- United States

- /

- Specialized REITs

- /

- NYSE:IRM

What Iron Mountain (IRM)'s Board Addition of Christie Kelly Means for Shareholders Amid Earnings Momentum

Reviewed by Sasha Jovanovic

- Iron Mountain announced that Christie Kelly, a seasoned executive with significant experience in finance and strategy roles at major real estate firms, has joined its Board of Directors effective October 21, 2025.

- An interesting insight is that this executive addition comes as analysts project a very large year-over-year increase in the company’s forthcoming quarterly earnings, highlighting strong growth across storage, service, and data center segments.

- We'll explore how Christie Kelly’s board appointment may influence Iron Mountain’s investment narrative amid heightened analyst confidence in earnings growth.

AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Iron Mountain Investment Narrative Recap

To be a shareholder in Iron Mountain, you need to believe the company can continue leveraging its global leadership in storage and data management, while successfully scaling its data center and digital solutions to offset risks from the move away from physical storage. The arrival of Christie Kelly on the Board reflects a deepening of financial and operational expertise, but it does not directly alter the immediate catalyst of robust near-term earnings growth or the main risk of rising leverage and exposure to competitive data center investments.

Of Iron Mountain’s recent announcements, its acquisition of two data center development sites in Virginia stands out as directly relevant to short-term catalysts and risks. This expansion highlights the company’s active response to surging demand for digital infrastructure, underlining management’s focus on growth in high-return segments but also amplifying challenges around capital allocation and competitive risks associated with large-scale data center expansion.

In contrast, investors should also be aware that as Iron Mountain increases its investments in infrastructure and digital platforms, the risk of overbuilding and elevated debt...

Read the full narrative on Iron Mountain (it's free!)

Iron Mountain's outlook projects $8.3 billion in revenue and $775.8 million in earnings by 2028. This assumes a 9.0% annual revenue growth rate and an earnings increase of $734.5 million from the current $41.3 million.

Uncover how Iron Mountain's forecasts yield a $114.50 fair value, a 11% upside to its current price.

Exploring Other Perspectives

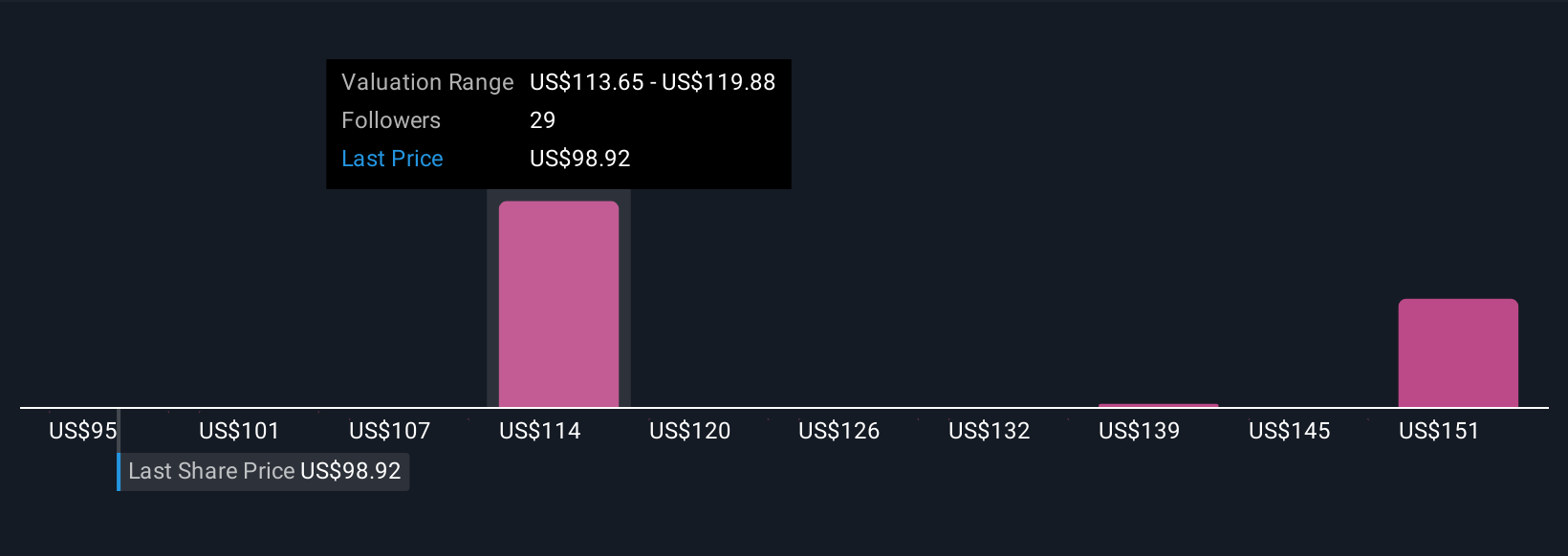

Six community analyses place Iron Mountain’s fair value between US$94.95 and US$158.37. While the company pursues bold growth in digital infrastructure, many community members point to its increased reliance on capital-intensive expansion and the broader implications for long-term financial stability. Explore how your perspective compares.

Explore 6 other fair value estimates on Iron Mountain - why the stock might be worth as much as 54% more than the current price!

Build Your Own Iron Mountain Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Iron Mountain research is our analysis highlighting 3 key rewards and 5 important warning signs that could impact your investment decision.

- Our free Iron Mountain research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Iron Mountain's overall financial health at a glance.

Seeking Other Investments?

Our top stock finds are flying under the radar-for now. Get in early:

- Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- These 16 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Outshine the giants: these 27 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:IRM

Iron Mountain

Iron Mountain Incorporated (NYSE: IRM) is trusted by more than 240,000 customers in 61 countries, including approximately 95% of the Fortune 1000, to help unlock value and intelligence from their assets through services that transcend the physical and digital worlds.

Undervalued with moderate risk.

Similar Companies

Market Insights

Community Narratives