- United States

- /

- Retail REITs

- /

- NYSE:MAC

Macerich (MAC): Losses Worsen 10.4% Annually, Margin Recovery Draws Focus Heading Into Earnings

Reviewed by Simply Wall St

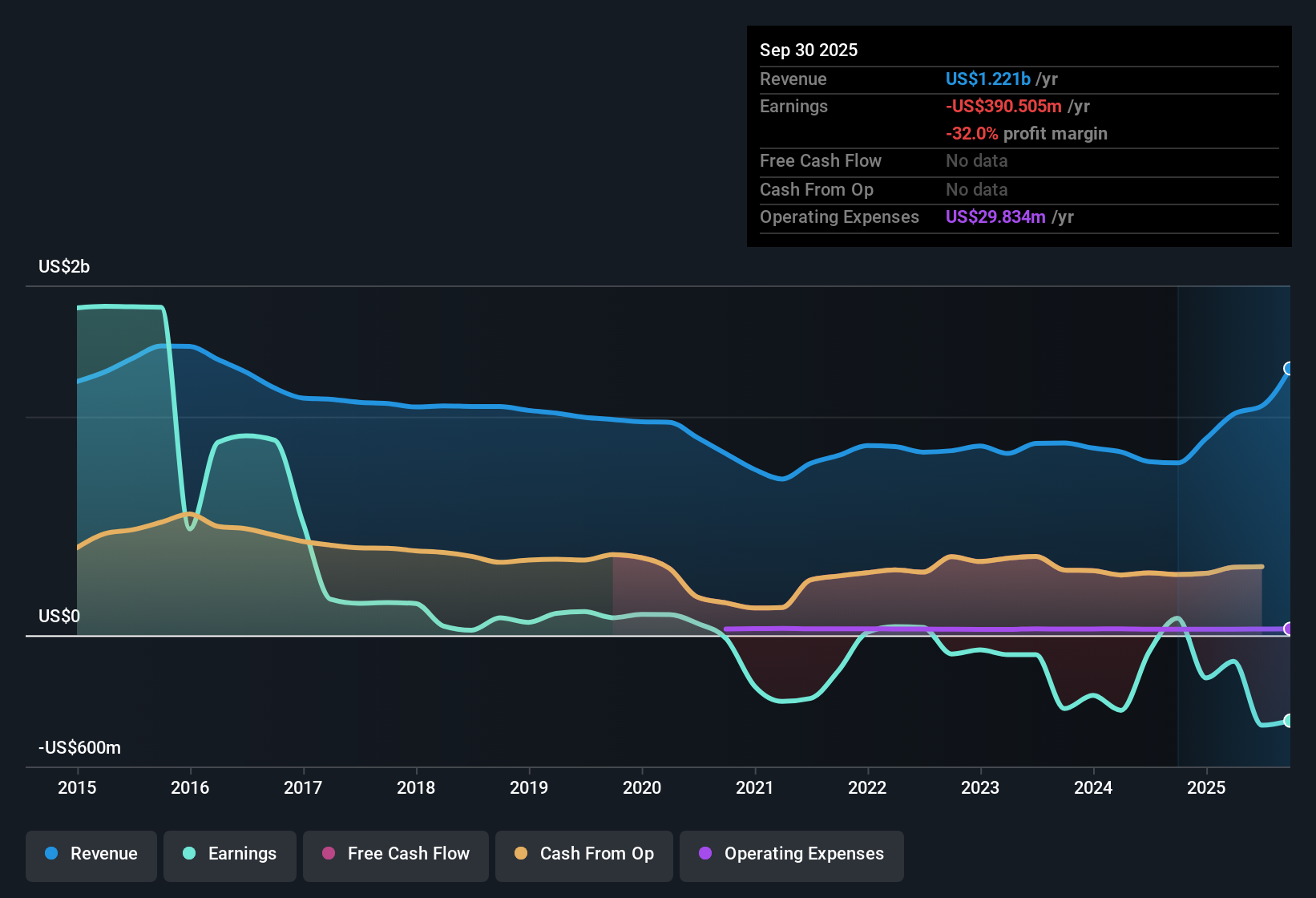

Macerich (MAC) remains unprofitable as net losses have expanded at an average rate of 10.4% per year over the past five years, and margin performance is yet to show improvement. Revenue growth is projected at just 1.8% per year, lagging well behind the broader US market’s pace of 10.5%. Despite these challenges, earnings are forecast to surge 89.5% per year with a return to profitability expected within the next three years. This outlook has drawn investor attention, especially with the share price currently trading at $17.67, below its estimated fair value of $30.8.

See our full analysis for Macerich.Next up, we put these latest earnings in context by comparing them to the community narratives circling around Macerich, seeing where the numbers reinforce the prevailing sentiment and where they might spark new debates.

See what the community is saying about Macerich

Leverage at 7.9x Net Debt to EBITDA Shapes Growth Limits

- Macerich carries net debt at 7.9 times EBITDA, a level that stands out as high for a REIT and adds financial pressure, especially with further refinancing needed in the next one to two years.

- Bears emphasize this heavy debt load challenges long-term earnings growth and margin expansion.

- Rising interest costs on this leverage could compress already-weak margins and squeeze net earnings, especially if refinancing conditions worsen.

- Critics highlight that delays in asset sales or higher refinancing costs risk derailing the path to profitability forecast by consensus.

Margin Recovery Outlook: -39.2% to 0.9% in Three Years

- Compared to current operating margins of -39.2%, analysts expect Macerich’s margins to turn positive, reaching 0.9% in three years. This represents one of the sharpest expected margin reversals among public REITs.

- Analysts' consensus view stresses this turnaround is propelled by several catalysts.

- Accelerated leasing activity, with strong tenant demand and higher rents on experiential retail offerings, could bolster net operating income if new leases materialize as planned.

- Consensus points to targeted acquisitions and the disposal of underperforming assets as boosting the quality of cash flows and stabilizing margins, but cautions that any slowdown in leasing would challenge upbeat estimates.

Peer Discount: 4.3x Price-to-Sales vs. 6 to 6.7x for Industry

- Macerich’s price-to-sales multiple of 4.3x is notably below both the US Retail REITs industry average (6x) and its peer group (6.7x). This gap reflects cautious market expectations despite projected earnings growth.

- Analysts' consensus view notes this discount may offer value if the company executes on margin recovery.

- While the current share price of $17.67 trades at a 43% discount to DCF fair value ($30.80), the consensus price target of $19.80 signals only 12% upside, indicating most analysts remain cautious until sustainable profitability is proven.

- Consensus recognizes that confidence in a successful turnaround is limited by ongoing risks like leverage and market exposure; bargain hunters will want to see clear execution before the gap closes.

- Momentum around Macerich's evolving story has the potential to shift quickly if key execution milestones are hit. Analysts are watching both leasing spreads and balance sheet moves for early signals. 📊 Read the full Macerich Consensus Narrative.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Macerich on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Not seeing the story in the same way? Bring your unique perspective to life in just a few minutes and share your take. Do it your way

A great starting point for your Macerich research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Explore Alternatives

Despite a positive earnings forecast, Macerich still faces high leverage, weak margins, and uncertainty about delivering a true turnaround.

If you want portfolios with sturdier finances and fewer balance sheet risks, check out solid balance sheet and fundamentals stocks screener (1979 results) designed to spotlight companies built for stronger financial resilience.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MAC

Macerich

Macerich is a fully integrated, self-managed, self-administered real estate investment trust (REIT).

Good value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives