- United States

- /

- Specialized REITs

- /

- NYSE:MRP

Millrose Properties (MRP): $25M One-Off Gain Challenges Profit Sustainability Narrative

Reviewed by Simply Wall St

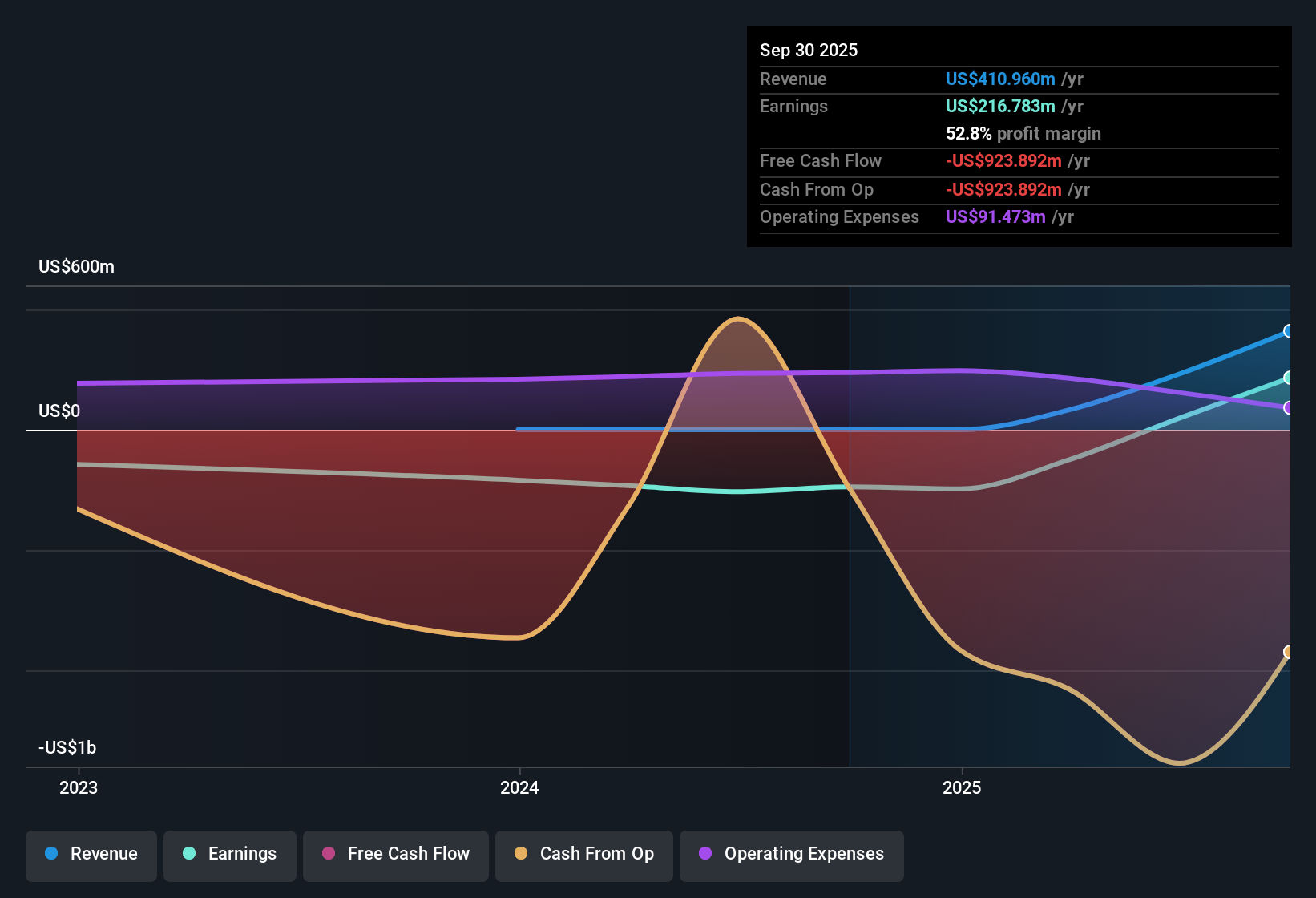

Millrose Properties (MRP) has swung to profitability over the past five years, highlighted by a one-off gain of $25.0 million in the most recent numbers to September 30, 2025. Investors will likely focus on the company’s projected 16.9% annual revenue growth and 21.4% annual expansion in earnings. Both figures are well ahead of the US market’s expected pace, although these headline numbers reflect the effects of a recent move to profitability and include notable non-recurring items.

See our full analysis for Millrose Properties.The next section sets these earnings in context, comparing them with the major narratives investors track in the market. It highlights points where the latest numbers reinforce or counter the consensus.

Curious how numbers become stories that shape markets? Explore Community Narratives

One-Off $25 Million Gain Lifts Margins

- The latest period includes a one-time $25.0 million gain, significantly boosting reported net profit margins and making the company appear more profitable than underlying trends alone suggest.

- What is surprising in the prevailing market view is that while this gain helped propel Millrose Properties to profitability, the sustainability of these improved margins will depend on core business growth rather than non-recurring items.

- The presence of a one-off gain raises questions about the durability of recent profit expansion.

- Investors should weigh whether future periods can maintain or improve margins without similar windfalls.

DCF Fair Value Highlights Upside Gap

- Shares last traded at $32.80, well below the DCF fair value estimate of $97.72. This suggests the market is heavily discounting future growth despite strong revenue and earnings projections.

- The prevailing market view draws attention to this valuation gap, but also notes that non-recurring earnings and sector risk may be keeping investors cautious.

- Despite trading at a high Price-To-Earnings Ratio of 113.3x, the substantial discount to DCF fair value implies upside if growth expectations are met.

- However, concerns around earnings quality and industry volatility may be contributing to this cautious stance.

Price-To-Earnings Far Exceeds Peers

- Millrose Properties is valued at a Price-To-Earnings Ratio of 113.3x, sharply above both the industry average of 29.5x and peer median of 27.2x.

- Prevailing market analysis points out that such a premium is only justified if extraordinary profit growth continues. Any sign of earnings normalization or stalled expansion could lead to a rapid re-rating downward.

- Investors must judge if the company’s move to profitability marks a genuine long-term shift or is mainly the result of short-term events.

- This elevated multiple puts extra pressure on management to deliver sustainable growth in coming periods.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Millrose Properties's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Millrose Properties’ elevated Price-To-Earnings Ratio and dependence on one-off gains highlight risks. Recent profit improvements may not be sustained over time.

If strong, reliable earnings growth matters to you, use our stable growth stocks screener (2088 results) to quickly find companies delivering consistently solid performance without the uncertainty of exceptional, non-recurring boosts.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MRP

Millrose Properties

Millrose purchases and develops residential land and sells finished homesites to home builders by way of option contracts with predetermined costs and takedown schedules.

Reasonable growth potential with adequate balance sheet.

Market Insights

Community Narratives