- United States

- /

- Specialized REITs

- /

- NYSE:OUT

Did Outfront Media (REIT)'s (NYSE:OUT) Share Price Deserve to Gain 54%?

There's no doubt that investing in the stock market is a truly brilliant way to build wealth. But not every stock you buy will perform as well as the overall market. Over the last year the Outfront Media Inc. (REIT) (NYSE:OUT) share price is up 54%, but that's less than the broader market return. However, the longer term returns haven't been so impressive, with the stock up just 20% in the last three years.

Check out our latest analysis for Outfront Media (REIT)

Outfront Media (REIT) isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Shareholders of unprofitable companies usually expect strong revenue growth. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

Outfront Media (REIT) actually shrunk its revenue over the last year, with a reduction of 31%. Given the revenue reduction the modest 54% share price rise over the year seems pretty decent. We'd want to see progress to profitability before getting too interested in this stock.

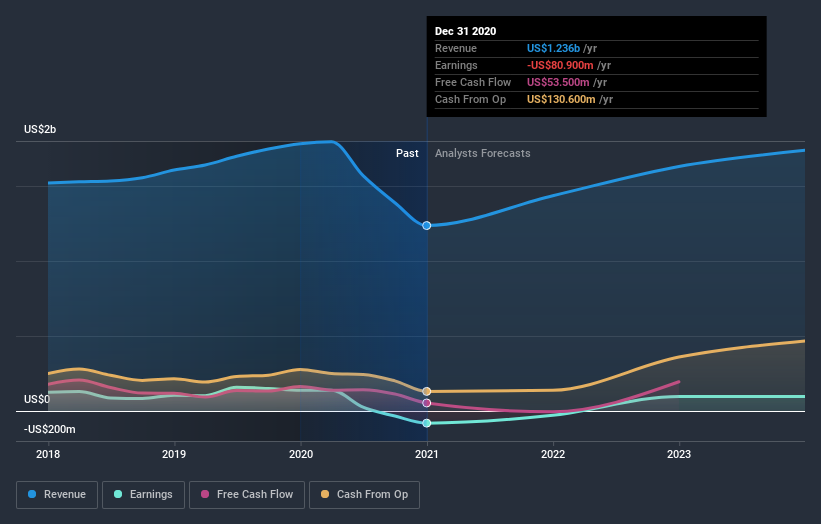

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

A Different Perspective

Outfront Media (REIT) provided a TSR of 54% over the year. That's fairly close to the broader market return. Most would be happy with a gain, and it helps that the year's return is actually better than the average return over five years, which was 6%. Even if the share price growth slows down from here, there's a good chance that this is business worth watching in the long term. It's always interesting to track share price performance over the longer term. But to understand Outfront Media (REIT) better, we need to consider many other factors. For example, we've discovered 1 warning sign for Outfront Media (REIT) that you should be aware of before investing here.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

If you decide to trade Outfront Media (REIT), use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NYSE:OUT

OUTFRONT Media

OUTFRONT is one of the largest and most trusted out-of-home media companies in the U.S., helping brands connect with audiences in the moments and environments that matter most.

Reasonable growth potential and fair value.

Market Insights

Community Narratives