- United States

- /

- Residential REITs

- /

- NYSE:IRT

A Fresh Look at Independence Realty Trust (IRT) Valuation Following Recent Share Price Decline

Reviewed by Simply Wall St

Investors keeping tabs on Independence Realty Trust (IRT) have noticed shares sliding nearly 5% over the past three months. While the move is drawing interest, a deeper look at the company’s fundamentals helps put the recent action in context.

See our latest analysis for Independence Realty Trust.

Independence Realty Trust’s share price has come under pressure recently, reflecting a broader trend of fading momentum this year as the stock’s year-to-date price return stands at -19.4%. Over the long term, however, the 5-year total shareholder return of nearly 49% highlights the potential rewards for patient investors, even as recent events prompt a reassessment of growth prospects or perceived risk.

If the recent volatility has you thinking more broadly about your portfolio, it could be the perfect time to discover fast growing stocks with high insider ownership.

With shares trading at a notable discount to analyst targets and strong multi-year returns on the books, the question now is whether Independence Realty Trust is undervalued, or if the market has already accounted for future growth.

Most Popular Narrative: 24% Undervalued

Trading nearly 24% below what the most popular narrative views as fair value, Independence Realty Trust’s recent close of $15.93 stands in stark contrast to that higher estimate. This attention-grabbing discount is built on expectations of strong earnings and operational tailwinds, laying the groundwork for the following perspective.

*Ongoing capital recycling, in which older, higher CapEx assets are sold to acquire newer, lower CapEx communities with higher growth profiles in high-demand regions, allows IRT to enhance portfolio quality, capture operating synergies, and improve overall net margins and earnings growth potential.*

Curious what powers this sizeable discount? There’s a secret behind the fair value: bold revenue growth projections, surging profit margins, and a future profit multiple well above industry norms. Only by reading further will you discover exactly what makes analysts so optimistic about the next phase for IRT.

Result: Fair Value of $21.04 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing apartment oversupply or weakening rent growth, especially in key Sun Belt markets, could quickly temper the optimism behind these projections.

Find out about the key risks to this Independence Realty Trust narrative.

Another View: Multiples Paint a Different Picture

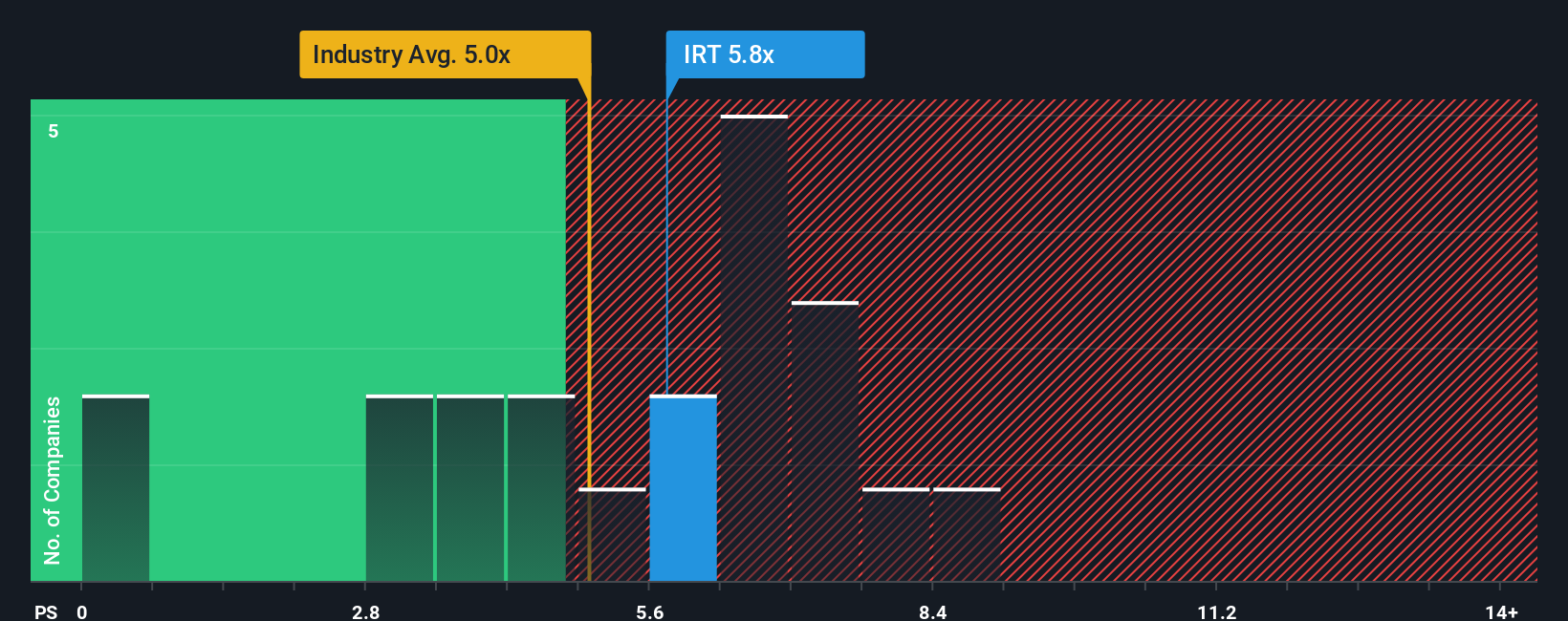

Looking at the price-to-sales ratio, Independence Realty Trust appears expensive, trading at 5.7 times sales versus 4.8 times for the industry average. While it beats direct peers at 5.9, and sits above a fair ratio of 4.6, this elevated multiple suggests investors are paying up for perceived stability. Will the market reward that premium or demand a discount?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Independence Realty Trust Narrative

If you feel the story told here only scratches the surface, or want to dig into the fundamentals yourself, you can easily assemble your own perspective in just a few minutes with Do it your way.

A great starting point for your Independence Realty Trust research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t let great opportunities slip away. Set yourself up for smarter investing moves with unique insights from the Simply Wall Street Screener. Check out these standout options:

- Grab consistent income potential with companies offering high yields and robust growth by starting your research with these 22 dividend stocks with yields > 3%.

- Spot tomorrow’s technology leaders early by tracking these 26 AI penny stocks shaping industries with game-changing artificial intelligence applications.

- Tap into hidden value by finding strong businesses currently trading below their fair value using these 832 undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:IRT

Independence Realty Trust

Independence Realty Trust, Inc. (NYSE: IRT), an S&P 400 MidCap Company, is a real estate investment trust (“REIT”) that owns and operates multifamily communities, across non-gateway U.S.

Good value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives