- United States

- /

- Retail REITs

- /

- NYSE:MAC

How Macerich's (MAC) Improving Q3 Results May Influence Its Turnaround and Investor Outlook

Reviewed by Sasha Jovanovic

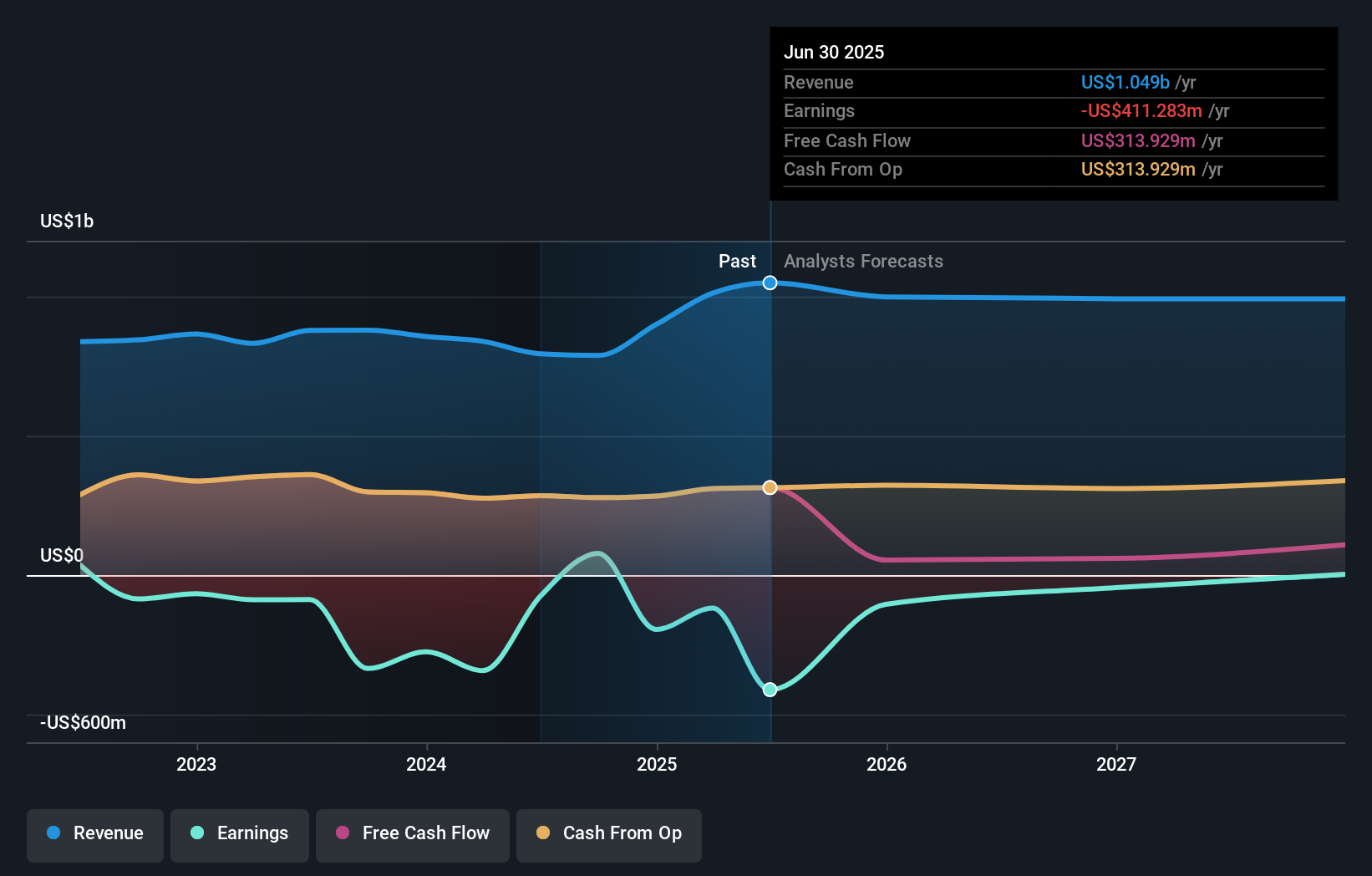

- The Macerich Company recently announced its third quarter 2025 results, reporting US$253.26 million in revenue and a net loss of US$87.36 million, both showing improvement compared to the same period last year.

- Despite ongoing losses, advances in leasing revenue and a decrease in net loss signal progress in Macerich’s operational turnaround efforts.

- We’ll explore how the quarter’s revenue increases and reduced losses impact Macerich’s investment narrative and future outlook.

Rare earth metals are the new gold rush. Find out which 38 stocks are leading the charge.

Macerich Investment Narrative Recap

To be a shareholder in Macerich today, you need to believe in a recovery story rooted in sustained leasing momentum and a shift toward experiential retail as core drivers of future growth. The latest quarterly results highlighted improving revenue and narrowing losses, which reinforce progress on operational turnarounds and support the short-term thesis of revenue stabilization. However, the material risk stemming from the company’s high leverage and need for refinancing remains very much in focus, with results having no significant impact on that risk at this stage.

Among recent developments, Macerich’s continued quarterly dividend of US$0.17 per share stands out. While the dividend shows management’s intent to maintain shareholder returns, it is particularly interesting given the company’s ongoing losses and high debt level, keeping the sustainability of future payouts closely tied to their ongoing financial and operational catalysts.

In contrast, investors should be aware that rising interest rates or tightening credit conditions could intensify Macerich’s refinancing and balance sheet pressures…

Read the full narrative on Macerich (it's free!)

Macerich's outlook anticipates $1.0 billion in revenue and $9.5 million in earnings by 2028. This forecast is based on a 0.7% annual revenue decline and an earnings increase of $420.8 million from current earnings of -$411.3 million.

Uncover how Macerich's forecasts yield a $19.53 fair value, a 10% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members have submitted two fair value estimates for Macerich ranging from US$19.53 to US$30.63 per share. While many see upside, the ongoing risk of high leverage and exposure to refinancing challenges could create sharply different performance paths as market conditions shift, so be sure to consider every angle.

Explore 2 other fair value estimates on Macerich - why the stock might be worth as much as 73% more than the current price!

Build Your Own Macerich Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Macerich research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Macerich research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Macerich's overall financial health at a glance.

Contemplating Other Strategies?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MAC

Macerich

Macerich is a fully integrated, self-managed, self-administered real estate investment trust (REIT).

Good value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives