- United States

- /

- Office REITs

- /

- NYSE:HPP

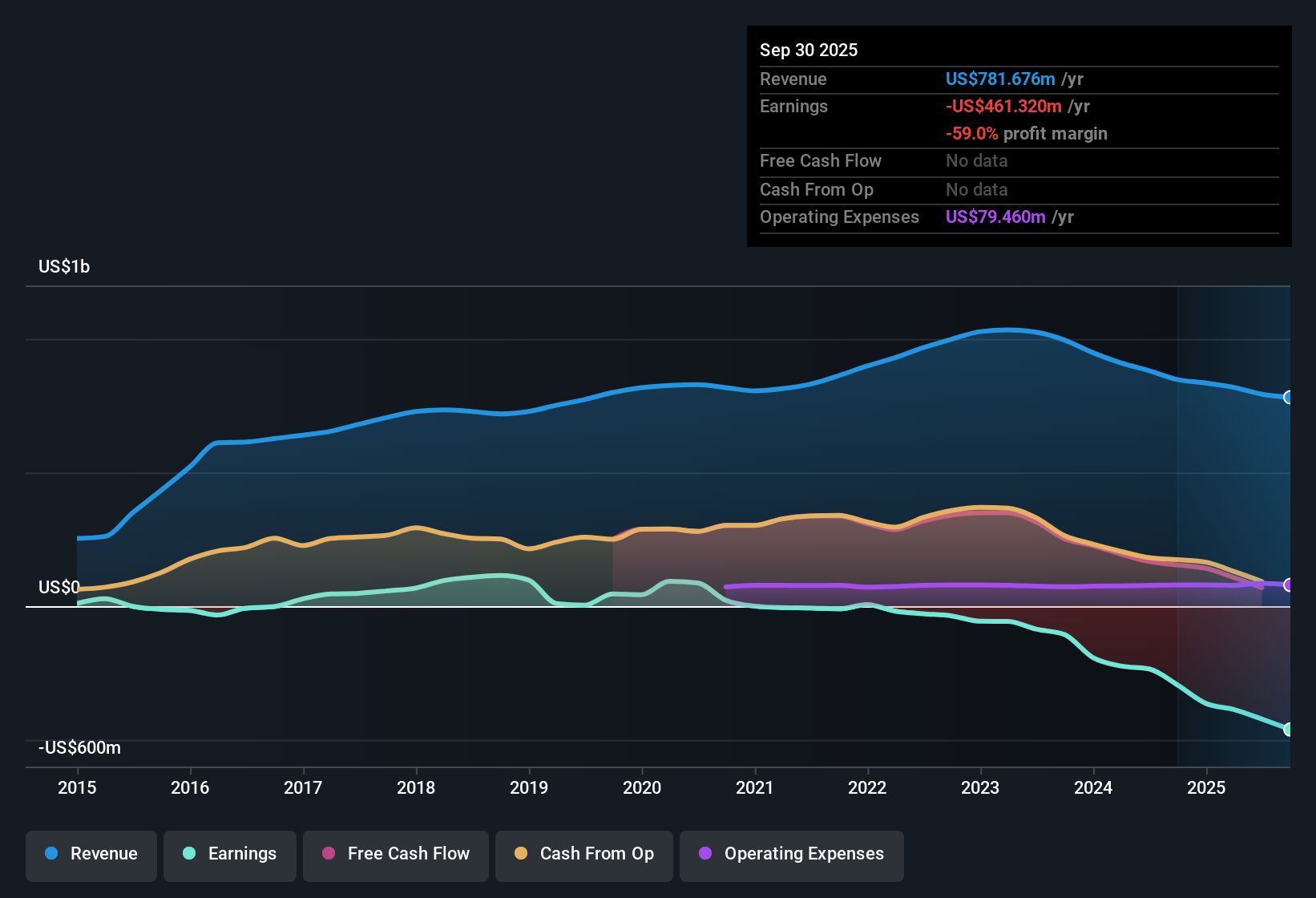

Hudson Pacific Properties (HPP): Losses Worsen 71.6% Annually, Profitability Unlikely Near Term

Reviewed by Simply Wall St

Hudson Pacific Properties (HPP) remains in the red, with losses worsening at an average rate of 71.6% per year over the past five years. Revenue is forecast to grow by 7.6% per year, which is slower than the wider US market’s 10.5% expected pace, and the company is not anticipated to reach profitability in the next three years. While the sustained losses are front and center this quarter, investors will note that the stock’s sales multiple stands at 1.2x, lower than the industry norm, even as shares currently trade above the estimated fair value of $1.97.

See our full analysis for Hudson Pacific Properties.The next section puts Hudson Pacific Properties' latest earnings in context, measuring the results against investor expectations and the prevailing narratives on Simply Wall St.

See what the community is saying about Hudson Pacific Properties

Studio Show Counts Rise Alongside Office Leasing Activity

- California film and TV studio projects are rebounding, with analysts highlighting rising show counts and improving core studio occupancy. These trends could help diversify revenue and support margin recovery.

- According to the analysts' consensus view, expanding AI and tech sector leasing, combined with increased content production, is adding momentum to occupancy gains and points to the potential for margin improvement over the next several years.

- Ongoing operational streamlining in the Quixote studio business and portfolio repositioning further strengthen the case for sustained growth.

- However, the consensus also notes that volatile studio performance remains a key variable influencing future earnings visibility.

- To see what’s fueling both optimism and caution in analysts’ latest balanced perspective, read the full consensus narrative. 📊 Read the full Hudson Pacific Properties Consensus Narrative.

Heavy West Coast Exposure Increases Risk

- With core office and studio assets mainly concentrated in tech-driven West Coast markets, Hudson Pacific Properties is highly exposed to swings in tech sector demand, outmigration, and regional downturns.

- Analysts' consensus view flags that while increased leasing in AI and streaming offers clear upside, the company’s narrow geographic and sector focus heightens revenue volatility risk if tech demand cools or office market headwinds worsen.

- Declining net effective office rents, down 11% compared to pre-pandemic levels, add to cash flow pressure in these core markets.

- Reliance on asset sales and new equity to bolster liquidity could dilute per-share performance, especially if macro challenges persist.

Shares Trade Above DCF Fair Value Despite Low Sales Multiple

- Although Hudson Pacific Properties carries a price-to-sales ratio of 1.2x versus an industry average of 2.1x, the current share price of $2.41 stands notably above the DCF fair value estimate of $1.97.

- Analysts' consensus view suggests that for the $3.28 price target to be justified, Hudson Pacific Properties would need to improve margins to industry levels by 2028 following substantial revenue growth and successful cost controls.

- Consensus points out that, while valuation looks attractive against peers, sustained losses and the premium to DCF fair value make the bullish case dependent on a significant turnaround.

- Material disagreement exists among analysts, with price targets ranging widely from $2.00 to $5.00, underscoring the uncertainty tied to future profitability timing.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Hudson Pacific Properties on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Do you interpret the figures another way? Take just a couple of minutes to shape your own perspective and share your story. Do it your way

A great starting point for your Hudson Pacific Properties research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

See What Else Is Out There

Ongoing losses, volatile core operations, and a premium price to fair value highlight Hudson Pacific Properties' struggles to deliver consistent and reliable financial performance.

If the uncertainty here is a concern, check out stable growth stocks screener (2074 results) for a lineup of companies that consistently deliver steady growth and dependable outcomes across cycles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hudson Pacific Properties might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HPP

Hudson Pacific Properties

A real estate investment trust, or REIT, and the sole general partner of our operating partnership.

Fair value with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives