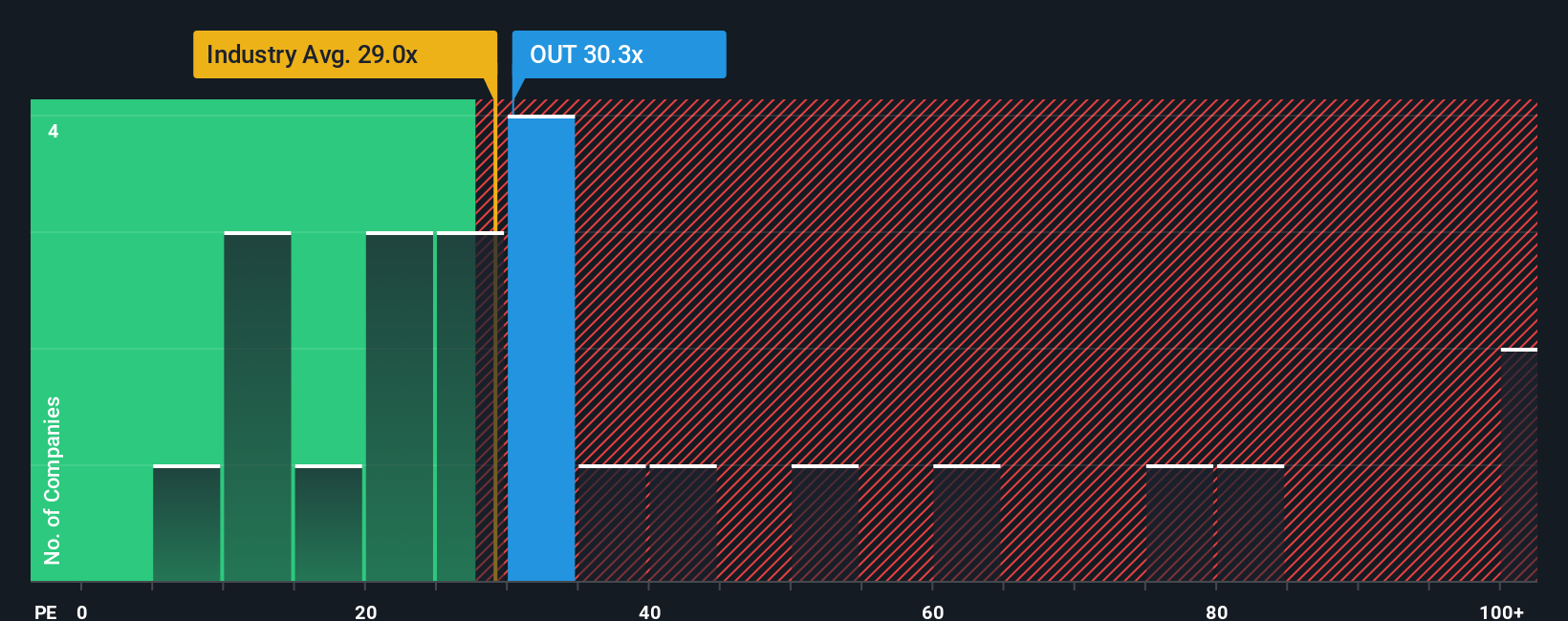

For profitable companies like OUTFRONT Media, the Price-to-Earnings (PE) ratio is a widely used valuation metric that reflects how much investors are willing to pay for each dollar of earnings. This ratio is especially valuable because it directly links the company's share price to its ability to generate profits, making it a familiar and trusted yardstick among investors.

What constitutes a "normal" or "fair" PE ratio often depends on the company’s growth prospects and risk profile. High-growth, lower-risk companies typically command higher PE multiples, while those with slower growth or greater uncertainty tend to trade at lower ratios.

OUTFRONT Media currently trades at a PE ratio of 29.94x. This figure is notably above the average for its industry, Specialized REITs, which sits at 17.29x. It is also higher than the average of its peers at 20.73x. At first glance, this suggests the stock might be priced at a premium.

However, Simply Wall St’s proprietary “Fair Ratio” model presents a more nuanced perspective. The Fair Ratio for OUTFRONT Media is 40.36x, a level that incorporates key factors like the company’s earnings growth, profit margins, market cap, specific industry characteristics, and relevant risks. Rather than relying solely on comparisons to peers or the average REIT, this Fair Ratio provides a more tailored benchmark and offers a clearer reflection of OUTFRONT Media's unique profile and prospects.

Since the Fair Ratio of 40.36x is significantly above the current PE of 29.94x, this suggests that OUTFRONT Media is undervalued based on its earning potential and risk-adjusted growth outlook.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1410 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your OUTFRONT Media Narrative

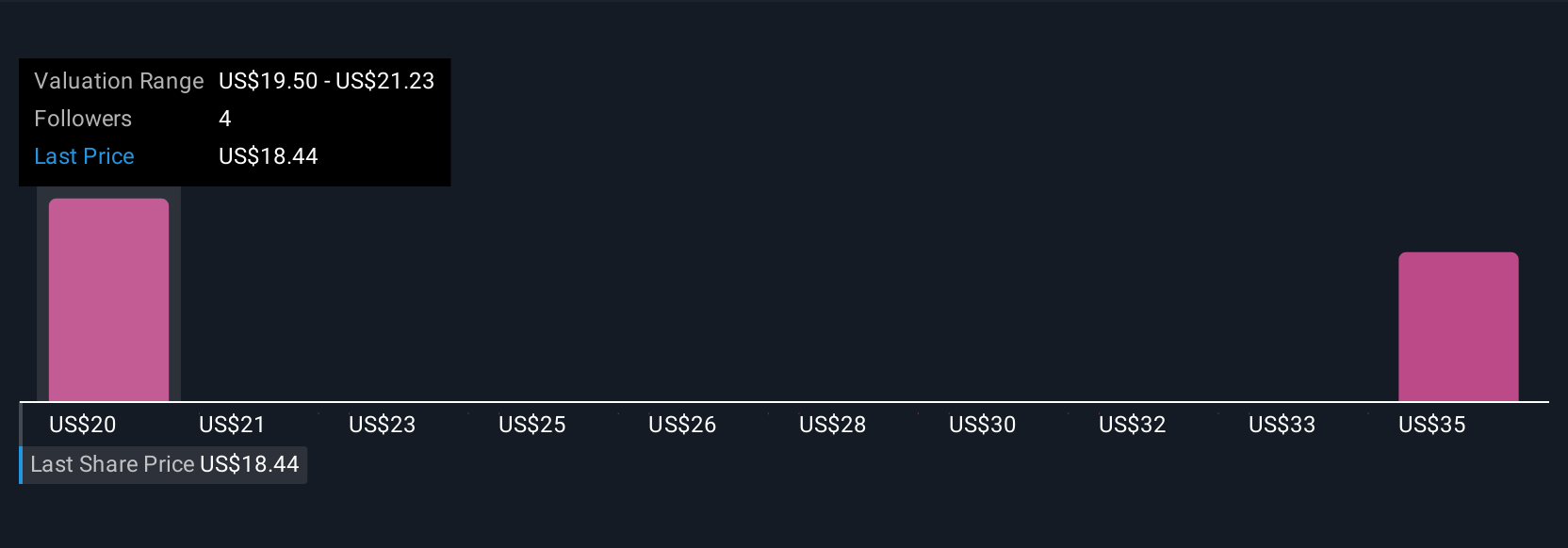

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is your interpretation of a company’s story, connecting what you know or expect about its future with numbers like revenue, margins, and your own fair value estimate. Instead of just looking at stock metrics, Narratives help you link OUTFRONT Media’s journey, from digital expansion and margin improvement to industry challenges and cost control, directly to what you believe it is really worth.

On Simply Wall St’s Community page, Narratives are a simple tool used by millions of investors to set out their perspective, compare fair value with the current share price, and see when it might make sense to buy or sell. Because Narratives are updated every time news or results come out, your forecast stays relevant as the facts change. For OUTFRONT Media, some investors are optimistic, expecting digital innovation to drive long-term growth and setting a higher fair value, while others are more cautious, factoring in risks from legacy assets and assigning a lower fair value. Narratives allow you to decide what matters most to you and turn your research into action, all in one place.

Do you think there's more to the story for OUTFRONT Media? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:OUT

OUTFRONT Media

OUTFRONT is one of the largest and most trusted out-of-home media companies in the U.S., helping brands connect with audiences in the moments and environments that matter most.

Reasonable growth potential and fair value.

Market Insights

Community Narratives