- United States

- /

- Specialized REITs

- /

- NYSE:IRM

Could Iron Mountain's (IRM) Expanded Credit Line Reveal a Shift in Its Long-Term Growth Strategy?

Reviewed by Sasha Jovanovic

- On November 13, 2025, Iron Mountain announced that it amended its long-standing Credit Agreement, securing $200 million in incremental term loans under conditions consistent with its previous borrowings due in 2031.

- This move further expands the company’s available funding, positioning Iron Mountain to support its ongoing operational commitments and future growth strategies.

- To assess how this additional US$200 million in credit may impact Iron Mountain’s growth outlook, let’s examine its effect on the investment narrative.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Iron Mountain Investment Narrative Recap

Shareholders in Iron Mountain typically believe in the company's evolving ability to monetize information management and data center services amid growing demand for both secure physical storage and digital solutions. The recent US$200 million incremental term loan is unlikely to materially shift the most important short term catalyst, expanding data center capacity or digital solutions growth, but it does add to the largest current risk: higher reliance on debt and sensitivity to interest rates.

Among recent announcements, Iron Mountain’s acquisition of two Virginia data center sites stands out as most relevant, as these assets tie directly to growth plans supported by the new funding and highlight expansion in high-demand infrastructure. This announcement also reinforces the short-term growth catalyst: bringing new data center capacity online while capturing tailwinds from AI and cloud infrastructure spending.

On the other hand, investors should be aware that rising leverage and capital costs could weigh on Iron Mountain’s future financial flexibility if...

Read the full narrative on Iron Mountain (it's free!)

Iron Mountain's narrative projects $8.3 billion revenue and $775.8 million earnings by 2028. This requires 9.0% yearly revenue growth and a $734.5 million earnings increase from the current $41.3 million.

Uncover how Iron Mountain's forecasts yield a $116.45 fair value, a 30% upside to its current price.

Exploring Other Perspectives

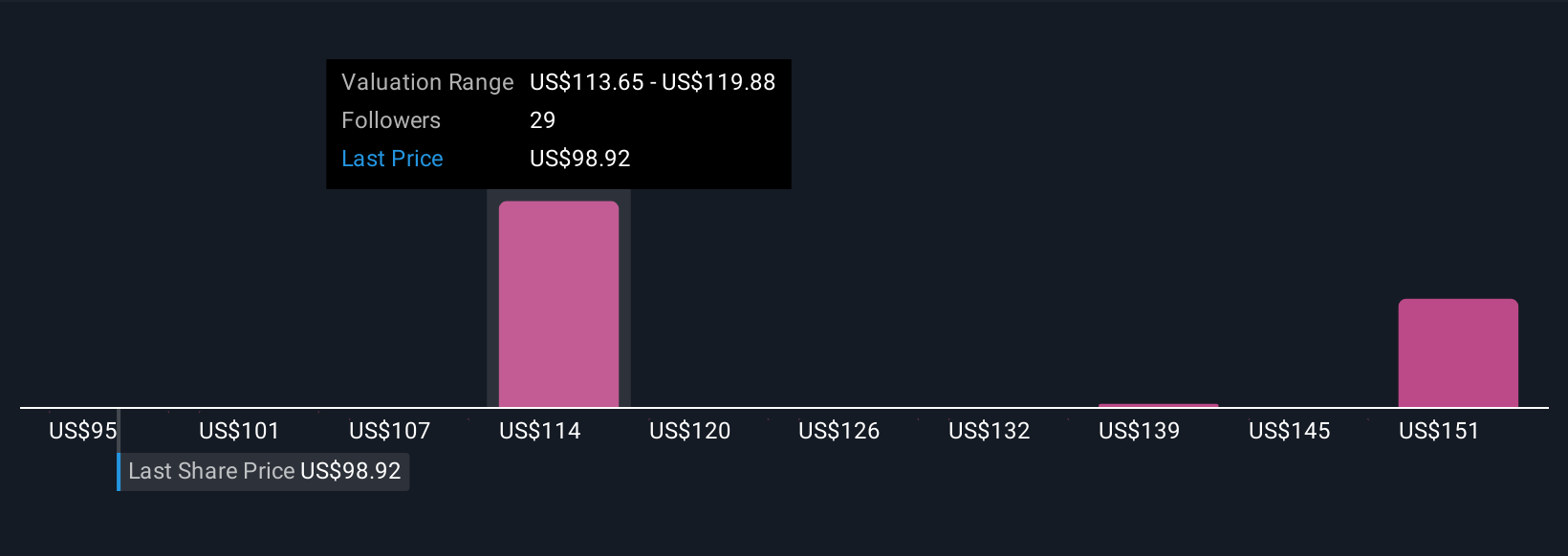

Six different fair value estimates from the Simply Wall St Community span a wide US$94.95 to US$220.44 range. With opinions this spread out, understanding how rising debt impacts the company’s earnings quality becomes even more important for your own view.

Explore 6 other fair value estimates on Iron Mountain - why the stock might be worth just $94.95!

Build Your Own Iron Mountain Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Iron Mountain research is our analysis highlighting 4 key rewards and 4 important warning signs that could impact your investment decision.

- Our free Iron Mountain research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Iron Mountain's overall financial health at a glance.

Searching For A Fresh Perspective?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Rare earth metals are the new gold rush. Find out which 37 stocks are leading the charge.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:IRM

Iron Mountain

Iron Mountain Incorporated (NYSE: IRM) is trusted by more than 240,000 customers in 61 countries, including approximately 95% of the Fortune 1000, to help unlock value and intelligence from their assets through services that transcend the physical and digital worlds.

Undervalued with slight risk.

Similar Companies

Market Insights

Community Narratives