- United States

- /

- Residential REITs

- /

- NYSE:INVH

Is Invitation Homes a Missed Opportunity After Shares Fall 11% in 2025?

Reviewed by Bailey Pemberton

- Curious if Invitation Homes is the bargain you've been waiting for? Let's dig into whether the market is missing something in the current share price.

- Despite growing interest in the rental home sector, Invitation Homes' stock has slipped by 1.1% over the past week and is down 11.1% for the year so far, hinting at shifting sentiment.

- Recent headlines highlight ongoing debates about housing affordability and institutional home ownership, which are keeping Invitation Homes in the spotlight. Industry moves, such as high-profile acquisitions in the build-to-rent space and changing regulatory pressures, are also playing a role in shaping market opinion.

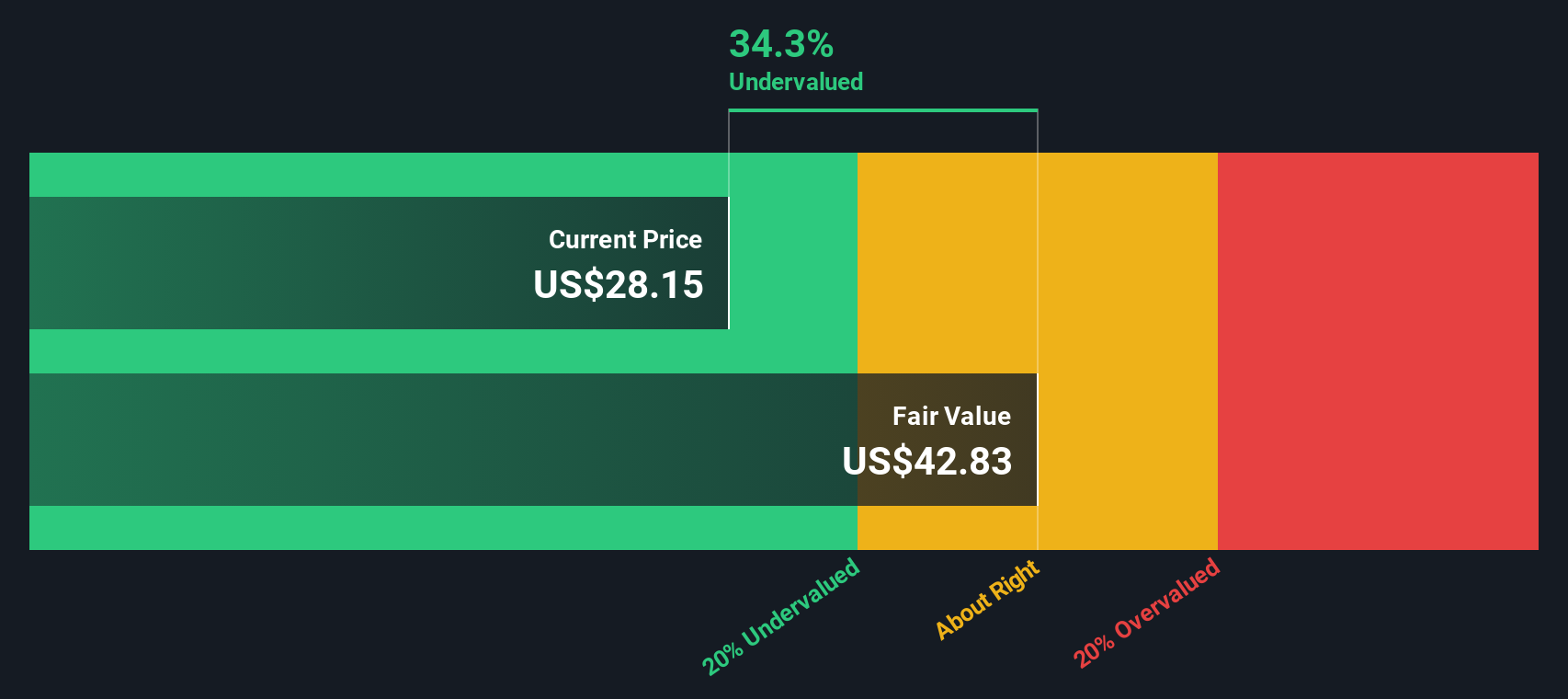

- When we score Invitation Homes on valuation, it gets a 4 out of 6, suggesting there is some, but not overwhelming, value on the table. We will break down what that number means using a few different approaches, and stick around because there is a smarter, more comprehensive way to gauge value that we will cover at the end.

Find out why Invitation Homes's -14.3% return over the last year is lagging behind its peers.

Approach 1: Invitation Homes Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model is designed to estimate a company's value by projecting future adjusted funds from operations and then discounting those cash flows back to their value today. It is a cornerstone method for evaluating stocks like Invitation Homes because it focuses on how much cash the business can generate over time.

