- United States

- /

- Retail REITs

- /

- NYSE:KRG

Did Dividend Hike and Buyback Just Shift Kite Realty Group Trust's (KRG) Investment Narrative?

Reviewed by Sasha Jovanovic

- Kite Realty Group Trust recently reported third quarter 2025 results, raised its quarterly dividend by 7.4% year-over-year, and announced the completion of a US$74.94 million share buyback program.

- This combination of financial updates, capital return, and share repurchases points to the company’s focus on shareholder returns and financial strength.

- We'll explore how the recently announced dividend increase informs the current investment narrative for Kite Realty Group Trust.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

Kite Realty Group Trust Investment Narrative Recap

Shareholders in Kite Realty Group Trust need to believe in the company’s ability to upgrade its tenant mix and drive growth through its focus on Sunbelt and high-growth suburban markets, even as the business faces short-term revenue pressure from anchor tenant bankruptcies and the lengthy backfilling process. The recent third-quarter results and buyback completion add capital return but do not materially change the immediate catalyst: re-leasing vacant spaces and managing execution risk in a shifting retail landscape.

One of the most relevant recent announcements is the 7.4% year-over-year dividend increase for the fourth quarter of 2025. This signals management’s confidence in cash flow strength and a willingness to reward shareholders despite earnings volatility, which aligns with Kite Realty’s broader commitment to returning capital amid operational challenges.

However, investors should be aware that, unlike the steady dividend increases, the pace and success of backfilling larger vacant spaces from recent tenant bankruptcies...

Read the full narrative on Kite Realty Group Trust (it's free!)

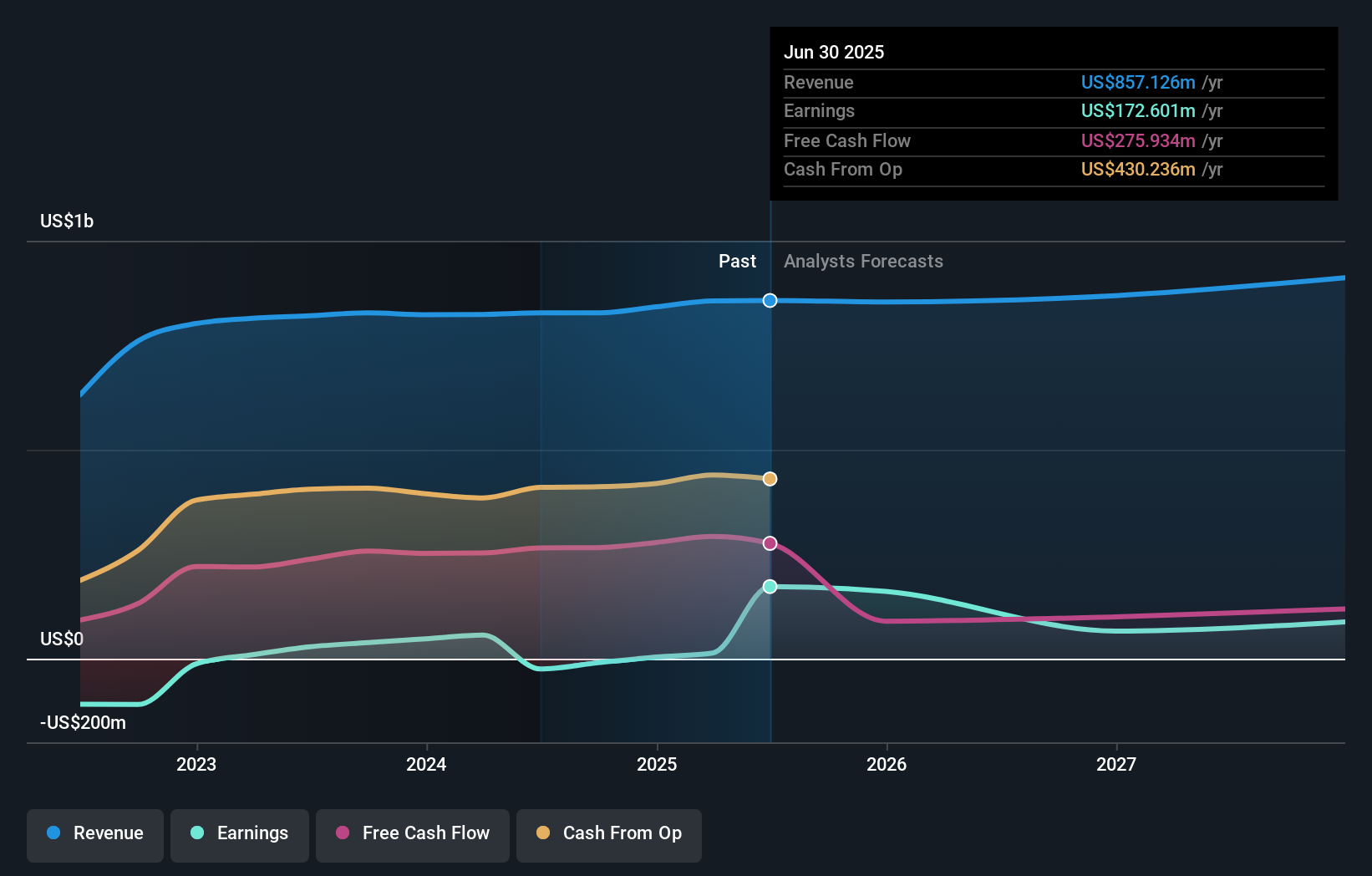

Kite Realty Group Trust is forecast to reach $944.2 million in revenue and $46.7 million in earnings by 2028. This assumes a 3.3% annual revenue growth rate but a sharp earnings decrease of $125.9 million from current earnings of $172.6 million.

Uncover how Kite Realty Group Trust's forecasts yield a $26.09 fair value, a 16% upside to its current price.

Exploring Other Perspectives

Fair value estimates from the Simply Wall St Community range from US$22.84 to US$26.09, with 2 individual perspectives represented. This diversity of opinion comes as Kite’s ongoing exposure to backfilling vacant anchor stores remains a key consideration for future cash flow and returns, so it’s essential to compare several views before making any decisions.

Explore 2 other fair value estimates on Kite Realty Group Trust - why the stock might be worth as much as 16% more than the current price!

Build Your Own Kite Realty Group Trust Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Kite Realty Group Trust research is our analysis highlighting 2 key rewards and 5 important warning signs that could impact your investment decision.

- Our free Kite Realty Group Trust research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Kite Realty Group Trust's overall financial health at a glance.

No Opportunity In Kite Realty Group Trust?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- The latest GPUs need a type of rare earth metal called Dysprosium and there are only 35 companies in the world exploring or producing it. Find the list for free.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kite Realty Group Trust might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:KRG

Kite Realty Group Trust

Kite Realty Group (NYSE: KRG), a real estate investment trust (REIT), is a premier owner and operator of open-air shopping centers and mixed-use assets.

Established dividend payer with moderate risk.

Similar Companies

Market Insights

Community Narratives