- United States

- /

- Health Care REITs

- /

- NYSE:OHI

Omega Healthcare Investors (OHI): Evaluating Valuation After Debt Moves and Investment in AI-Driven Healthcare Tech

Reviewed by Kshitija Bhandaru

Omega Healthcare Investors (OHI) recently redeemed $600 million in senior notes, secured a new $2.3 billion unsecured credit facility, and reduced its debt interest margins. The company also invested in MedaSync, an AI-powered healthcare technology firm.

See our latest analysis for Omega Healthcare Investors.

Omega Healthcare Investors’ recent moves to shore up its balance sheet and invest in healthcare technology have added a dose of optimism to its story. While the 1-month share price return has slipped by 6.1%, the stock has still delivered a 5.8% gain year-to-date. Long-term investors who stuck with the company have seen a total shareholder return of over 100% in five years, pointing to resilient momentum despite some near-term volatility.

If these strategic shifts in healthcare REITs have you looking for more opportunities, now’s the perfect moment to discover See the full list for free.

But with shares currently trading around $40 and nearly a 10% gap to the average analyst price target, the real question is whether Omega Healthcare remains undervalued or if the market is already accounting for all the expected growth.

Most Popular Narrative: 8.6% Undervalued

With Omega Healthcare Investors closing at $40.08 and the most-followed narrative placing fair value at $43.87, valuation optimism is clearly building. Analyst confidence is shifting, and this has brought key business drivers into sharper focus.

Omega's robust acquisition pipeline in the U.S. and U.K., with ample liquidity, attractive yields around 10%, and strategic focus on both off-market and regional opportunities, positions the company to capitalize on sector consolidation and value-based care trends. This supports future revenue and FAD (Funds Available for Distribution) growth.

Curious what gutsy revenue and margin projections analysts are betting on? One number could unlock why Omega’s future multiple outshines industry rivals. Find the story behind this valuation before the next price move surprises you.

Result: Fair Value of $43.87 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing tenant credit issues and uncertain regulatory changes could quickly dampen sentiment. These factors pose near-term risks to Omega Healthcare's growth outlook.

Find out about the key risks to this Omega Healthcare Investors narrative.

Another View: When Multiples Send Mixed Signals

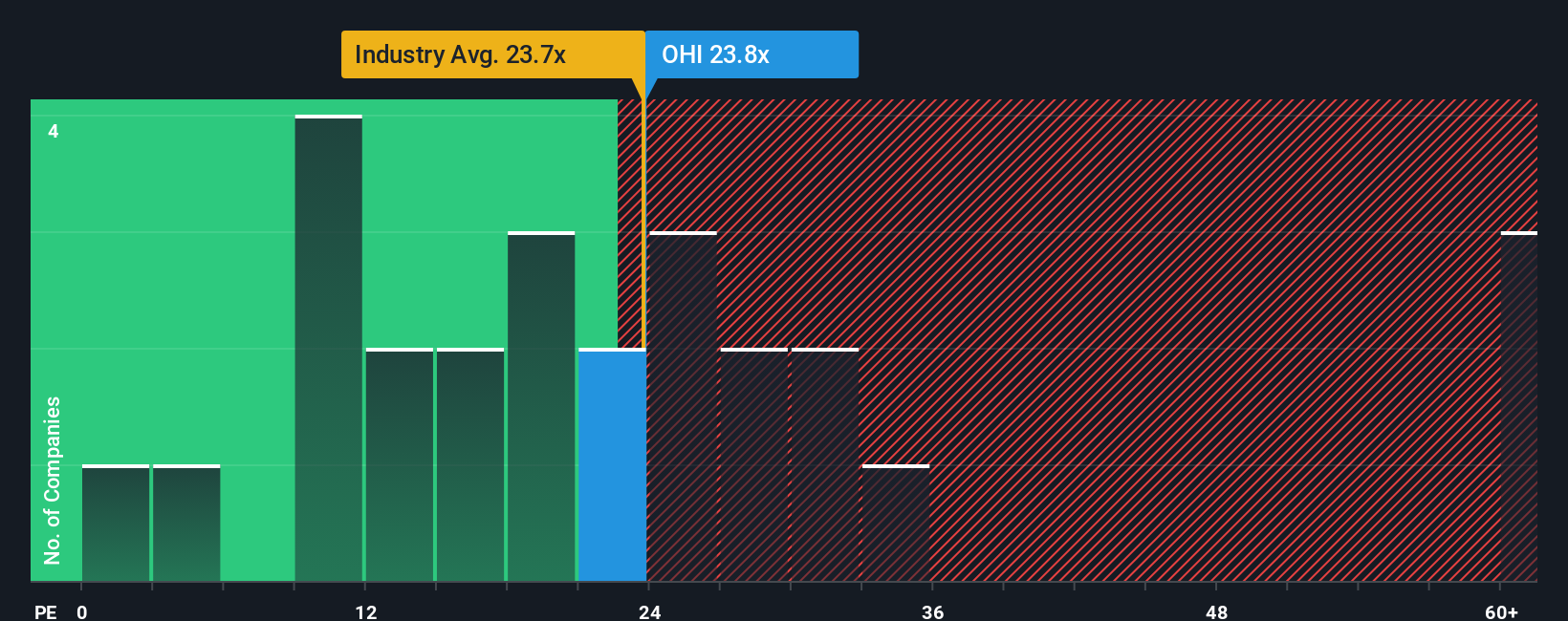

Looking at price-to-earnings, Omega Healthcare Investors trades at around 26 times earnings, while the broader global healthcare REITs average is 24 times, and peer companies trade near 72.6 times. Yet, the fair ratio for Omega could be closer to 35 times. This gap means there is both valuation caution and opportunity, which may indicate that market sentiment does not fully align with underlying fundamentals. Is the market missing out, or just being prudent?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Omega Healthcare Investors Narrative

If you want to dig deeper or put your own spin on the data, you can build a customized Omega Healthcare narrative in just a few minutes with Do it your way.

A great starting point for your Omega Healthcare Investors research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Stay ahead of the market by checking out other handpicked opportunities. You could spot tomorrow’s leaders by branching out from Omega Healthcare today. Don’t let these insights pass you by.

- Tap into emerging trends and ride momentum by evaluating these 24 AI penny stocks, which are shaping tomorrow’s breakthroughs in artificial intelligence.

- Capture income and stability by reviewing these 18 dividend stocks with yields > 3%, which features strong yields and robust payouts for long-term growth.

- Position yourself early in innovation by scanning these 26 quantum computing stocks, where rapid advancements could unlock new value drivers.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:OHI

Omega Healthcare Investors

A Real Estate Investment Trust (“REIT”) providing financing and capital to the long-term healthcare industry in the United States and the United Kingdom with a focus on skilled nursing and assisted living facilities, including care homes in the United Kingdom.

6 star dividend payer with solid track record.

Similar Companies

Market Insights

Community Narratives