- United States

- /

- Real Estate

- /

- NYSE:JOE

Here's Why We Think St. Joe (NYSE:JOE) Might Deserve Your Attention Today

Investors are often guided by the idea of discovering 'the next big thing', even if that means buying 'story stocks' without any revenue, let alone profit. Sometimes these stories can cloud the minds of investors, leading them to invest with their emotions rather than on the merit of good company fundamentals. Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

Despite being in the age of tech-stock blue-sky investing, many investors still adopt a more traditional strategy; buying shares in profitable companies like St. Joe (NYSE:JOE). Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide St. Joe with the means to add long-term value to shareholders.

See our latest analysis for St. Joe

St. Joe's Improving Profits

St. Joe has undergone a massive growth in earnings per share over the last three years. So much so that this three year growth rate wouldn't be a fair assessment of the company's future. So it would be better to isolate the growth rate over the last year for our analysis. St. Joe boosted its trailing twelve month EPS from US$1.06 to US$1.28, in the last year. This amounts to a 21% gain; a figure that shareholders will be pleased to see.

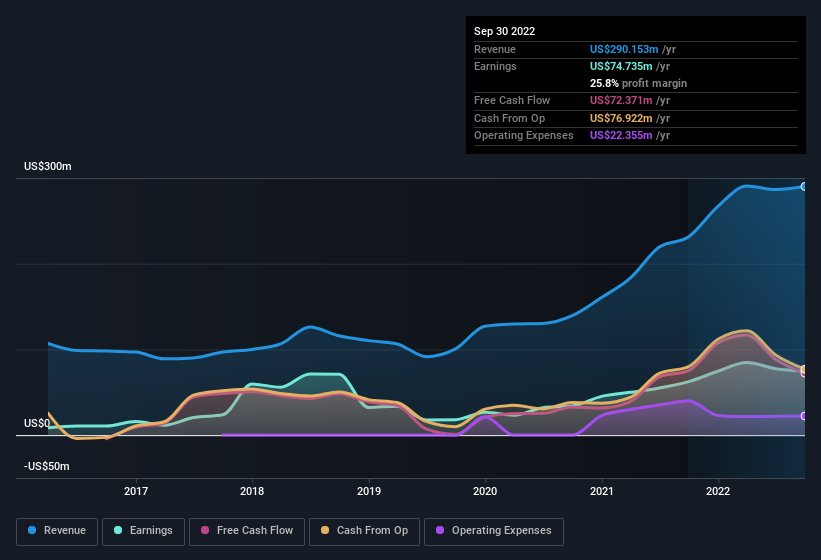

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. St. Joe maintained stable EBIT margins over the last year, all while growing revenue 25% to US$290m. That's encouraging news for the company!

The chart below shows how the company's bottom and top lines have progressed over time. To see the actual numbers, click on the chart.

While profitability drives the upside, prudent investors always check the balance sheet, too.

Are St. Joe Insiders Aligned With All Shareholders?

Investors are always searching for a vote of confidence in the companies they hold and insider buying is one of the key indicators for optimism on the market. Because often, the purchase of stock is a sign that the buyer views it as undervalued. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

With strong conviction, St. Joe insiders have stood united by refusing to sell shares over the last year. But more importantly, President Jorge Gonzalez spent US$146k acquiring shares, doing so at an average price of US$45.76. Purchases like this clue us in to the to the faith management has in the business' future.

The good news, alongside the insider buying, for St. Joe bulls is that insiders (collectively) have a meaningful investment in the stock. With a whopping US$79m worth of shares as a group, insiders have plenty riding on the company's success. This should keep them focused on creating long term value for shareholders.

While insiders are apparently happy to hold and accumulate shares, that is just part of the big picture. That's because St. Joe's CEO, Jorge Gonzalez, is paid at a relatively modest level when compared to other CEOs for companies of this size. The median total compensation for CEOs of companies similar in size to St. Joe, with market caps between US$2.0b and US$6.4b, is around US$6.5m.

The CEO of St. Joe only received US$1.4m in total compensation for the year ending December 2021. First impressions seem to indicate a compensation policy that is favourable to shareholders. While the level of CEO compensation shouldn't be the biggest factor in how the company is viewed, modest remuneration is a positive, because it suggests that the board keeps shareholder interests in mind. It can also be a sign of a culture of integrity, in a broader sense.

Is St. Joe Worth Keeping An Eye On?

One positive for St. Joe is that it is growing EPS. That's nice to see. In addition, insiders have been busy adding to their sizeable holdings in the company. That should do plenty in prompting budding investors to undertake a bit more research - or even adding the company to their watchlists. It's still necessary to consider the ever-present spectre of investment risk. We've identified 1 warning sign with St. Joe , and understanding this should be part of your investment process.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of St. Joe, you'll probably love this free list of growing companies that insiders are buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:JOE

St. Joe

Operates as a real estate development, asset management, and operating company in the United States.

Solid track record and fair value.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success