- United States

- /

- Health Care REITs

- /

- NYSE:LTC

LTC Properties (LTC): Assessing Valuation After 2025 Outlook Boost and $270M Seniors Housing Shift

Reviewed by Simply Wall St

LTC Properties (LTC) has just raised its 2025 guidance, putting a spotlight on the company’s strategic shift toward seniors housing. This follows a $270 million investment in that portfolio and a move to restructure long-term debt.

See our latest analysis for LTC Properties.

The market is starting to take notice of LTC Properties’ repositioning efforts, as seen in its steady year-to-date share price return of 5.7%. While recent momentum has been moderate, the longer-term picture is compelling. The company has reported a 15.3% total shareholder return over three years and 33.6% over five years, hinting at renewed interest as it focuses on growth and stability in seniors housing.

If LTC’s transformation has you curious about other resilient companies making strategic moves, now’s the perfect moment to broaden your perspective and discover fast growing stocks with high insider ownership

Yet with a solid track record and ambitious guidance, is LTC Properties still trading at a discount to its true value? Or have investors already priced in the company’s growth trajectory and sector rebound?

Most Popular Narrative: 4.9% Undervalued

With LTC Properties closing at $35.97 and the most popular narrative setting fair value at $37.83, there is a modest upside that investors are watching closely. The valuation rests on more than just price; it is built from the company’s expansion moves, financial expectations, and its transformation within the senior housing sector.

"LTC's aggressive push to expand its SHOP (Senior Housing Operating Portfolio) footprint through acquisitions of newer, stabilized senior housing assets positions the company to capitalize on the increasing demand for institutional senior care as the U.S. population ages, driving future revenue and NOI growth."

Curious what explosive growth rates and bold earnings forecasts fuel this valuation? Find out which surprising assumptions about revenue and profit margins create this narrow price gap. The next section will reveal what numbers drive this fair value, and if the market is already on board or lagging behind.

Result: Fair Value of $37.83 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, heavy competition for acquisitions or rising debt costs could put pressure on LTC's margin growth and slow the pace of long-term earnings expansion.

Find out about the key risks to this LTC Properties narrative.

Another View: A Multiples-Based Reality Check

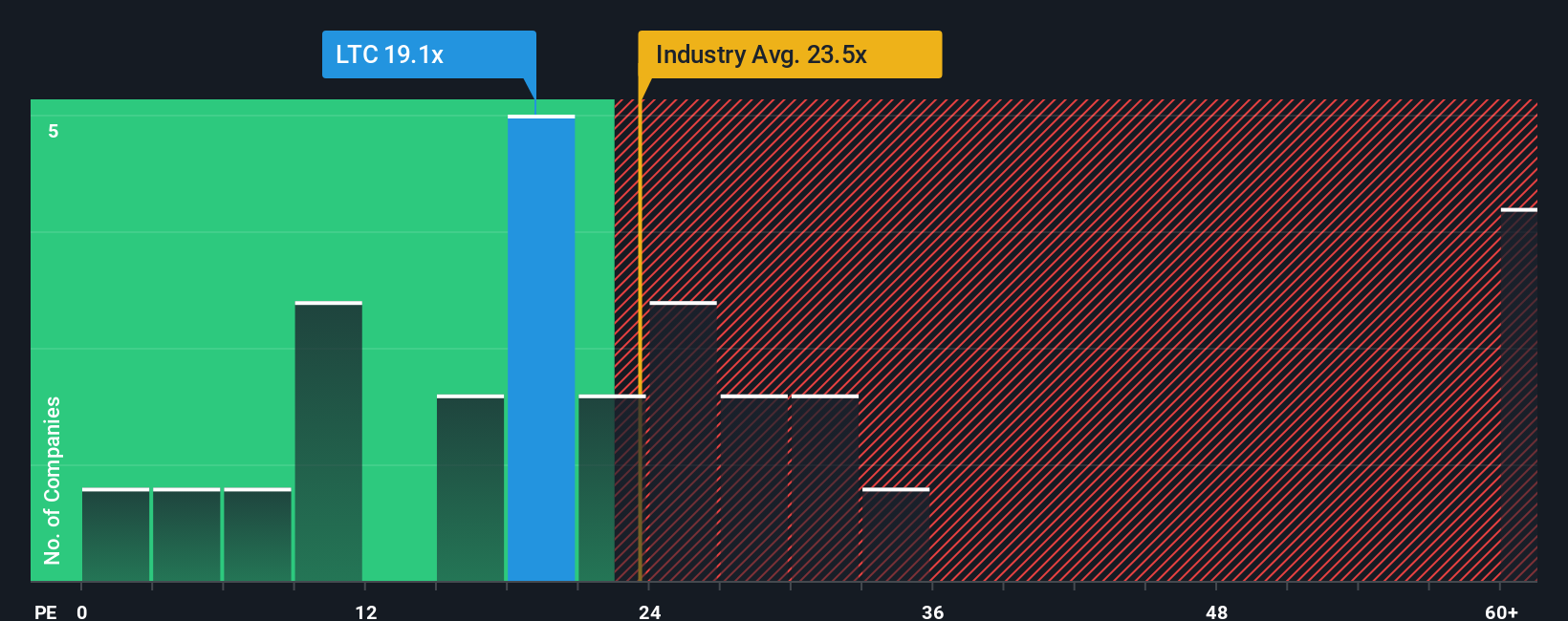

While some models see LTC Properties as modestly undervalued, a quick look at its price-to-earnings ratio tells a different story. At 51.6x, LTC trades far above the industry average of 25.5x, its peer group’s 26.9x, and even its own fair ratio of 50.3x. This premium may reflect optimism or expose investors to higher valuation risk if financial expectations falter. Is the market too enthusiastic, or is there more runway ahead?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own LTC Properties Narrative

If you see the story differently or want to dig into the data yourself, you can build your own LTC Properties narrative in just a few minutes. Do it your way

A great starting point for your LTC Properties research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Every investor deserves an edge. Why settle for what everyone else is watching? Tap into new opportunities and see which high-potential trends could supercharge your next move.

- Unlock tomorrow’s tech breakthroughs by jumping on these 26 AI penny stocks that are reshaping how businesses operate and disrupt entire industries.

- Maximize your cash flow with these 15 dividend stocks with yields > 3% that provide consistent income and strong financial fundamentals for lasting confidence in your portfolio.

- Capitalize on stock market swings by seeking out these 922 undervalued stocks based on cash flows trading below their intrinsic value, before the broader market catches on.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:LTC

LTC Properties

LTC is a real estate investment trust (REIT) focused on seniors housing and health care properties, investing through RIDEA, triple-net leases, joint ventures, and structured finance solutions.

High growth potential established dividend payer.

Similar Companies

Market Insights

Community Narratives