- United States

- /

- Industrial REITs

- /

- NYSE:IIPR

Is Innovative Industrial Properties a Bargain After 47% Stock Slide and Regulatory Scrutiny?

Reviewed by Bailey Pemberton

- Curious whether Innovative Industrial Properties is a bargain or still overpriced? You're not alone; many investors are re-examining this stock right now as the market shifts.

- The stock has moved up 1.9% this past week, but it’s still down a hefty 47.2% over the past year. There has definitely been a change in how investors perceive its potential and its risks.

- Recent news has centered around shifting regulatory landscapes in the cannabis sector and evolving real estate market conditions, both of which directly impact Innovative Industrial Properties. Headlines have also highlighted increased scrutiny of lease structures and tenant stability, adding more intrigue to the company’s outlook.

- For the numbers-driven crowd, Innovative Industrial Properties scores a 5 out of 6 on our valuation checklist, which means it is considered undervalued by most standards. We will break down how we get to that number and why the best way to assess a company’s true value may be to go one step beyond the typical analysis, so stay tuned.

Approach 1: Innovative Industrial Properties Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model calculates the value of a business by projecting its future cash flows, specifically Innovative Industrial Properties’ adjusted funds from operations, and then discounting those amounts back to their value in today’s dollars. This approach aims to estimate what the company is genuinely worth based on its potential to generate cash for shareholders over time.

For Innovative Industrial Properties, the most recent trailing twelve months free cash flow is $256.1 Million. Analyst forecasts indicate moderate growth, with the projected free cash flow in 2027 reaching $204 Million. While direct analyst estimates end there, additional long-range projections suggest somewhat stable cash flows through 2035, mostly above $180 Million per year and gradually increasing towards $205 Million by the end of the period.

Based on this analysis, the calculated intrinsic value per share comes to $105.19. Compared to the current price, this valuation implies the stock is trading at a 52.6% discount and is strongly undervalued by DCF standards.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Innovative Industrial Properties is undervalued by 52.6%. Track this in your watchlist or portfolio, or discover 929 more undervalued stocks based on cash flows.

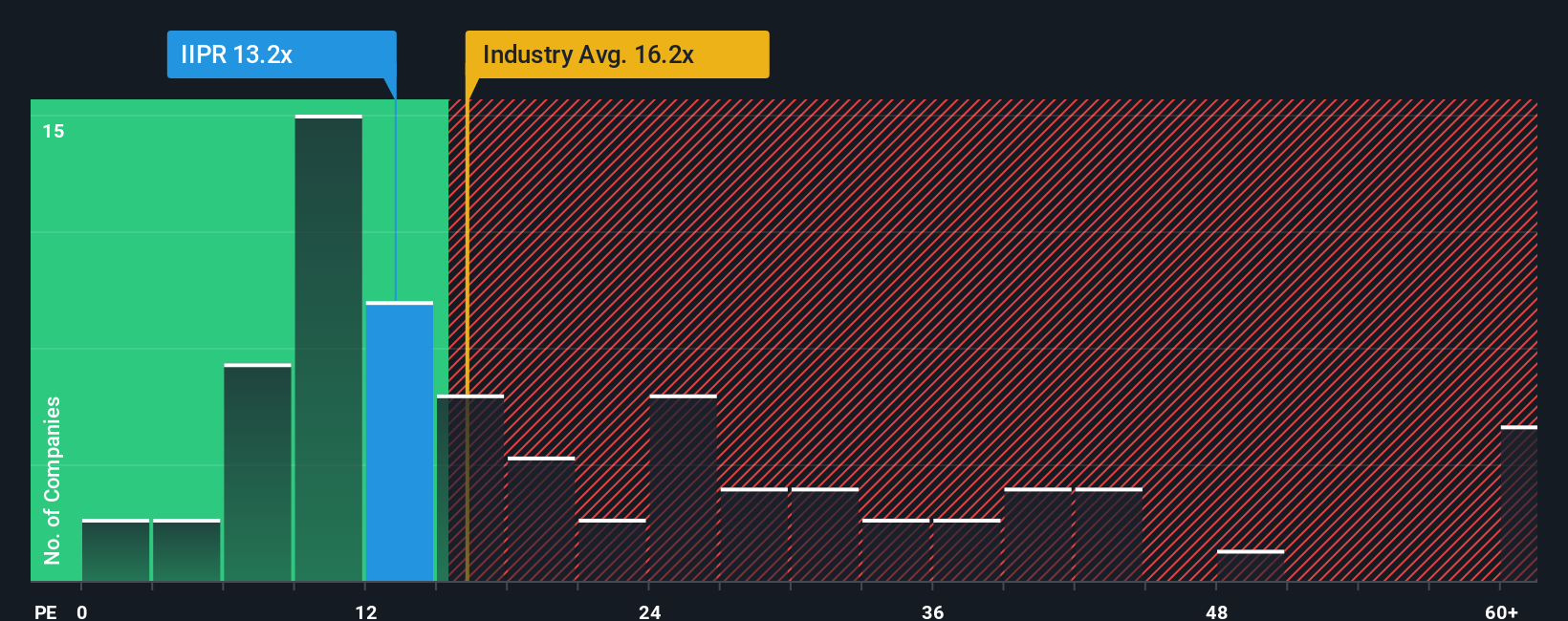

Approach 2: Innovative Industrial Properties Price vs Earnings

The price-to-earnings (PE) ratio remains one of the most reliable ways to value profitable companies like Innovative Industrial Properties, because it links what investors are willing to pay to the company’s bottom-line earnings. This metric is popular because it is simple to calculate and quickly compares stocks on a like-for-like basis, especially among established businesses generating consistent profits.

