- United States

- /

- Health Care REITs

- /

- NYSE:MPW

Is the Recent Rally in Medical Properties Trust Shares Backed by Fair Value in 2025?

Reviewed by Bailey Pemberton

- Wondering whether Medical Properties Trust is a bargain or a value trap? You are not alone, as plenty of investors are trying to make sense of the story behind this healthcare REIT’s share price.

- After a rough few years, the stock has started 2024 strong, with shares up 28.6% year-to-date and gaining 2.2% in the last week. However, the longer-term returns over three and five years are still deeply negative.

- Recent headlines have focused on Medical Properties Trust’s asset sales and new agreements aimed at bolstering its liquidity and reducing risk. These moves have certainly contributed to the recent bounce, but long-term uncertainty around hospital tenant health and debt levels is still weighing on investor sentiment.

- On Simply Wall St’s valuation checks, Medical Properties Trust scores a 5 out of 6 for being undervalued. But what does that actually mean? Let’s dig into how different valuation methods stack up for this stock, and why the best approach to valuation might surprise you at the end of this article.

Find out why Medical Properties Trust's 19.6% return over the last year is lagging behind its peers.

Approach 1: Medical Properties Trust Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's fair value by projecting future cash flows, in this case adjusted funds from operations, and discounting them back to present-day dollars. For Medical Properties Trust, this approach highlights both its challenges and long-term potential.

Currently, Medical Properties Trust has a trailing twelve months free cash flow (FCF) of negative $1.4 Billion, indicating a period of outflows or reinvestment. Analyst forecasts anticipate a turnaround, projecting positive cash flow growth in the coming years. The FCF is expected to reach $393 Million by the end of 2029. Further projections, extrapolated beyond five years, indicate continued but more moderate growth through 2035.

