- United States

- /

- Health Care REITs

- /

- NYSE:MPW

A Look at Medical Properties Trust's Valuation Following Dividend Increase and Renewed Shareholder Focus

Reviewed by Simply Wall St

Medical Properties Trust (MPW) just announced a quarterly dividend increase to $0.09 per share, with payment scheduled for January 2026. This decision reflects management’s confidence in future cash flow and ongoing shareholder returns.

See our latest analysis for Medical Properties Trust.

Momentum has turned positive for Medical Properties Trust, with the stock's 90-day share price return jumping an impressive 21.2% and total shareholder return over the past year reaching 30.8%. While it faced financial headwinds and saw a major shareholder reduce its position earlier in the year, recent bullish options activity and the announcement of a dividend increase have prompted renewed interest among investors. This hints at improved sentiment and potential for further upside if the trust delivers on its rent and repurchase goals.

If your curiosity is piqued by sector shifts, now is the perfect opportunity to broaden your perspective and discover fast growing stocks with high insider ownership

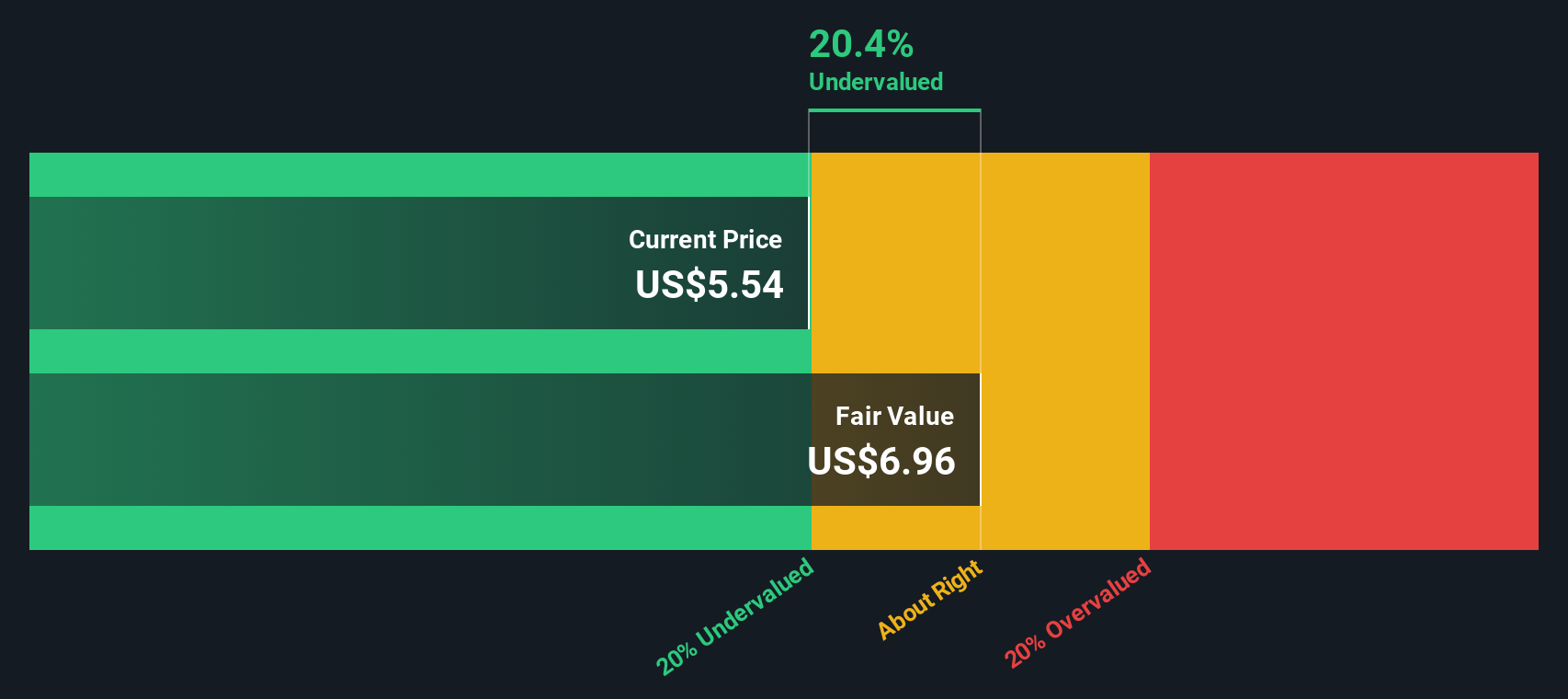

But with shares rebounding and optimism swirling around higher dividends and improved fundamentals, the question remains: Is Medical Properties Trust truly undervalued at these levels, or has the market already built in its next stage of growth?

Most Popular Narrative: 2.8% Overvalued

The last close for Medical Properties Trust was $5.14, while the most widely followed narrative puts its fair value at $5.00 per share, based on a discount rate of 12.32%. This suggests that the stock is currently trading slightly above what analysts believe it is worth. Let’s take a closer look at a critical driver shaping this consensus.

Strategic international expansion, including increased investments in the UK, Germany, and Switzerland, is enhancing portfolio diversification, reducing geographic concentration risk, and providing exposure to higher-growth healthcare markets, positively impacting long-term net margins and earnings consistency.

Curious how bold expansion plans and dramatic assumptions about future growth could push this REIT's valuation higher? One pivotal assumption swings the numbers, especially when profit margins and growth rates are set to shift dramatically. Only a dive into the full narrative reveals which forecasts unlock this valuation puzzle.

Result: Fair Value of $5.00 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent tenant concentration and rising debt costs remain looming threats and could potentially undercut Medical Properties Trust's renewed optimism in the coming quarters.

Find out about the key risks to this Medical Properties Trust narrative.

Another View: Discounted Cash Flow Perspective

Taking a step back from the consensus price targets, our SWS DCF model estimates Medical Properties Trust's fair value at $6.70 per share. This suggests the stock may actually be undervalued by over 23 percent, raising the question of whether the market is missing a longer-term recovery story, or if risks continue to cloud the outlook.

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Medical Properties Trust Narrative

If you see things differently or want to analyze Medical Properties Trust from your own perspective, you can build your own view in just a few minutes, so why not Do it your way

A great starting point for your Medical Properties Trust research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Don’t limit your strategy to just one stock. Take action now and uncover opportunities others are missing by focusing on trends shaping tomorrow’s market leaders.

- Supercharge your returns by tapping into these 26 AI penny stocks that may benefit from significant AI sector growth and transformative technology advancements.

- Maximize your portfolio’s income by targeting these 18 dividend stocks with yields > 3% with consistently high yields and reliable fundamentals for potentially stronger long-term gains.

- Get ahead of market shifts by evaluating these 82 cryptocurrency and blockchain stocks supporting innovation in blockchain and decentralized finance.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MPW

Medical Properties Trust

A self-advised real estate investment trust formed in 2003 to acquire and develop net-leased hospital facilities.

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Community Narratives