- United States

- /

- Retail REITs

- /

- NYSE:O

Realty Income (NYSE:O) Equity Offering Spurs Fresh Look at Valuation, Guidance, and Dividend Prospects

Reviewed by Simply Wall St

Realty Income (NYSE:O) is in the spotlight after launching an at-the-market equity offering for up to 150 million shares. This decision follows updated 2025 guidance, ongoing dividend declarations, and recent quarterly revenue gains.

See our latest analysis for Realty Income.

After announcing its large equity offering, Realty Income’s share price recently closed at $56.87, reflecting some short-term volatility with a 1-month share price return of -3.6%. However, the real story is its steady long-term appeal. Total shareholder returns were 4.6% over the past year and nearly 20% over five years. This demonstrates that momentum for income-oriented investors remains solid even as guidance tightens and new capital is raised.

If Realty Income’s mix of resiliency and reliable dividends has you curious about other opportunities, now’s a good time to broaden your investing horizons and discover fast growing stocks with high insider ownership

With Realty Income now trading below its price target and boasting a notable intrinsic discount, the question for investors is clear: is this a genuine buying opportunity, or is future growth already reflected in the share price?

Most Popular Narrative: 7.2% Undervalued

The most widely followed narrative, authored by andre_santos, values Realty Income at $61.26 per share, which is moderately above its last close of $56.87. The fair value estimate suggests that the current market price still leaves some room for appreciation according to the narrative’s methodology.

“Realty Income currently appears to be trading slightly below its estimated fair value, with a discount of approximately 7.5%. Although future dividend growth is expected to moderate, the company remains a reliable option for investors seeking consistent and predictable monthly income.”

Want to understand the secret behind this fair value? The answer relies on a strategic split between future dividend growth and historical yield trends. There are bold predictions hidden in the fine print of this forecast. Will that next dividend boost tilt the scales? See the numbers that could shift the story.

Result: Fair Value of $61.26 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, Realty Income still faces risks, such as rising interest rates or unexpected tenant instability. These factors could pressure future dividends and share price momentum.

Find out about the key risks to this Realty Income narrative.

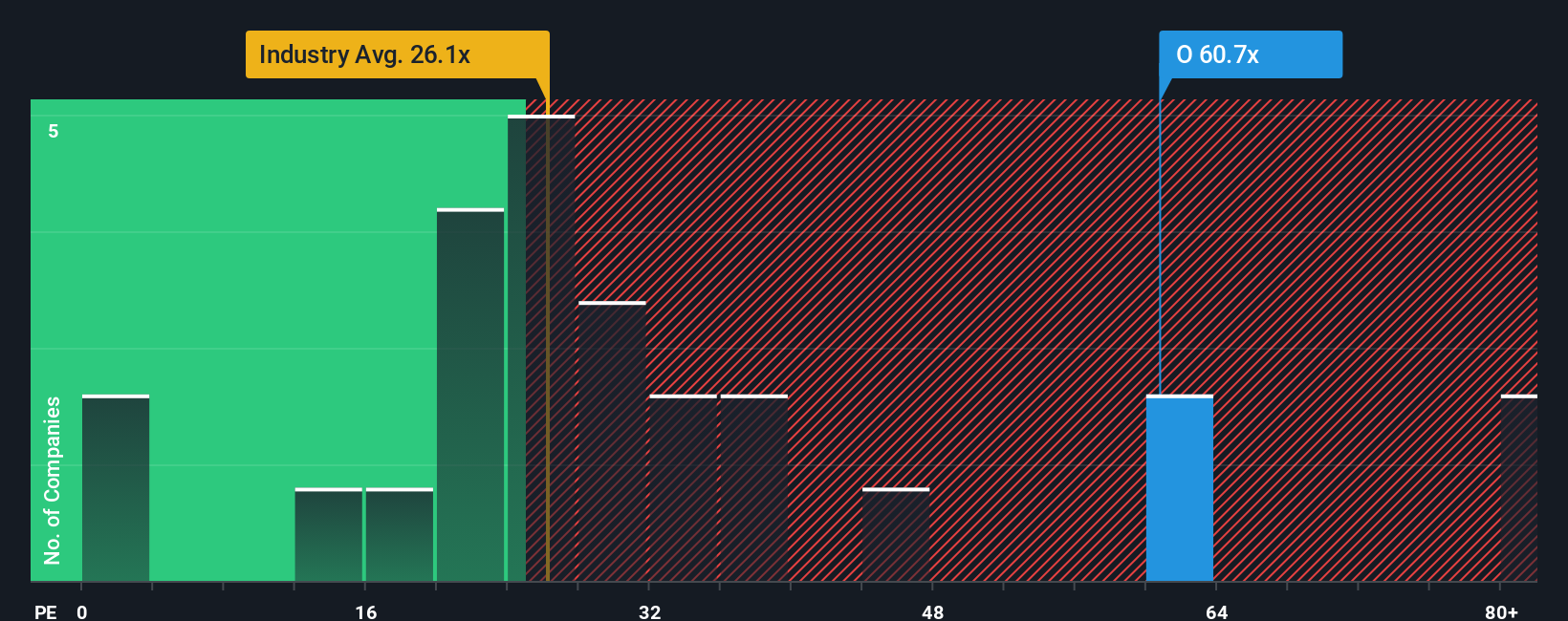

Another View: Market Ratios Tell a Different Story

Looking beyond dividend models, Realty Income's valuation using the price-to-earnings ratio paints a less optimistic picture. The company trades at a P/E of 54.4x, well above the US Retail REITs industry average of 26.7x and a peer average of 32.2x. Even compared to the fair ratio of 37.4x, Realty Income commands a steep premium. This raises practical concerns about valuation risk. Could the market eventually push the share price closer to industry norms, or does Realty Income’s reliability justify the higher price?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Realty Income Narrative

If your perspective differs or you like to investigate the numbers firsthand, you can easily craft your own take on Realty Income’s outlook in just a few minutes. Do it your way.

A great starting point for your Realty Income research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Ready for More Smart Investment Opportunities?

Great investing isn't limited to one stock. Unlock your next winning idea with these hand-picked screeners and join thousands of investors seizing fresh market momentum today.

- Tap into value by following these 876 undervalued stocks based on cash flows, which show strong cash flow potential and may be trading below their intrinsic worth.

- Boost your passive income potential by harnessing these 16 dividend stocks with yields > 3%, which consistently deliver dividend yields above 3%.

- Stay ahead of innovation by scouting these 24 AI penny stocks, which are benefiting from rapid advancements in artificial intelligence and automation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:O

Realty Income

Realty Income (NYSE: O), an S&P 500 company, is real estate partner to the world's leading companies.

6 star dividend payer and slightly overvalued.

Similar Companies

Market Insights

Community Narratives