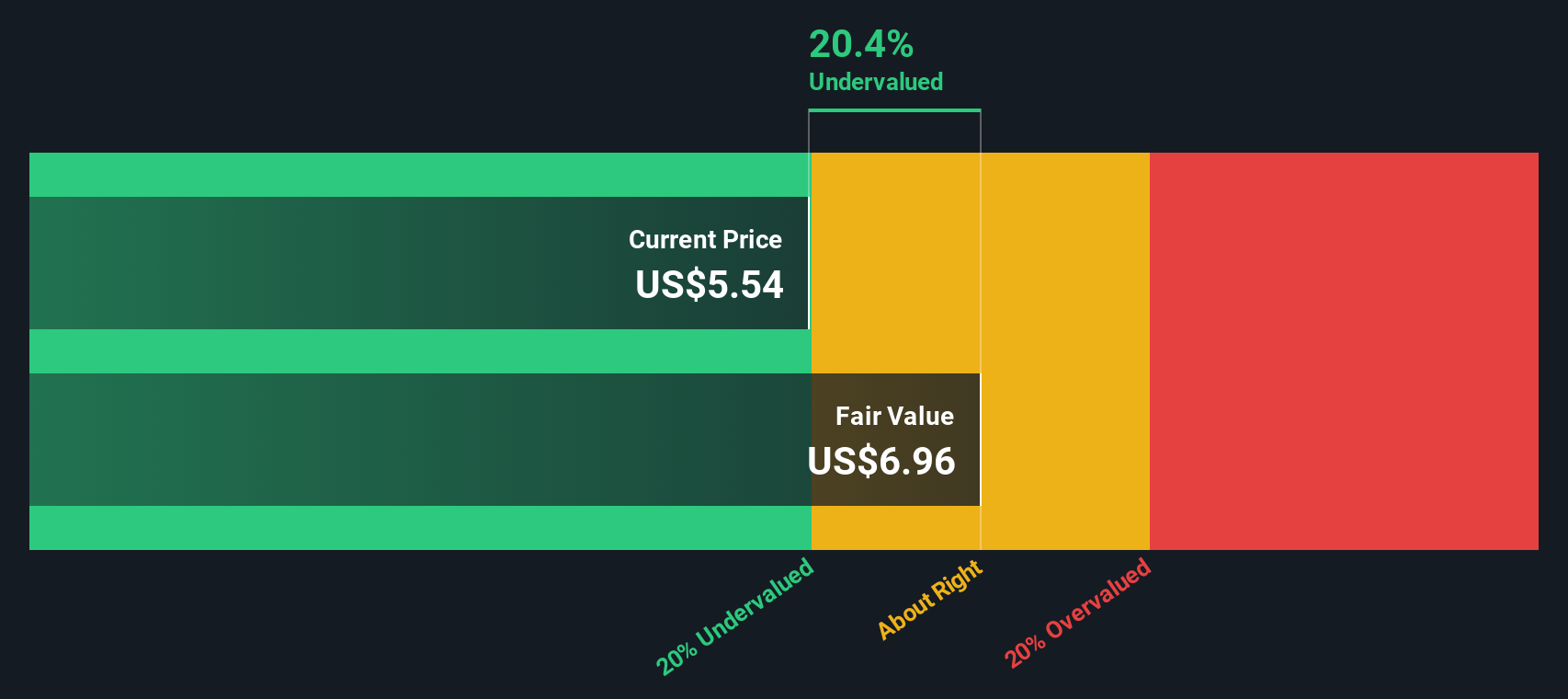

Based on the 2 Stage Free Cash Flow to Equity method, the DCF model estimates the intrinsic value of Medical Properties Trust shares to be $6.80. With the current share price trading about 23.9% below this intrinsic value, the DCF model suggests the stock is noticeably undervalued at present levels.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Medical Properties Trust is undervalued by 23.9%. Track this in your watchlist or portfolio, or discover 849 more undervalued stocks based on cash flows.

Approach 2: Medical Properties Trust Price vs Sales

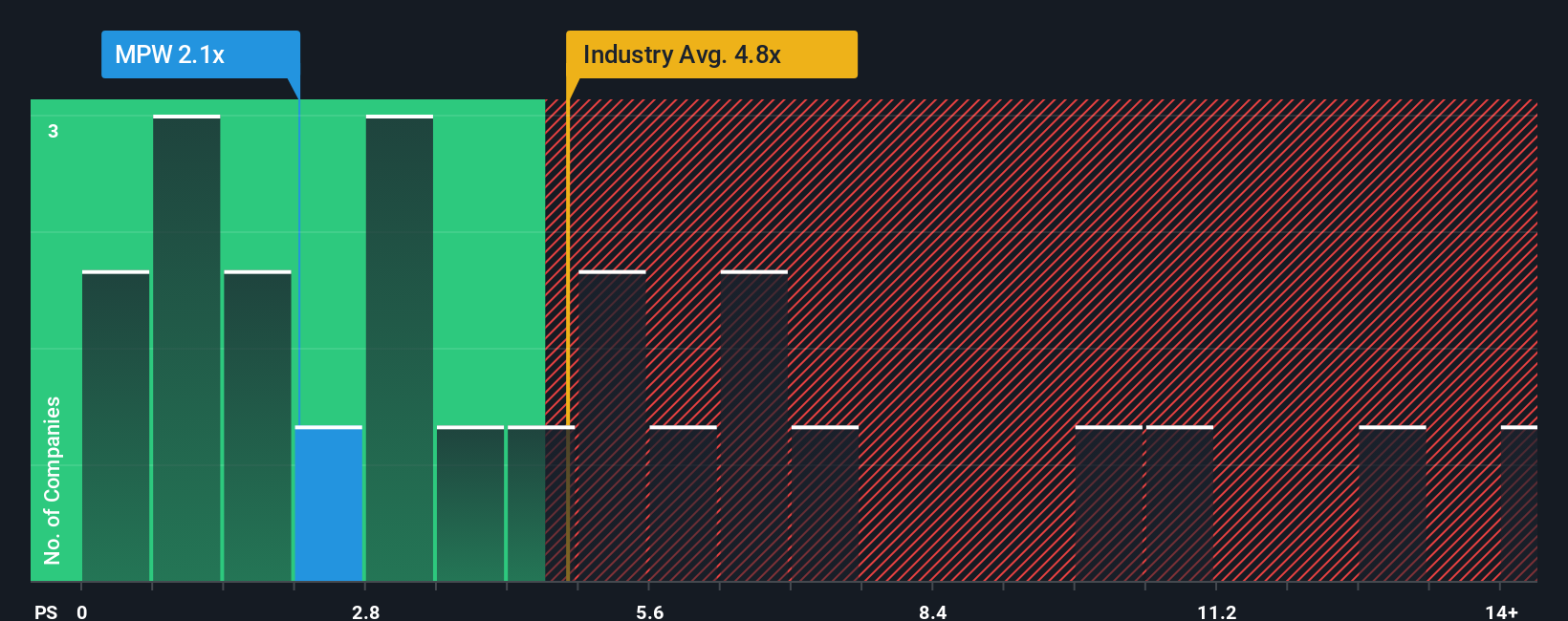

The price-to-sales (P/S) ratio is frequently used to value companies like Medical Properties Trust, especially when net earnings are volatile or negative, but revenues are steady and meaningful. Since Medical Properties Trust’s bottom line has fluctuated in recent periods, the P/S multiple offers a direct way to measure the value investors are currently assigning to its sales and recurring revenue stream.

Typically, higher growth prospects and lower perceived risks warrant a higher P/S ratio. Companies facing growth challenges or elevated risks tend to trade at a lower multiple. Medical Properties Trust is currently trading at a P/S ratio of 3.16x. This is notably below the average Health Care REITs industry P/S of 6.32x and also undercuts its peer group average of 7.58x.