When using a PE ratio, it is important to remember that higher growth rates, lower risk profiles, and more stable profit margins typically justify higher “normal” multiples. Companies facing uncertainty or stagnation usually trade at lower ratios. So context, such as how fast a company is growing compared to its peers or whether there is risk on the horizon, matters just as much as the number itself.

Currently, Innovative Industrial Properties trades at a PE ratio of 11.6x. This is well below the Industrial REITs industry average of 16.1x and also lower than the peer group average of 15.2x. To refine the comparison, Simply Wall St’s proprietary Fair Ratio takes into account not only these broad benchmarks, but also factors like Innovative Industrial Properties’ specific earnings growth, profit margin, risk level, size, and typical multiples for its sector. For this stock, the Fair Ratio is calculated at 31.9x, much higher than both the company’s actual PE ratio and the industry averages. Since the stock’s current multiple is significantly below its Fair Ratio, this model suggests the shares are undervalued rather than just “cheap” relative to peers.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1445 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Innovative Industrial Properties Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is a simple concept: it is your story or perspective about a company that connects your expectations for its future (such as revenue growth, profit margins, and risks) to a calculated fair value, making the numbers more meaningful and personal.

Narratives go beyond formulas by letting you share the “why” behind your numbers, linking your own view of Innovative Industrial Properties’ future to its forecast, and then to an actionable estimate of what the stock is truly worth.

This approach, available directly on Simply Wall St’s Community page, is used by millions of investors because it’s accessible to all experience levels. It allows you to quickly visualize if your unique take on the company tells a “buy,” “hold,” or “sell” story by comparing your Fair Value to the current price.

Narratives are always up to date; whenever key news, earnings, or industry shifts occur, your forecast and fair value automatically adjust so your view stays timely and relevant.

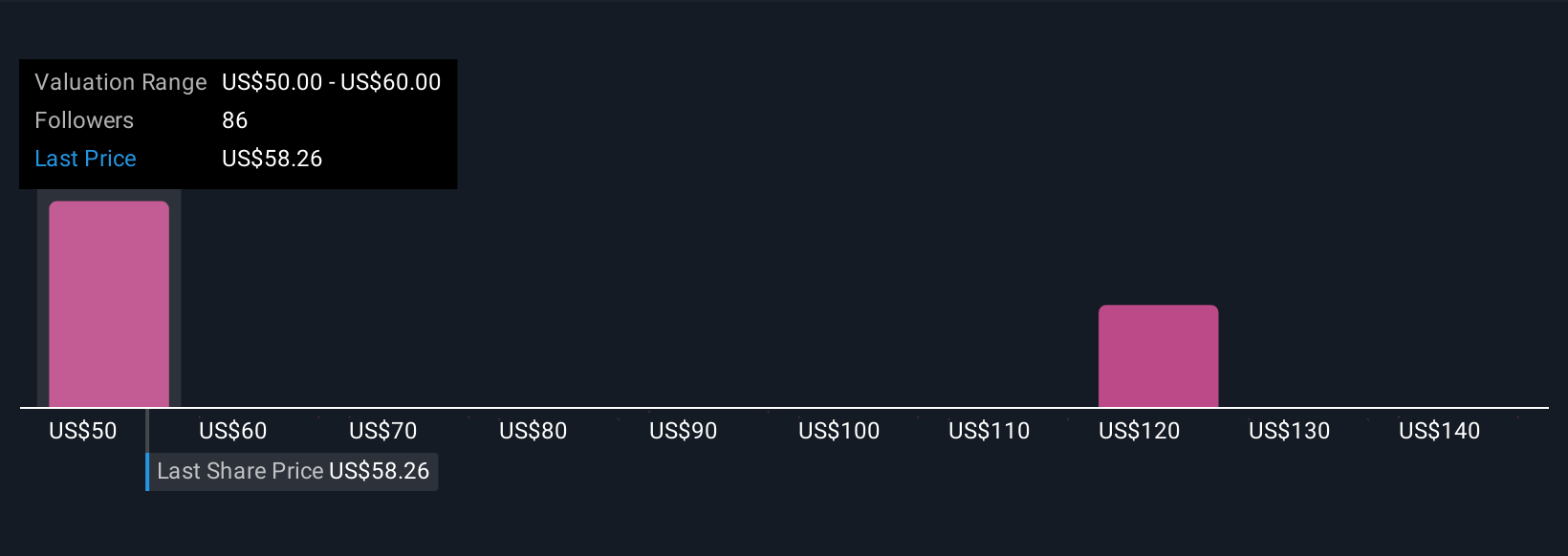

For example, recent Narratives on Innovative Industrial Properties range widely: some investors are pessimistic, forecasting lower revenues and a $43 fair value, while others see opportunity and assign a $90 target. This demonstrates just how flexible and dynamic narrative investing can be.

Do you think there's more to the story for Innovative Industrial Properties? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:IIPR

Innovative Industrial Properties

A real estate investment trust (REIT) focused on the acquisition, ownership and management of specialized industrial properties and life science real estate.

Undervalued with mediocre balance sheet.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Not a Bubble, But the "Industrial Revolution 4.0" Engine

The "David vs. Goliath" AI Trade – Why Second Place is Worth Billions

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026