Currently, Invitation Homes reports Free Cash Flow (FCF) of $986.24 million. Analysts provide cash flow estimates for the next five years, with projections reaching $1.20 billion by 2029. Beyond that, Simply Wall St extends forecasts through 2035 using reasonable growth assumptions. This approach captures both near-term analyst consensus and longer-term potential, giving investors a fuller picture of expected performance.

Based on this model, Invitation Homes' intrinsic value is calculated at $43.99 per share, implying the stock is trading at a substantial 36.5% discount. Compared to its current market price, this suggests a significant undervaluation.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Invitation Homes is undervalued by 36.5%. Track this in your watchlist or portfolio, or discover 909 more undervalued stocks based on cash flows.

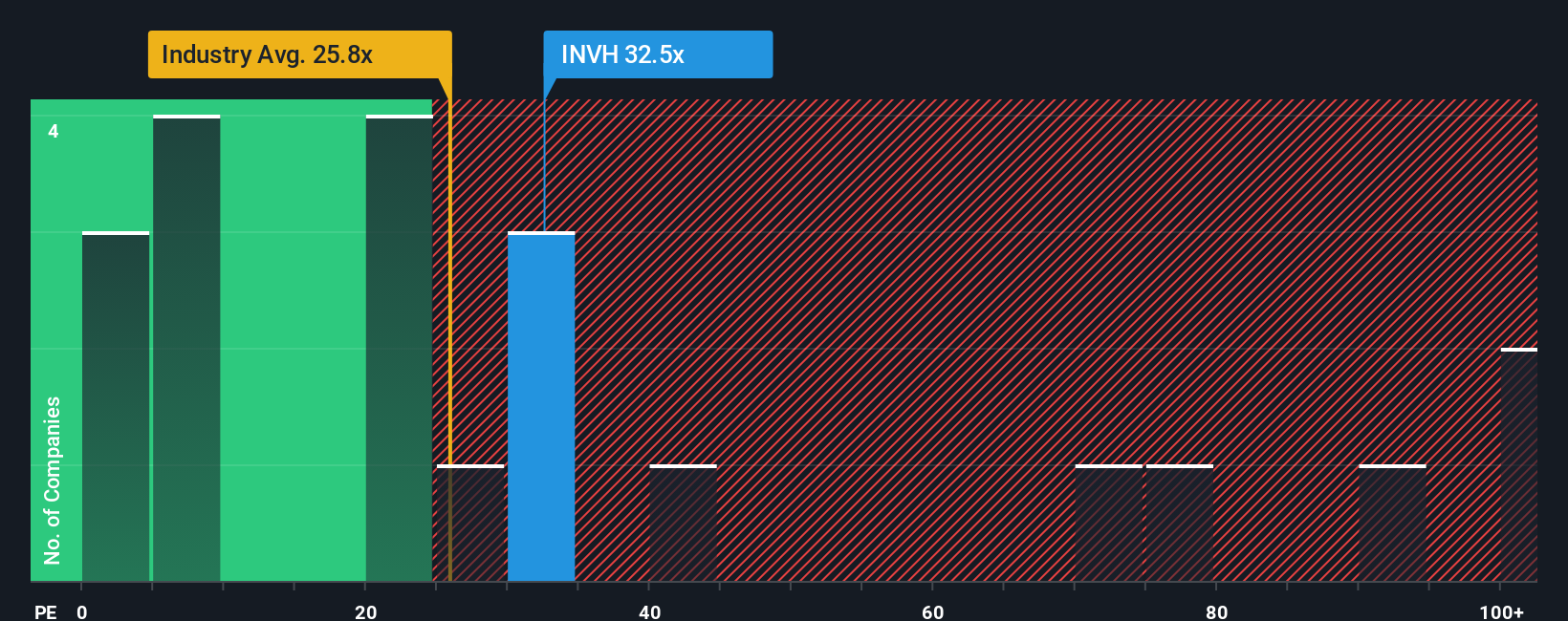

Approach 2: Invitation Homes Price vs Earnings

The Price-to-Earnings (PE) ratio is a popular way to value companies that are generating steady profits, like Invitation Homes. This metric reflects what investors are willing to pay for each dollar of reported earnings, making it particularly meaningful for established, income-producing businesses.

A "normal" or "fair" PE ratio is not set in stone. It generally depends on the company's growth prospects and risk profile. Fast-growing firms or those with stable, predictable cash flows tend to command higher PE multiples, while slower-growing or riskier businesses trade at lower ratios.

Invitation Homes currently trades at a PE ratio of 29.26x. For comparison, the average PE for Residential REITs is 19.92x, and the peer group average is 68.35x. At first glance, Invitation Homes appears modestly priced compared to similar companies and slightly on the high end versus its broader sector.

