- United States

- /

- Residential REITs

- /

- NYSE:IRT

Independence Realty Trust (IRT): Exploring Valuation After Recent 7% Pullback in Share Price

Reviewed by Kshitija Bhandaru

Independence Realty Trust (IRT) shares have pulled back about 7% over the past month, catching the attention of some investors. With its current price marked at $16.32, the company’s performance stands out in light of its steady annual revenue growth and improving net income figures.

See our latest analysis for Independence Realty Trust.

While Independence Realty Trust’s share price has slipped 7% over the past month, this move fits a longer pattern as momentum has faded after a challenging year, with the 1-year total shareholder return down by 14%. Despite some near-term volatility, investors keeping an eye on the big picture will notice that longer-term total returns remain in positive territory. This suggests the current period could be a reset rather than the start of a prolonged decline.

If you’re looking to broaden your opportunities and see what else stands out in today’s market, consider exploring fast growing stocks with high insider ownership.

Yet with shares now trading nearly 30% below average analyst targets and more than 40% below some intrinsic value estimates, the question remains: Are investors overlooking a bargain, or is the market fairly pricing in IRT’s future prospects?

Most Popular Narrative: 22.4% Undervalued

Compared to its last closing price of $16.32, the widely-followed narrative estimates fair value for Independence Realty Trust at $21.04. This creates a meaningful gap worth exploring, given dynamic sector trends and growth projections.

The tapering of new multifamily supply and a 43% year-over-year reduction in deliveries projected for IRT's Sun Belt-focused markets in 2026 positions the company for a reacceleration of rent growth and stronger occupancy as demand continues to outpace incoming inventory. This should drive future revenue and NOI growth.

This bold narrative hinges on powerful industry shifts and ambitious growth forecasts. The fair value relies on major gains in future profit margins and revenue expansion. Curious how aggressive assumptions and a high earnings multiple could lead to such a sizable upside? Find out what makes these expectations stand out and see if the logic stacks up to scrutiny.

Result: Fair Value of $21.04 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, an unexpected surge in apartment supply or persistent rent softness in core Sun Belt markets could quickly challenge analysts’ optimistic growth projections for Independence Realty Trust.

Find out about the key risks to this Independence Realty Trust narrative.

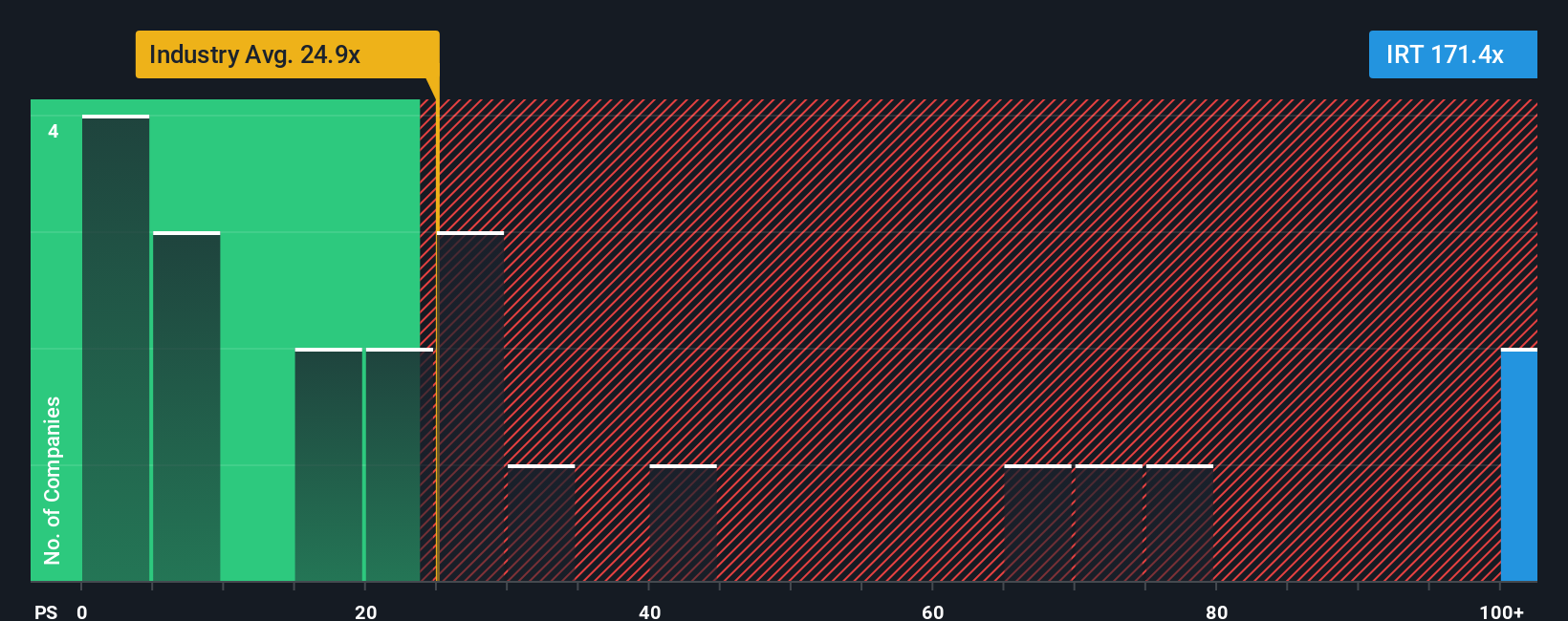

Another View: How Multiples Stack Up

Switching focus to price-to-earnings ratios reveals a different perspective. Independence Realty Trust trades at 137.2x earnings, which is much higher than US REIT peers at 54x and the global industry at 19.9x. Even compared to its own fair ratio of 43.3x, the current valuation looks lofty. This wide gap points to a valuation risk. What would cause the market to sustain such a premium?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Independence Realty Trust Narrative

If you see things differently or want to uncover your own story from the numbers, you can dive in and craft a fresh take in just minutes with Do it your way.

A great starting point for your Independence Realty Trust research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

There’s a world of opportunities beyond IRT, and every smart investor should see what else is gaining momentum. Don’t miss out on today’s most promising possibilities.

- Earn passive income by tapping into these 19 dividend stocks with yields > 3% and find established companies rewarding shareholders with yields above 3%.

- Spark your portfolio’s growth with these 24 AI penny stocks featuring innovators at the heart of artificial intelligence breakthroughs.

- Target future industry disruptors by uncovering these 26 quantum computing stocks in the emerging field of quantum computing.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:IRT

Independence Realty Trust

Independence Realty Trust, Inc. (NYSE: IRT), an S&P 400 MidCap Company, is a real estate investment trust (“REIT”) that owns and operates multifamily communities, across non-gateway U.S.

Good value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives