- United States

- /

- Retail REITs

- /

- NYSE:GTY

Getty Realty’s US$250 Million Debt Raise Might Change The Case For Investing In GTY

Reviewed by Sasha Jovanovic

- On November 20, 2025, Getty Realty Corp. announced it had raised US$250 million by issuing 5.76% Senior Unsecured Notes with a ten-year term through a private placement, with funding scheduled for January 22, 2026.

- This significant capital raise marks a substantial addition to Getty Realty’s funding resources, potentially enhancing its financial flexibility and long-term growth capacity.

- Now, we’ll consider how access to US$250 million in new long-term debt funding could reshape Getty’s existing investment narrative.

AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Getty Realty Investment Narrative Recap

To be a shareholder of Getty Realty, you need to believe in the ongoing demand for automotive and convenience retail, as well as the company's ability to profit from net lease assets despite shifting industry dynamics. The recent US$250 million debt offering reinforces Getty’s financial agility, though it does not significantly reduce near-term risks from tenant concentration or industry changes related to fuel demand decline.

Among recent announcements, the October 21, 2025 dividend increase, raising the quarterly payout by 3.2%, stands out. This move, in tandem with the new funding, suggests Getty is intent on maintaining shareholder distributions even as it seeks growth through acquisitions and fortifies its balance sheet.

However, even with expanded capital and higher dividends, investors should not overlook the long-term implications of declining gasoline demand on legacy sites...

Read the full narrative on Getty Realty (it's free!)

Getty Realty's outlook anticipates $252.2 million in revenue and $92.5 million in earnings by 2028. This forecast assumes 6.3% annual revenue growth and an increase in earnings of $29 million from the current $63.5 million.

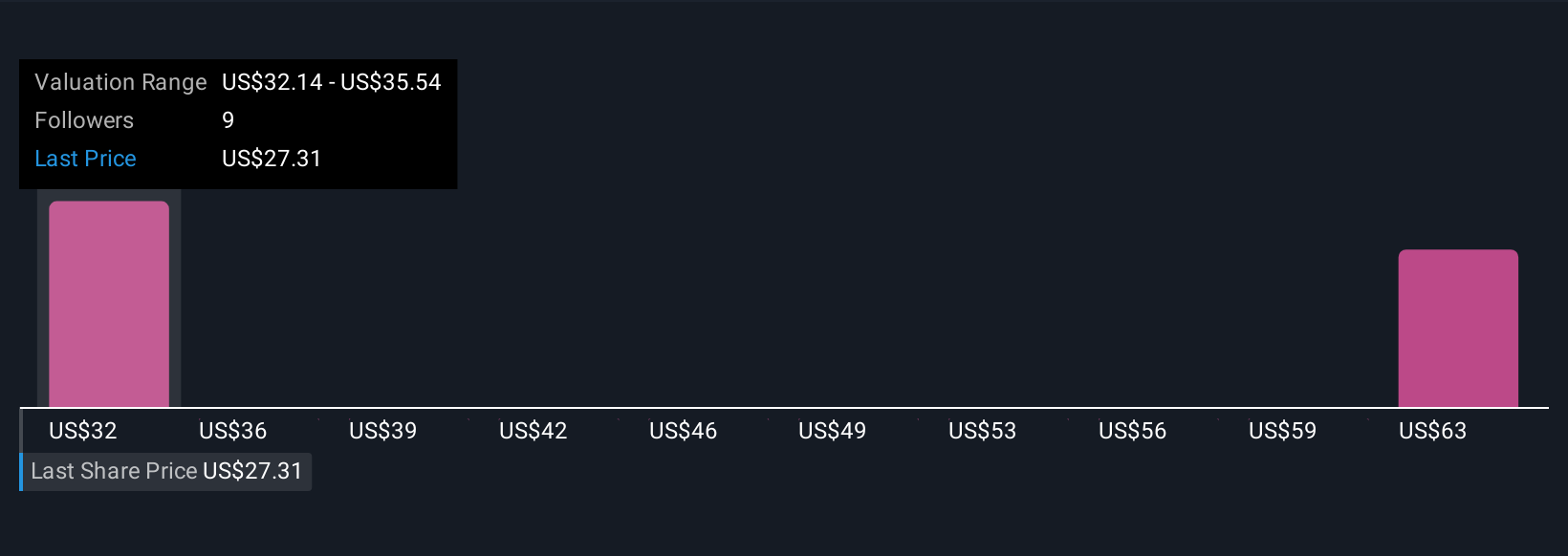

Uncover how Getty Realty's forecasts yield a $32.14 fair value, a 14% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members provided fair value estimates for Getty Realty ranging from US$32.14 to US$67.00, based on two individual perspectives. While the latest capital raise boosts balance sheet flexibility, sector-wide risks tied to fuel demand and evolving tenant profiles continue to shape future outcomes, consider multiple viewpoints before forming an opinion.

Explore 2 other fair value estimates on Getty Realty - why the stock might be worth over 2x more than the current price!

Build Your Own Getty Realty Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Getty Realty research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Getty Realty research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Getty Realty's overall financial health at a glance.

Searching For A Fresh Perspective?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Find companies with promising cash flow potential yet trading below their fair value.

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:GTY

Getty Realty

A publicly traded, net lease REIT specializing in the acquisition, financing and development of convenience, automotive and other single tenant retail real estate.

Undervalued established dividend payer.

Similar Companies

Market Insights

Community Narratives