- United States

- /

- Residential REITs

- /

- NYSE:MAA

Will MAA’s Sun Belt Bet Drive Sustained Growth or Signal Shifting Priorities for Investors?

Reviewed by Sasha Jovanovic

- Mid-America Apartment Communities, Inc. recently announced it will release its third-quarter 2025 results after the market closes on October 29, with a conference call scheduled for October 30 to review performance and answer questions.

- The company has been expanding its Sun Belt portfolio by completing four new apartment communities totaling over 1,400 units, adding to the focus on profitability and growth in fast-growing rental markets.

- We'll look at how anticipation around upcoming earnings and new community completions shapes Mid-America Apartment Communities’ investment narrative.

Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

Mid-America Apartment Communities Investment Narrative Recap

Investors considering Mid-America Apartment Communities generally need to believe in the strength and resilience of rental demand in the Sun Belt, despite ongoing challenges from new apartment supply and potential softening of earnings growth. While anticipation for the Q3 2025 earnings release is high, the recent announcement about new community completions does not appear to materially change the near-term catalyst of stabilizing occupancy rates or the persistent risk from elevated supply and lease-up pressures in key markets.

The company's recent completion of four apartment communities, adding over 1,400 units mostly in Sun Belt cities, directly links to the most important short-term catalyst, how effectively these new developments achieve stabilization against ongoing pricing headwinds. With further details expected in the Q3 earnings call, these completions will help clarify the progress toward improving occupancy and revenue despite persistent competitive pressures.

Yet, in contrast, investors should keep in mind that an oversupply of new apartments and slow lease-up in markets like Austin and Phoenix can quickly...

Read the full narrative on Mid-America Apartment Communities (it's free!)

Mid-America Apartment Communities is expected to reach $2.5 billion in revenue and $488.4 million in earnings by 2028. This projection assumes annual revenue growth of 4.8%, but a decrease in earnings of $79.4 million from the current $567.8 million.

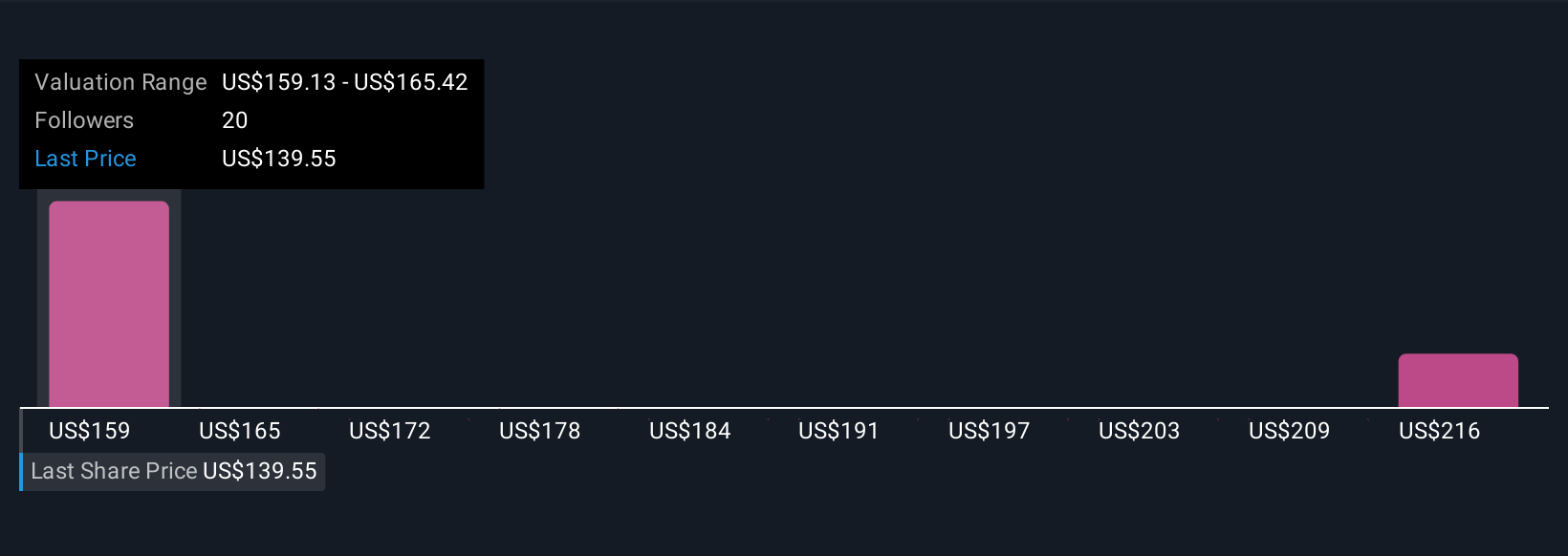

Uncover how Mid-America Apartment Communities' forecasts yield a $159.12 fair value, a 18% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members have shared five fair value estimates for MAA, showing a wide range between US$90.19 and US$224.80 per share. Many point to ongoing new supply and slow lease-up velocity as major industry headwinds, underlining why opinions can vary so much, make sure to compare these perspectives before making up your mind.

Explore 5 other fair value estimates on Mid-America Apartment Communities - why the stock might be worth 33% less than the current price!

Build Your Own Mid-America Apartment Communities Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Mid-America Apartment Communities research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Mid-America Apartment Communities research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Mid-America Apartment Communities' overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Rare earth metals are the new gold rush. Find out which 35 stocks are leading the charge.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MAA

Mid-America Apartment Communities

MAA, an S&P 500 company, is a real estate investment trust (REIT) focused on delivering full-cycle and superior investment performance for shareholders through the ownership, management, acquisition, development and redevelopment of quality apartment communities primarily in the Southeast, Southwest and Mid-Atlantic regions of the United States.

6 star dividend payer and undervalued.

Similar Companies

Market Insights

Community Narratives