- United States

- /

- Retail REITs

- /

- NYSE:GTY

Getty Realty (GTY) Margin Expansion Reinforces Bullish Narrative Despite Growth and Dividend Concerns

Reviewed by Simply Wall St

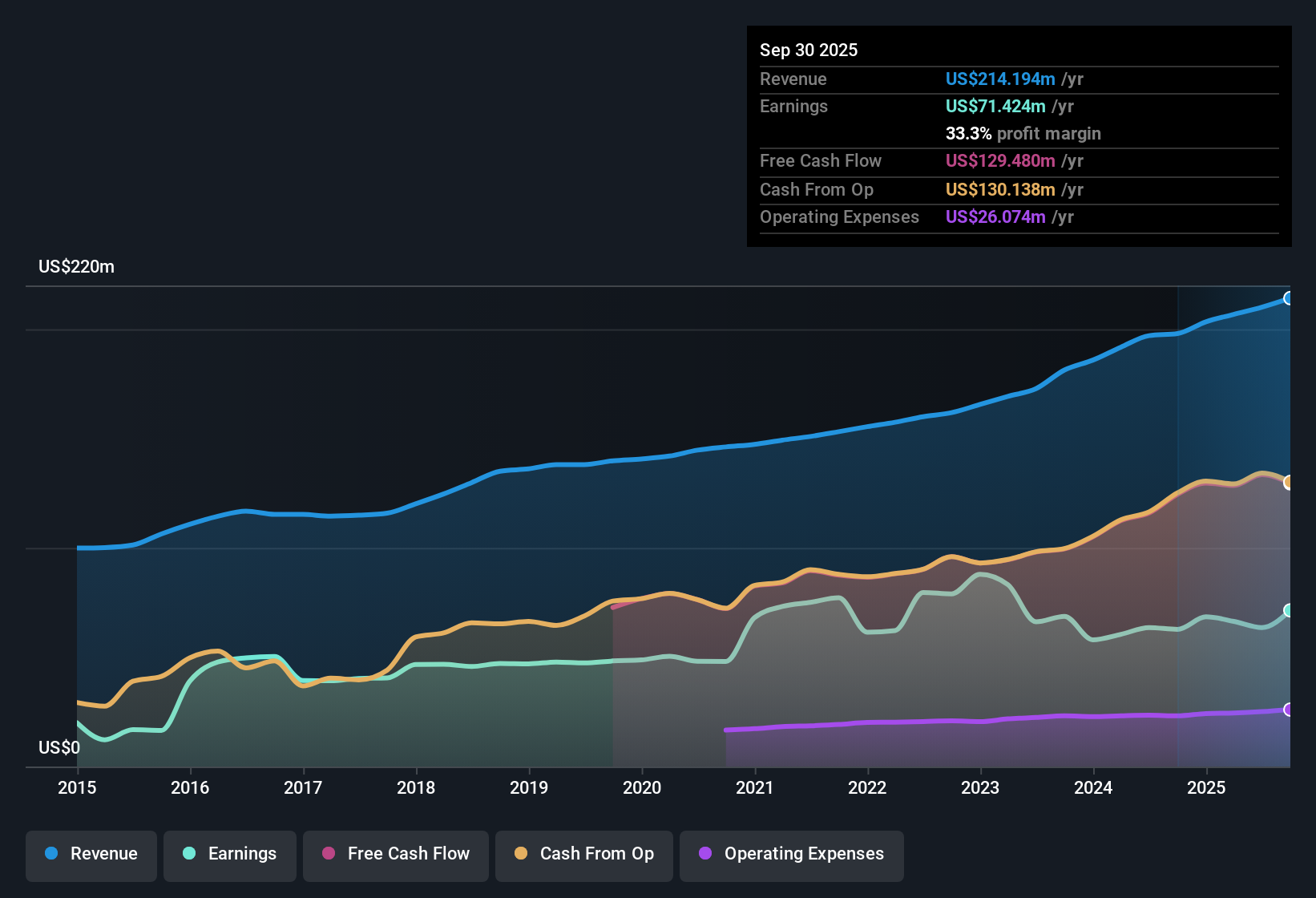

Getty Realty (GTY) reported a net profit margin of 33.5%, up from 31.7% a year earlier, signaling improved profitability. EPS climbed 14.5% year over year, comfortably outpacing the company’s five-year average annual decline of 0.7%. With earnings expected to rise at 12% per year and shares priced well below estimated fair value, investors are sizing up Getty’s robust margin trends and strong quality of earnings, even as forecasts point to slower growth than the broader US market and some questions remain over dividend sustainability and balance sheet strength.

See our full analysis for Getty Realty.Next, we’ll see how these latest numbers stack up against the popular narratives shaping expectations for Getty Realty. We will examine which views are supported and which may need to be reconsidered.

See what the community is saying about Getty Realty

Analyst Price Target Sits Above Today’s Share Price

- The current share price of $28.23 sits 11% below the consensus analyst price target of $31.75, highlighting a modest upside implied by market expectations for future profitability and growth.

- Analysts’ consensus view emphasizes that upside is tied to stable cash flows and asset values. However,

- Management’s focus on strategic acquisitions and a diversified tenant base supports rental revenue and dividend consistency, while the current discount to target may reflect growth rates trailing the broader US market.

- Heavy exposure to legacy auto assets and the risk of industry headwinds, such as electric vehicle adoption or environmental liabilities, could cap near-term multiple expansion, so outperformance depends on balancing portfolio stability with these evolving challenges.

- To see if analyst expectations warrant a closer look at Getty Realty, check how their balanced narrative measures up to the numbers: 📊 Read the full Getty Realty Consensus Narrative.

Portfolio Diversification Drives Rental Stability

- The company’s high occupancy rate of 99.7% and long average lease terms of 10 years provide vital visibility into recurring rental cash flows, even as many assets are concentrated in automotive service sectors.

- Consensus narrative highlights that steady occupancy, diversified tenants, and disciplined balance sheet management have supported consistent earnings and dividends.