Simply Wall St’s proprietary Fair Ratio model, which incorporates factors like forecasted growth, profit margins, risk profile, market cap, and industry trends, estimates a fair P/S multiple for Medical Properties Trust at 5.20x. Unlike simple peer or industry comparisons, the Fair Ratio is tailored to the company’s specific financial outlook and risk profile, providing a clearer picture of its intrinsic value relative to its sales.

Given that the current P/S is 3.16x and the fair ratio sits at 5.20x, Medical Properties Trust appears undervalued based on this metric as well, suggesting further upside relative to its current sales levels.

Result: UNDERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1404 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Medical Properties Trust Narrative

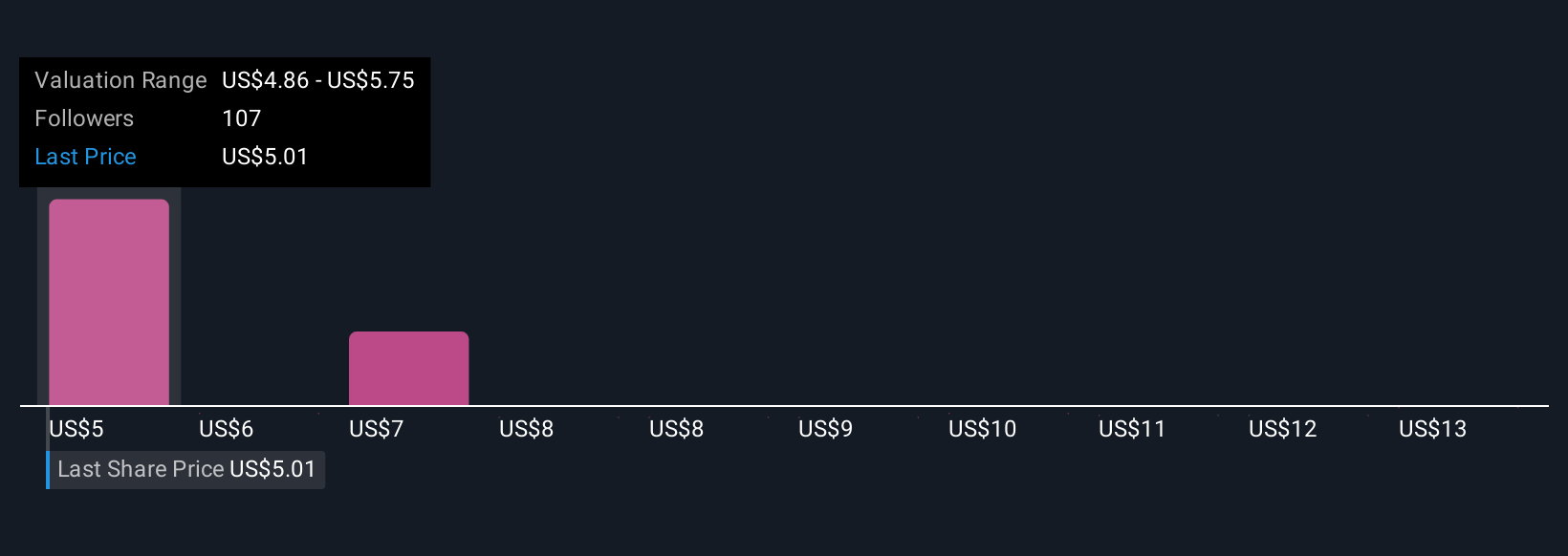

Earlier we mentioned that there is an even better way to understand valuation. Let's introduce you to Narratives. A Narrative is a simple, approachable way to express your investment perspective by telling the story you believe about a company, then linking that story directly to estimates for future revenue, margins, and ultimately a fair value.

On Simply Wall St’s Community page, used by millions of investors, Narratives make complex analysis accessible by guiding you to connect a company's outlook to its financial future and a personal fair value. This process is all backed up by your own reasoning or the key factors you think matter most.

With Narratives, you can instantly see whether your fair value is above or below the current share price, informing your decision to buy or sell. In addition, Narratives update dynamically whenever important new information or earnings come out, keeping your analysis up to date with the latest developments.

For example, one Medical Properties Trust Narrative sees international expansion and improving hospital performance driving earnings and a fair value of $6.00 per share. A more cautious Narrative emphasizes debt burdens and tenant risks, arriving at a fair value closer to $4.00 per share. By choosing your Narrative and tracking the numbers behind your story, you become the investor with clarity and confidence.

Do you think there's more to the story for Medical Properties Trust? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MPW

Medical Properties Trust

A self-advised real estate investment trust formed in 2003 to acquire and develop net-leased hospital facilities.

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Community Narratives