- United States

- /

- Office REITs

- /

- NYSE:JBGS

JBG SMITH Properties (JBGS): Assessing Current Valuation After Recent Share Price Slide

Reviewed by Simply Wall St

JBG SMITH Properties (JBGS) stock has edged lower recently, catching the eye of investors curious about what is shaping the real estate company’s current valuation. Looking at recent trends, shares have slipped around 7% this month.

See our latest analysis for JBG SMITH Properties.

While JBG SMITH Properties’ share price has lost some ground in recent weeks, there is still positive momentum in a bigger-picture sense, with a 2024 year-to-date share price return of 17.29%. Even with choppy trading lately, its one-year total shareholder return stands at a solid 9.39%, showing resilience despite short-term swings.

If you’re curious about what’s moving outside real estate, now is a smart moment to broaden your search and discover fast growing stocks with high insider ownership

With shares still trading near recent lows and a slight discount to some analyst price targets, the question is clear: is JBG SMITH Properties undervalued at these levels or is the market accurately pricing in future prospects?

Price-to-Sales Ratio of 2.1x: Is it justified?

JBG SMITH Properties currently trades at a price-to-sales (P/S) ratio of 2.1x, which puts it slightly above its peer average of 2.0x and higher than its estimated fair P/S ratio of 1.9x. With a last close price of $18.11, this suggests the market values its sales more richly than some comparable companies.

The P/S ratio indicates how much investors are willing to pay for each dollar of the company’s revenue. For real estate investment trusts like JBGS, this multiple helps investors compare how the market prices similar businesses, especially in sectors where earnings can fluctuate or be negative.

JBGS’s ratio being above both the peer average and its own fair value signals the stock is priced at a premium. Compared to the US Office REITs industry average of 2.2x, it remains close, but the multiple is notably above what our fair value model suggests could be warranted. This may be potentially due to ongoing unprofitability, expectations for future revenue declines, and risk factors unique to the business and its balance sheet.

Explore the SWS fair ratio for JBG SMITH Properties

Result: Preferred multiple of price-to-sales ratio 2.1x (OVERVALUED)

However, persistent negative revenue growth and ongoing profitability challenges could make it difficult for JBG SMITH Properties to close its valuation gap.

Find out about the key risks to this JBG SMITH Properties narrative.

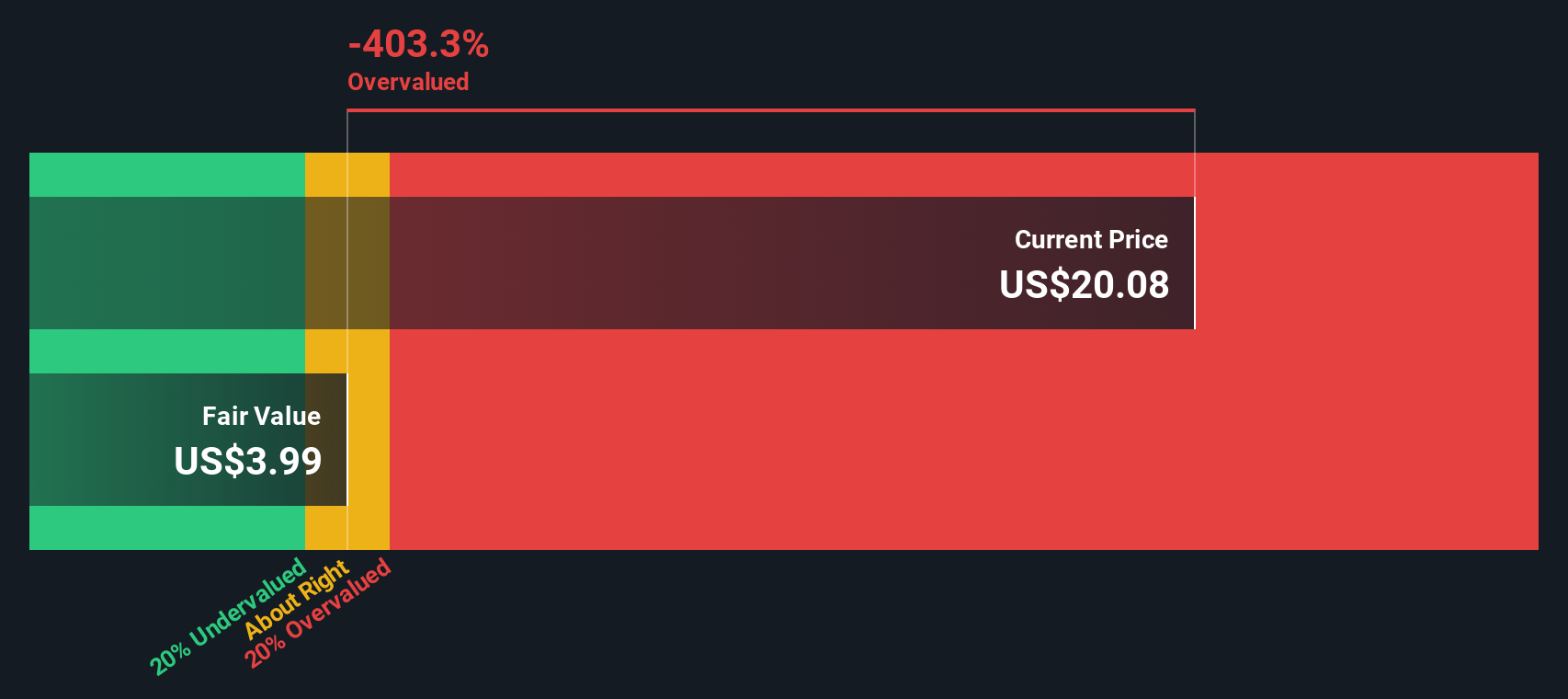

Another View: DCF Model Paints a Starkly Different Picture

Looking at JBG SMITH Properties through the lens of our DCF model tells a much less optimistic story compared to the price-to-sales ratio. According to our SWS DCF model, the company's shares trade well above their estimated fair value, suggesting potential downside. Does this mean the stock is due for a re-rating, or is the market factoring in other upside catalysts?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out JBG SMITH Properties for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 861 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own JBG SMITH Properties Narrative

If you see things differently or want to dive into the numbers on your own terms, you can craft your own perspective in just a few minutes. Do it your way

A great starting point for your JBG SMITH Properties research is our analysis highlighting 3 important warning signs that could impact your investment decision.

Ready for More Smart Investing Moves?

Smart investors don’t let great opportunities pass them by. Expand your horizons right now and pinpoint stocks other investors wish they had found first.

- Boost your potential for long-term gains by spotting these 861 undervalued stocks based on cash flows that are currently flying under Wall Street’s radar.

- Tap into the future with these 28 quantum computing stocks that are set to transform computing, medicine, and cybersecurity.

- Capture stable returns by choosing these 17 dividend stocks with yields > 3% for resilient portfolios in any market condition.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:JBGS

JBG SMITH Properties

JBG SMITH owns, operates, and develops mixed-use properties concentrated in amenity-rich, Metro-served submarkets in and around Washington, DC, most notably National Landing, that we believe have long-term growth potential and appeal to residential, office, and retail tenants.

Mediocre balance sheet with low risk.

Similar Companies

Market Insights

Community Narratives