- However, analysts note that limited industry diversification and expansion into assets vulnerable to technological change could increase susceptibility to tenant churn or erosion of rental revenue as market dynamics shift.

- Still, minimal new competing developments and favorably located assets enhance Getty’s leverage in lease negotiations, which could help preserve rental rates and asset values over time.

Discount to DCF Fair Value Remains Wide

- Getty Realty's current share price of $28.23 trades at less than half of its DCF fair value estimate of $61.83, and at a lower P/E (22.7x) versus peers (27.1x), highlighting a significant valuation gap that could attract long-term investors.

- Analysts’ consensus view points to this discount as a product of both cautious growth forecasts and specific risk factors.

- These concerns include dividend sustainability and required capital outlays to manage environmental liabilities, which may limit near-term re-rating potential even if core earnings quality remains solid.

- The gap between DCF fair value and market price underlines an opportunity for those confident in balance sheet strength and management’s ability to navigate regulatory and industry shifts.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Getty Realty on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Spot something in the numbers others might have missed? Share your interpretation and shape a fresh narrative in just a few minutes by using Do it your way.

A great starting point for your Getty Realty research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

See What Else Is Out There

Getty Realty’s limited industry diversification and looming questions over dividend sustainability and balance sheet strength could restrict its upside and increase risk for some investors.

If you want to prioritize companies with healthier financial foundations and resilient balance sheets, focus your research on solid balance sheet and fundamentals stocks screener (1984 results) better equipped to weather market uncertainty.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:GTY

Getty Realty

A publicly traded, net lease REIT specializing in the acquisition, financing and development of convenience, automotive and other single tenant retail real estate.

Undervalued established dividend payer.

Similar Companies

Market Insights

Community Narratives