- United States

- /

- Office REITs

- /

- NYSE:KRC

Kilroy Realty (KRC): One-Off Gain Drives Earnings Jump, Challenging Bearish Margin Narratives

Reviewed by Simply Wall St

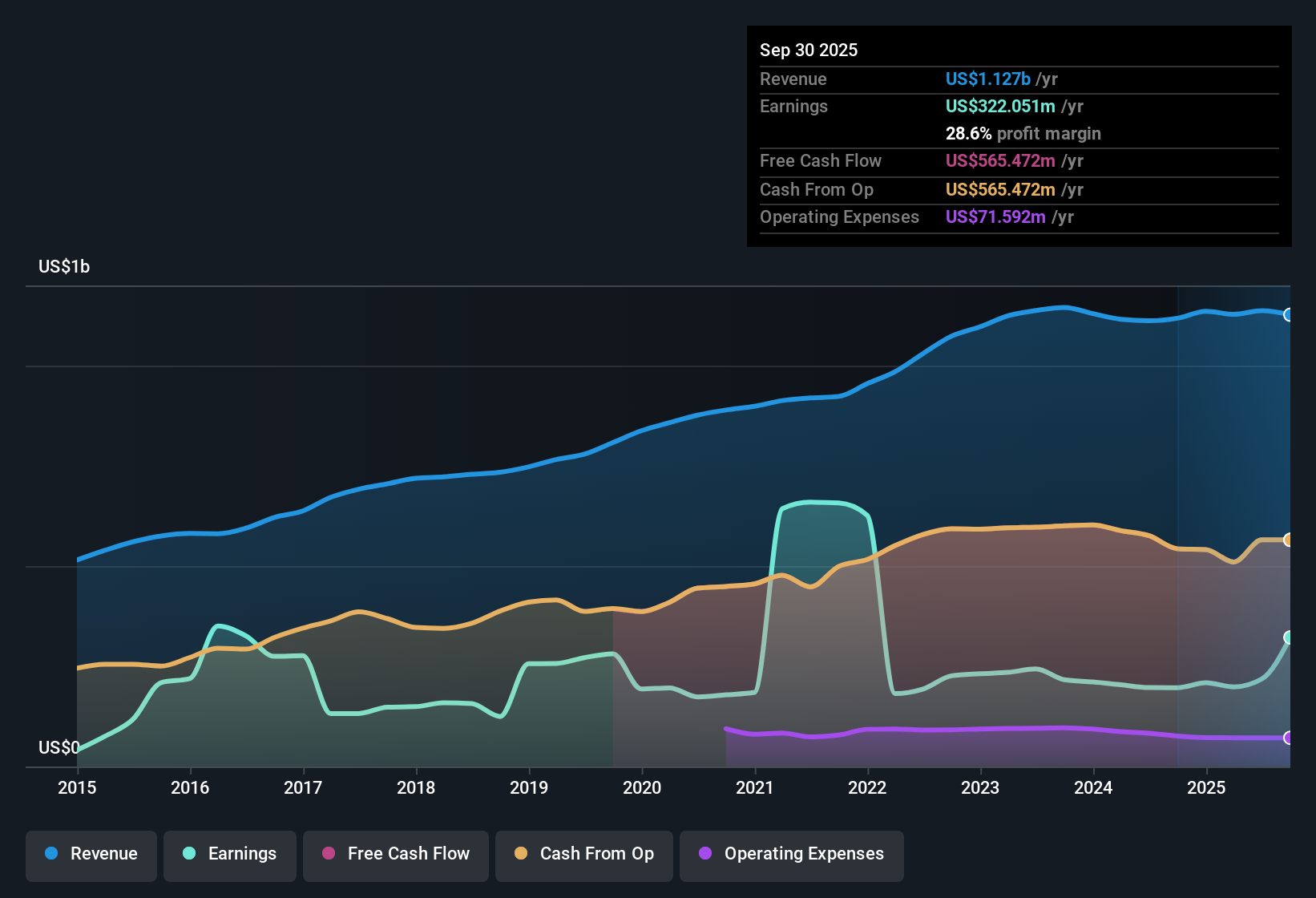

Kilroy Realty (KRC) posted a notable turnaround in its latest annual results, with earnings jumping 63.3% and net profit margins rising to 28.5% from 17.6% in the prior year. This sharp improvement, fueled by a one-off $133 million gain, follows a five-year period during which earnings declined by an average of 17.1% annually. However, forecasts point to a less optimistic future, with revenue expected to grow just 0.5% per year and earnings projected to decline by 52.3% yearly over the next three years.

See our full analysis for Kilroy Realty.Next, we will set these headline results against the broader narratives that typically follow Kilroy, highlighting where the recent numbers confirm or contradict market perceptions.

See what the community is saying about Kilroy Realty

Profit Margins Outpace Industry Trends

- Kilroy Realty reported net profit margins of 28.5%, a meaningful edge over the previous year's 17.6% and above many direct peers.

- Analysts' consensus view notes that this margin bump is heavily influenced by a non-recurring $133 million gain, which creates tension with ongoing pressures from persistent tenant downsizing and the shift to hybrid work.

- The consensus narrative points out that while margins appear robust now, shrinking office demand and increased ESG-related capital needs are likely to compress margins significantly in the years ahead.

- Additionally, consensus expects profit margins to fall from 19.2% today to just 5.7% in three years, warning that recent margin strength may not prove durable as sector headwinds accelerate.

Consensus narrative urges investors to weigh temporary boosts against long-term challenges shaping revenue and occupancy. 📊 Read the full Kilroy Realty Consensus Narrative.

Revenue Growth Lags US Market

- Kilroy's projected annual revenue growth stands at just 0.5%, trailing the US market average of 10.1% and reflecting analysts' expectations of continued weak office demand.

- According to the consensus narrative, analysts see ongoing tenant consolidation, especially among tech firms, as a major reason for the slow revenue outlook.

- This scenario suggests that Kilroy's revenue will likely decrease by 0.2% annually over the next three years, highlighting vulnerability to further asset revaluations and possible negative impacts on net asset value (NAV).

