- United States

- /

- Health Care REITs

- /

- NYSE:OHI

Omega Healthcare Investors (OHI): Evaluating Valuation After Major Stake Increase by Cohen & Steers

Reviewed by Simply Wall St

Cohen & Steers, a widely followed investment manager, recently boosted its position in Omega Healthcare Investors (OHI) by picking up nearly 8 million more shares. This move suggests growing institutional confidence in Omega's role within healthcare real estate.

See our latest analysis for Omega Healthcare Investors.

Omega Healthcare Investors has seen a steady uptick in momentum lately, with a 12.4% gain in the 1-month share price return and 19.6% total shareholder return over the last year. With major firms like Cohen & Steers increasing their stakes, investors appear to be growing more interested in Omega’s long-term prospects in healthcare real estate.

If this surge has you scanning for more opportunities in the sector, you might discover fresh potential by exploring See the full list for free.

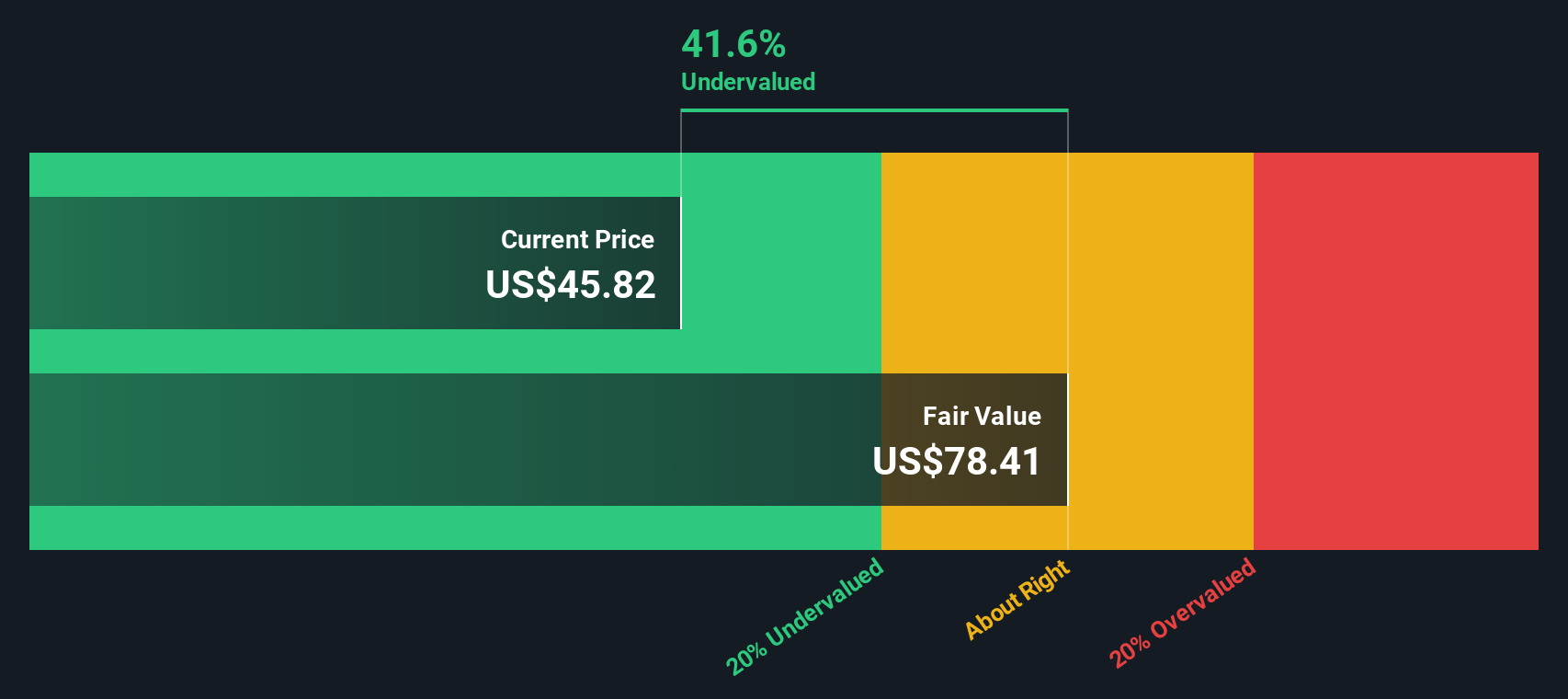

But with shares trading near analyst targets and strong returns posted over the past year, investors must now consider whether Omega Healthcare Investors is undervalued or if the company’s growth story is already fully reflected in today’s price.

Most Popular Narrative: Fairly Valued

With Omega Healthcare Investors closing at $45.50 and the narrative fair value at $45.13, the latest narrative points to a consensus that shares are close to fair value. This sets a clear expectation for what is driving current convictions in the market.

Omega's disciplined balance sheet management and opportunistic use of both debt and equity, along with a low leverage ratio at decade lows and a largely fixed-rate debt structure, position the company to pursue high-yield acquisitions and portfolio expansion at accretive rates. This supports long-term AFFO and net earnings growth.

Want to know which financial levers are powering this balanced view? The most influential projections involve margin expansion and disciplined expansion, but the real surprise is what analysts are forecasting for profit growth over the next few years. Discover the bold assumptions behind this fair value and see if you agree with their outlook.

Result: Fair Value of $45.13 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.

However, lingering risks remain, such as tenant credit events or changes in reimbursement policy. These factors could quickly shift sentiment and challenge the current outlook.

Find out about the key risks to this Omega Healthcare Investors narrative.

Another View: DCF Model Paints a Different Picture

While the market consensus considers Omega Healthcare Investors fairly valued, our SWS DCF model suggests a very different story. With shares trading around $45.50 and the model estimating fair value at $78.41, Omega may actually be significantly undervalued. Can this optimistic number stand up to real-world uncertainties?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Omega Healthcare Investors for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 924 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Omega Healthcare Investors Narrative

If you'd rather take a hands-on approach or see different angles, it only takes a few minutes to build your own narrative from scratch. Do it your way

A great starting point for your Omega Healthcare Investors research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Take the lead with your investing journey and tap into a world of new opportunities beyond Omega Healthcare Investors. The next standout stock could be waiting for you right now, but only if you know where to look.

- Tap into fast-growing trends by tracking the innovators behind these 26 AI penny stocks as they push artificial intelligence into every corner of the market.

- Sharpen your search for value with these 924 undervalued stocks based on cash flows to uncover stocks trading below their potential and poised for a re-rating.

- Maximize your passive income strategies by evaluating these 14 dividend stocks with yields > 3% offering solid yields above 3 percent and reliable payout histories.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:OHI

Omega Healthcare Investors

A Real Estate Investment Trust (“REIT”) providing financing and capital to the long-term healthcare industry in the United States and the United Kingdom with a focus on skilled nursing and assisted living facilities, including care homes in the United Kingdom.

6 star dividend payer with solid track record.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success