- United States

- /

- Residential REITs

- /

- NYSE:MAA

A Fresh Look at Mid-America Apartment Communities (MAA) Valuation After Analysts Trim Price Targets

Reviewed by Simply Wall St

Several major analysts have recently lowered their outlook on Mid-America Apartment Communities (MAA), highlighting a more cautious stance on the company’s near-term prospects. Ratings from most firms remain neutral or positive. However, sentiment appears to be shifting.

See our latest analysis for Mid-America Apartment Communities.

After a tough stretch earlier in the year, Mid-America Apartment Communities has been working to steady the ship, recently pricing a $400 million bond offering and seeing analysts grow wary about near-term headwinds. Even with these moves, the share price has dipped 11.4% so far this year, and the total shareholder return over the past year stands at -13.8%. This highlights that momentum remains on the back foot as investors reassess growth and risk outlooks, despite a respectable 5-year total return of nearly 29%.

If you’re looking to broaden your search beyond apartment REITs, now could be the perfect time to uncover fast growing stocks with high insider ownership

With analysts trimming their price targets but leaving room for upside, the question is whether Mid-America Apartment Communities is now trading at a compelling discount, or if the market has already factored in all the growth risks ahead.

Most Popular Narrative: 9.7% Undervalued

Mid-America Apartment Communities is trading below the narrative's fair value estimate, suggesting a notable gap between prevailing market sentiment and underlying forecasts. The most widely followed narrative highlights strong drivers in the Sun Belt region and structural factors shaping the company's prospects, creating a compelling backdrop for the valuation that follows.

Absorption in MAA's core Sun Belt markets has materially outpaced new supply for four consecutive quarters. This has led to a significant reduction in available units and firming occupancy, positioning the company for improved pricing power and accelerating revenue growth as new supply continues to decline in the back half of 2025 and into 2026.

Want to uncover the bold assumptions that drive this gap? What if the foundation for this valuation is shifting rental dynamics, fresh demographic tailwinds, and wallet-stretching profit multiples? The narrative signals a surprising financial blueprint that goes far beyond surface-level forecasts. See what else is built into the fair value target.

Result: Fair Value of $149.52 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent high supply in key markets or slowing demand could quickly challenge optimism and may keep earnings and lease growth under pressure for a longer period than expected.

Find out about the key risks to this Mid-America Apartment Communities narrative.

Another View: Pricing Based on Earnings

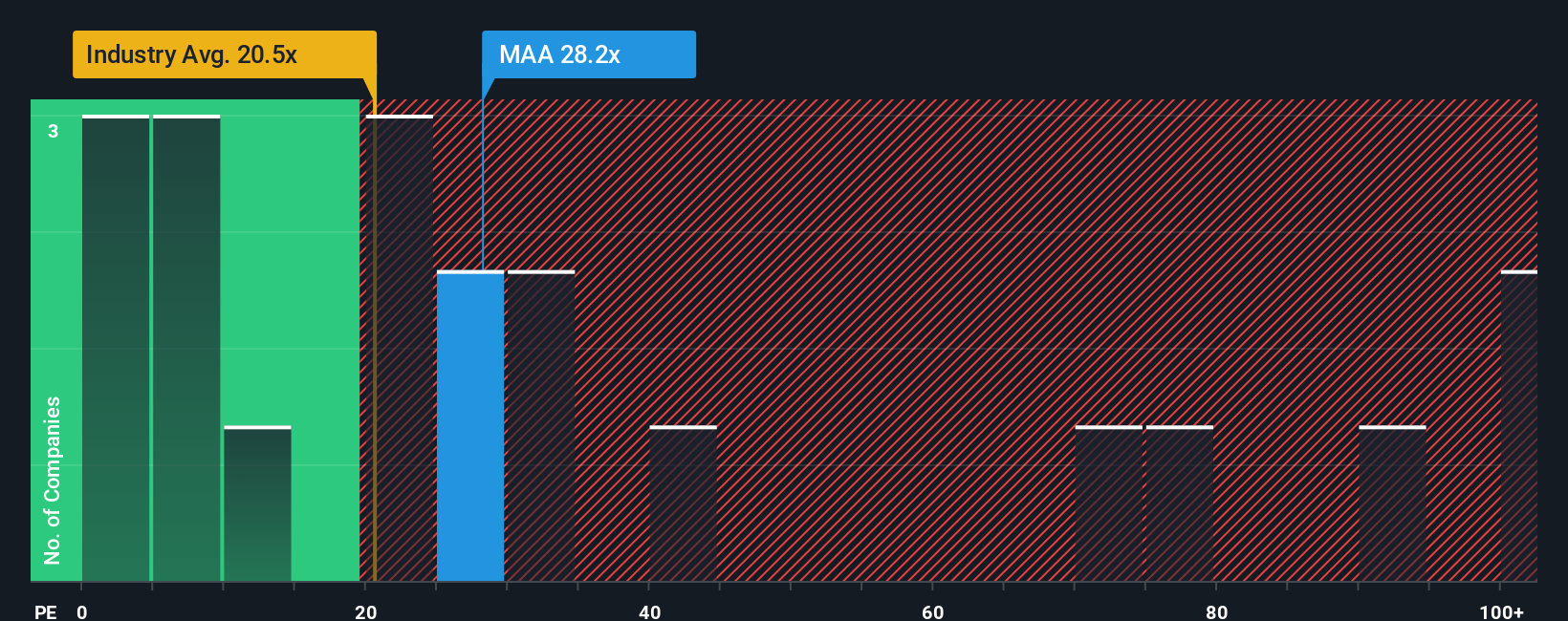

Looking at how Mid-America Apartment Communities is valued by its price-to-earnings ratio, there are some notable contrasts. The company trades at 28.6x earnings, higher than the North American Residential REITs industry average of 25.6x, yet below the peer group’s 41.1x. This suggests some optimism, but also points to a premium that may signal risk if earnings do not outpace sector norms. The market’s current price exceeds the fair ratio of 27.3x, so investors pay more than our regression analysis suggests is justified. Is this premium warranted, or could it mean limited upside from here?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Mid-America Apartment Communities Narrative

If you’d rather chart your own course or dig deeper into the numbers, you can craft an alternative perspective in just a few minutes. Do it your way

A great starting point for your Mid-America Apartment Communities research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Don’t limit your opportunities. There is a world of standout stocks waiting just beyond the usual picks. Try the Simply Wall Street Screener to spot your next big winner now.

- Unlock tomorrow’s technology leaders by checking out these 26 AI penny stocks, which are reshaping industries with artificial intelligence and automation breakthroughs.

- Tap into high-yield potential by exploring these 14 dividend stocks with yields > 3% that may boost your income through reliable and growing payouts.

- Seize opportunities in value by reviewing these 935 undervalued stocks based on cash flows with strong fundamentals currently trading at attractive prices.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MAA

Mid-America Apartment Communities

MAA, a S&P 500 company, is a real estate investment trust (REIT) focused on delivering full-cycle and superior investment performance for shareholders through the ownership, management, acquisition, development and redevelopment of quality apartment communities primarily in the Southeast, Southwest and Mid-Atlantic regions of the United States.

Established dividend payer and fair value.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success