To cut through the noise, Simply Wall St calculates a "Fair Ratio" for each stock, which in Invitation Homes' case is 28.65x. This proprietary metric considers the company's specific growth rate, profitability, industry trends and market cap, providing a more tailored benchmark than a one-size-fits-all industry or peer comparison.

Looking at these numbers, Invitation Homes' actual PE ratio is almost identical to its Fair Ratio, signaling that the stock is trading close to fair value based on its earnings and risk-adjusted profile.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1423 companies where insiders are betting big on explosive growth.

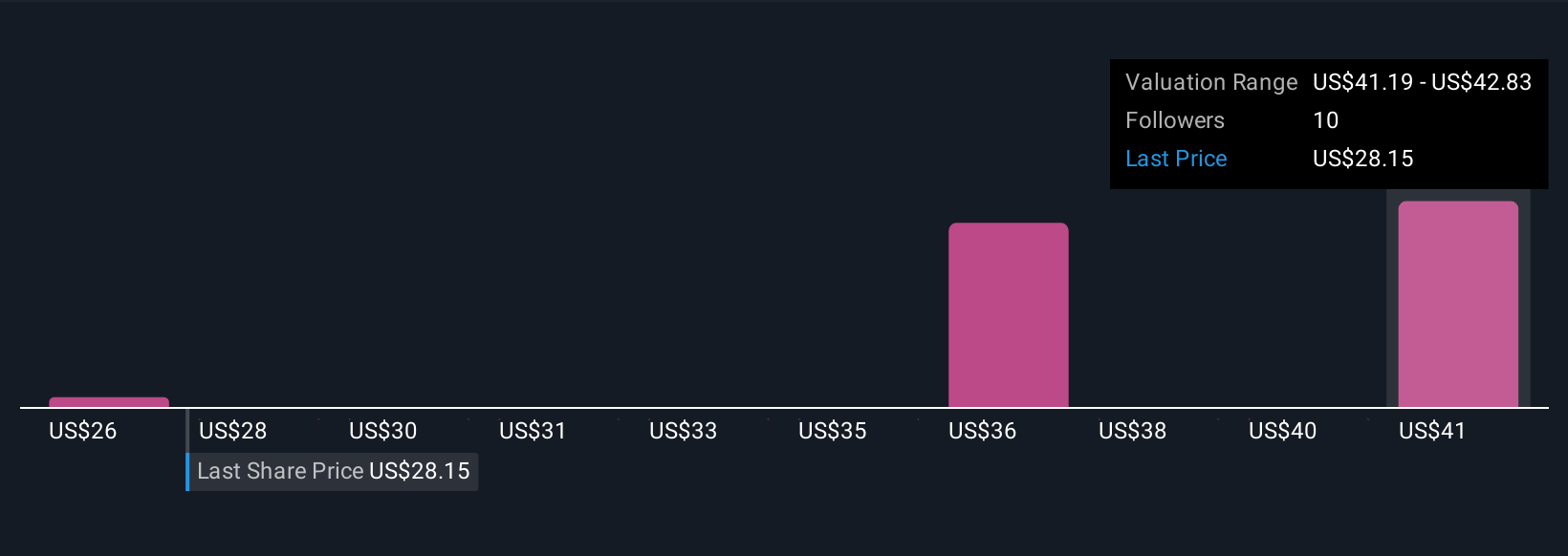

Upgrade Your Decision Making: Choose your Invitation Homes Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is a simple, personalized story you create for a company where you connect your assumptions about its future, such as revenue growth, earnings, and margins, to a financial forecast and then, ultimately, to your own fair value for the shares.

Narratives let you move beyond just numbers or analyst consensus by spelling out why you believe in your valuation and what could change your mind. On Simply Wall St’s Community page, Narratives are accessible for anyone to use, making this dynamic tool available to millions of investors.

Narratives help make buy or sell decisions easier by clearly comparing your unique view of Invitation Homes’ fair value to its latest market price. If new earnings or news arrives, your Narrative updates automatically, ensuring your outlook always reflects the latest information.

For example, some investors may expect Invitation Homes’ earnings to rise above $633.4 million by 2028, leading to a fair value up at $41.0, while others are more cautious, using a lower earnings estimate of $441.1 million and assigning a fair value of just $32.0. By writing and sharing your own Narrative, you can see how your expectations stack up, bringing both confidence and context to every investment call.

Do you think there's more to the story for Invitation Homes? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:INVH

Invitation Homes

Invitation Homes, an S&P 500 company, is the nation’s premier single-family home leasing and management company, meeting changing lifestyle demands by providing access to high-quality homes with valued features such as close proximity to jobs and access to good schools.

Good value with proven track record.

Similar Companies

Market Insights

Community Narratives