- United States

- /

- Health Care REITs

- /

- NYSE:OHI

Omega Healthcare Investors (OHI): Evaluating Valuation Following Strong Q3 Results and Raised Guidance

Reviewed by Simply Wall St

Omega Healthcare Investors (OHI) just reported its third quarter results, beating expectations on both revenue and profit. The company’s raised full-year outlook, new investments, and favorable regulatory news are creating a positive story for shareholders.

See our latest analysis for Omega Healthcare Investors.

The momentum around Omega Healthcare Investors has clearly picked up steam, helped by a wave of strong earnings, optimistic guidance, and several strategic investments in new facilities and joint ventures. The share price is up 10.98% so far this year, while its total return over the past three years has climbed an impressive 60.5%. As positive regulatory news and solid financials drive fresh optimism, investors seem to be treating Omega less like a turnaround story and more like a consistent long-term compounder.

If Omega’s recent results have you thinking about what else is out there, this is a perfect moment to expand your search and discover fast growing stocks with high insider ownership

With shares rallying after a string of strong results and upgraded forecasts, the real question is whether Omega Healthcare Investors remains undervalued by the market or if future growth is already reflected in the current price.

Most Popular Narrative: 4.8% Undervalued

Omega Healthcare Investors’ current share price of $42.03 sits just below the most widely followed narrative's fair value estimate of $44.13. This suggests the market may be undervaluing the company according to the latest consensus. This valuation is based on expectations of sector resilience and improved dividend coverage following a period of stronger operating performance.

"Bullish analysts have increased price targets in response to stronger dividend coverage prospects. This suggests greater confidence in the company's ability to maintain and potentially grow distributions."

Ready for a deep valuation reveal? The numbers fueling this fair value hinge on aggressive forecasts for profits and growing confidence in management’s financial execution. Curious about the bold projections and hidden assumptions pushing analyst targets higher? Discover the drivers powering this valuation and why the margin for error is razor thin.

Result: Fair Value of $44.13 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, issues such as tenant credit risks and potential changes in healthcare reimbursement could quickly challenge the current outlook and alter Omega’s long-term growth story.

Find out about the key risks to this Omega Healthcare Investors narrative.

Another View: What Do the Ratios Say?

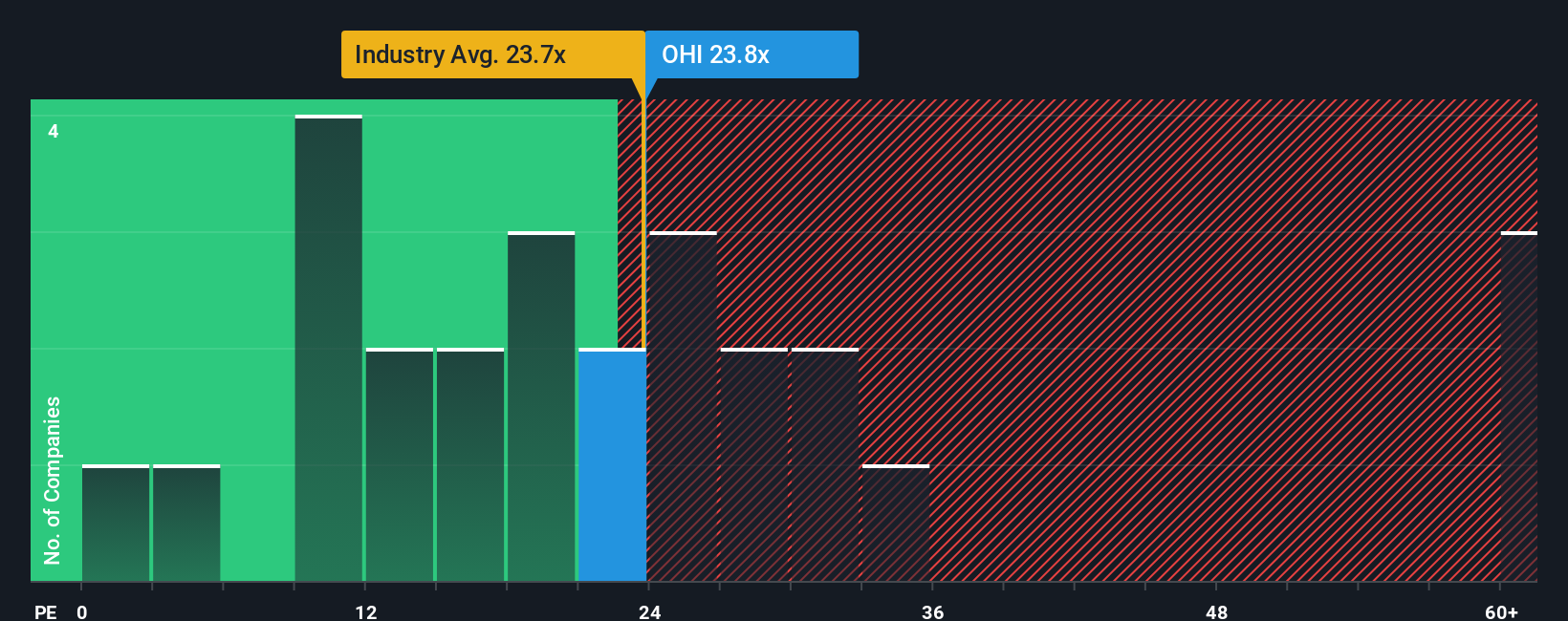

Looking at Omega Healthcare Investors through a price-to-earnings lens reveals a mixed message. The company trades at 23.8 times earnings, which is slightly pricier than the global industry average of 23.6, but well below the peer average of 57.3. More importantly, it is still far under the fair ratio of 33, suggesting some valuation upside if the market re-rates the stock. But does a lower multiple mean less risk, or could it indicate lingering skepticism?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Omega Healthcare Investors Narrative

If you'd rather dig into the numbers and shape your own Omega story, you’re only a few minutes away from building your own view. Do it your way

A great starting point for your Omega Healthcare Investors research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Why stick with the usual picks when you could uncover smarter opportunities? Move ahead of the crowd and expand your watchlist today by getting hands-on with these powerful stock ideas:

- Fuel your portfolio with high potential income options. Tap into these 20 dividend stocks with yields > 3% for opportunities offering exceptional yields over 3% and solid fundamentals.

- Seize the unique potential of emerging tech. Check out these 27 AI penny stocks featuring companies at the forefront of artificial intelligence innovation.

- Capitalize on tomorrow’s standouts before the rest. Spot these 839 undervalued stocks based on cash flows now and position yourself for returns driven by strong underlying cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:OHI

Omega Healthcare Investors

A Real Estate Investment Trust (“REIT”) providing financing and capital to the long-term healthcare industry in the United States and the United Kingdom with a focus on skilled nursing and assisted living facilities, including care homes in the United Kingdom.

6 star dividend payer with solid track record.

Similar Companies

Market Insights

Community Narratives