- The consensus also highlights that with occupancy and rent growth under pressure, future lease renewals may occur at lower rates, limiting cash flow growth and heightening volatility for investors.

Discounted Valuation Signals Mixed Opportunity

- Kilroy trades at a price-to-earnings ratio of 15.5x, notably under the industry average of 22.8x and well below the peer average of 32.5x. Its share price of $42.00 sits slightly under a DCF fair value estimate of $43.09.

- Consensus narrative argues that this valuation discount could attract value-oriented investors, but also stresses analysts' muted outlook, projecting that unless earnings stabilize or improve, a low PE alone may not offset deteriorating fundamentals.

- With analysts’ consensus price target at $42.00, right in line with the current share price, there is little implied upside. This reinforces the belief that the stock is fairly valued given the present risks and rewards.

- The analysts further caution that justifying higher share prices would require believing in a sharp recovery or operational turnaround, something not yet backed by forecasts or current tenant trends.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Kilroy Realty on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a different take on the figures? Share your own perspective and craft a unique narrative in just minutes. Do it your way.

A great starting point for your Kilroy Realty research is our analysis highlighting 4 key rewards and 4 important warning signs that could impact your investment decision.

See What Else Is Out There

Kilroy Realty faces persistent profit margin pressure and sluggish revenue growth. Analysts warn that earnings are projected to decline substantially over the next few years.

If you’re looking for steadier performance, use stable growth stocks screener (2115 results) to find companies with a track record of consistent revenue and earnings growth across economic cycles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kilroy Realty might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:KRC

Kilroy Realty

Kilroy is a leading U.S. landlord and developer, with operations in San Diego, Los Angeles, the San Francisco Bay Area, Seattle, and Austin.

6 star dividend payer and good value.

Similar Companies

Market Insights

Community Narratives