- United States

- /

- Industrial REITs

- /

- NYSE:IIPR

Innovative Industrial Properties (IIPR) Margin Miss Reinforces Investor Concerns on Profitability and Future Dividend Stability

Reviewed by Simply Wall St

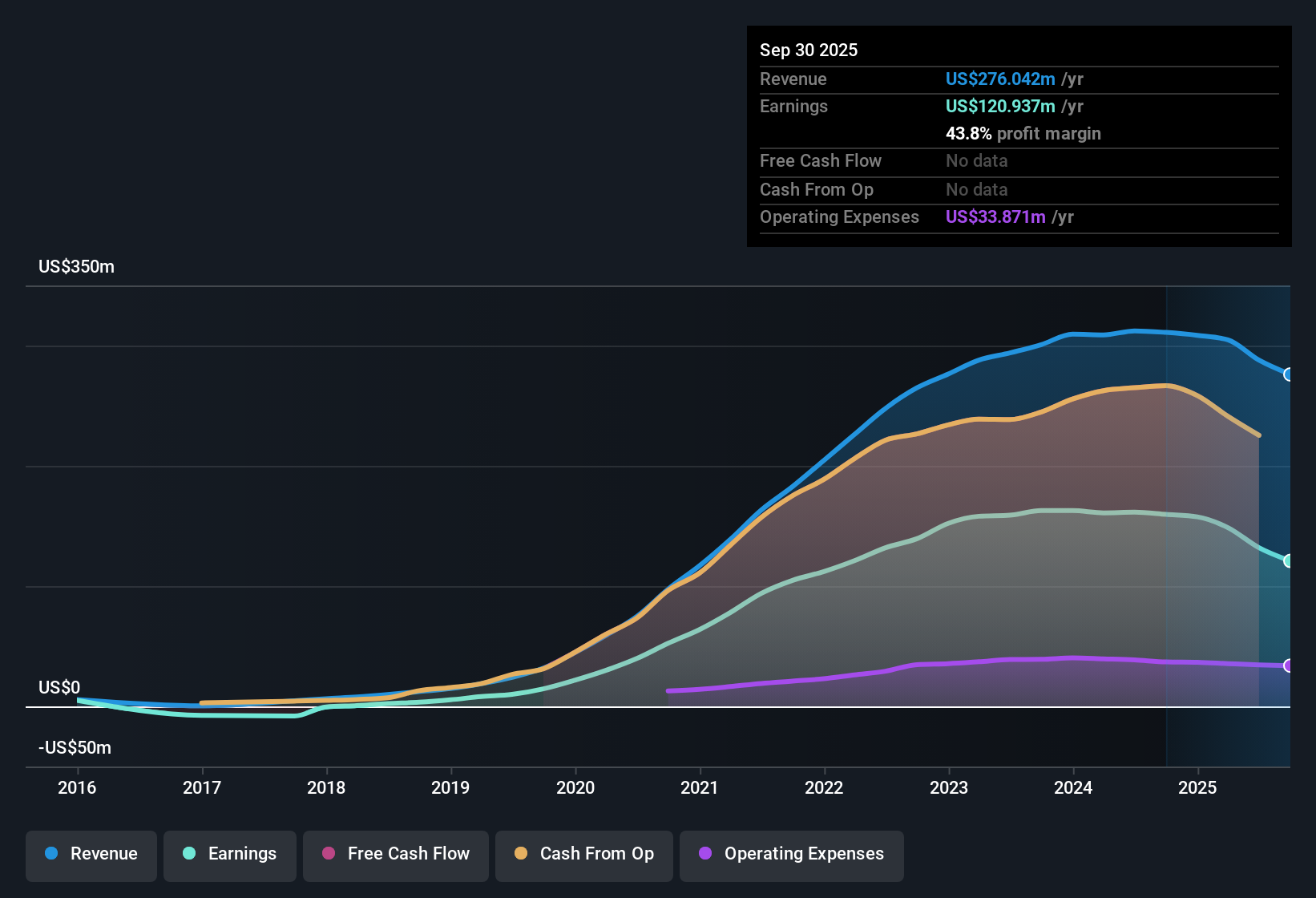

Innovative Industrial Properties (IIPR) posted a net profit margin of 43.8%, down from 51.3% last year, signaling margin pressure even as the company’s five-year annual earnings growth sits at 12.7%. Looking ahead, both revenue and earnings are forecast to decrease by 1.7% per year over the next three years, and recent results show negative earnings growth over the past year. Amid these setbacks, investors are weighing risks like income stability and potential dividend cuts against an undemanding valuation, with shares trading at $49.76, well below the estimated fair value of $109.53 and at a lower multiple than peers.

See our full analysis for Innovative Industrial Properties.The next section puts these earnings numbers side by side with the stories investors are telling, revealing where the data supports the narrative and where surprises may emerge.

See what the community is saying about Innovative Industrial Properties

Margin Compression Signals Cash Flow Tightening

- Net profit margin shrank to 43.8% from last year’s 51.3%. This reflects that income from properties is absorbing a heavier load of costs and pressuring cash flows.

- Consensus narrative notes that shrinking margins support analyst concerns about future profitability and dividend sustainability.

- Profit margin is projected to decline further, with analysts expecting it to reach 41.1% in three years. This heightens uncertainty around whether rental income can cover operating expenses and support distributions.

- Ongoing tenant distress and industry oversupply combine with these margin pressures, raising questions about the durability of IIPR’s sale-leaseback business as cannabis reform and access to cheaper funding threaten the core real estate model.

- To see how margin pressures are shaping analysts’ outlook and where consensus sees value or risk, check out the detailed Consensus Narrative for Innovative Industrial Properties.

📊 Read the full Innovative Industrial Properties Consensus Narrative.

Tenant Distress and Asset Diversification in Focus

- Analysts highlight that IIPR’s heavy cannabis tenant concentration, coupled with high-profile bankruptcies and defaults, increases rent collection risk and complicates re-leasing assets at attractive rates.

- Consensus narrative acknowledges that diversification such as the IQHQ life sciences investment offers the company flexibility, but does not fully offset industry headwinds.

- Life sciences investments are expected to deliver over 14% returns, supporting earnings and dividends. However, their impact is limited by the relatively small size compared to the cannabis portfolio.

- Resilience is tied to a conservative balance sheet, with only $291 million in fixed-rate debt versus $2.6 billion in mostly unencumbered assets. This gives IIPR more options than highly leveraged peers.

Discounted Valuation Contrasts with Analyst Targets

- IIPR’s share price sits at $49.76, notably below the DCF fair value of $109.53 and under the consensus analyst target of $57.00, while trading at only 11.5x earnings compared to the industrial REITs sector average of 17.1x.

- Consensus narrative weighs the appeal of this valuation gap against the forecasted 1.7% annual revenue and earnings contraction over the next three years.

- For price appreciation to match analyst targets, earnings must meet or exceed the projected $105.7 million and PE ratios need to rise. Both are at risk if profit margins continue to decline.

- The narrow gap between current price and price target implies that analysts see the stock as fairly valued for now. This challenges the view that the persistent discount is a straightforward buying opportunity.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Innovative Industrial Properties on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a new angle on the data? Share your unique take and shape your own narrative in just a few minutes. Do it your way.

A great starting point for your Innovative Industrial Properties research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

See What Else Is Out There

Innovative Industrial Properties faces margin compression, shrinking earnings, and profit uncertainty, especially as industry headwinds and tenant defaults create pressure on earnings stability.

Worried about unpredictable income and unreliable cash flow? Use stable growth stocks screener (2082 results) to discover companies consistently delivering robust revenue and earnings regardless of the economic climate.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:IIPR

Innovative Industrial Properties

A real estate investment trust (REIT) focused on the acquisition, ownership and management of specialized industrial properties leased to experienced, state-licensed operators for their regulated cannabis facilities.

Undervalued with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives