- United States

- /

- Retail REITs

- /

- NYSE:FRT

Is Federal Realty Trading Below Its Intrinsic Value After 2025 Price Drop?

Reviewed by Bailey Pemberton

- Wondering if Federal Realty Investment Trust is a smart buy at today's price? Let's break down what really matters when determining whether this REIT offers value right now.

- Despite a recent 0.8% gain this week, shares are still down 2.6% over the past month and have slipped 11.7% year-to-date. This hints at shifting investor sentiment and possible opportunity.

- Federal Realty's recent media attention has focused on heightened activity in the real estate investment trust space. Analysts are weighing in on sector resilience as interest rates remain a hot topic. Broader news has emphasized both challenges in commercial property and discussions around REIT strategies for weathering economic uncertainty.

- Looking purely at the numbers, Federal Realty scores a 5 out of 6 on our valuation checks, pointing to evidence of undervaluation. We will examine these valuation approaches in detail shortly, but keep in mind there is an even more useful perspective on value to wrap up with at the end of this article.

Approach 1: Federal Realty Investment Trust Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company’s intrinsic worth by forecasting its future cash flows and then discounting those cash flows back to today, reflecting the company’s adjusted funds from operations. For Federal Realty Investment Trust, the DCF analysis focuses on predicting future free cash flow, using both analyst estimates for the next five years and Simply Wall St’s own careful extrapolations for the years that follow.

Currently, Federal Realty generates $570 million in free cash flow. Analysts anticipate a steady increase, with projections reaching $615 million by the end of 2029. Simply Wall St extends these estimates, forecasting continued growth through the early 2030s. All projections are denominated in US dollars, helping investors assess potential real-world gains.

The model’s results indicate that Federal Realty’s estimated intrinsic value stands at $140.34 per share. This implies the stock is currently trading at a substantial 31.5% discount. In plain terms, the DCF approach suggests Federal Realty is notably undervalued at its current price.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Federal Realty Investment Trust is undervalued by 31.5%. Track this in your watchlist or portfolio, or discover 836 more undervalued stocks based on cash flows.

Approach 2: Federal Realty Investment Trust Price vs Earnings

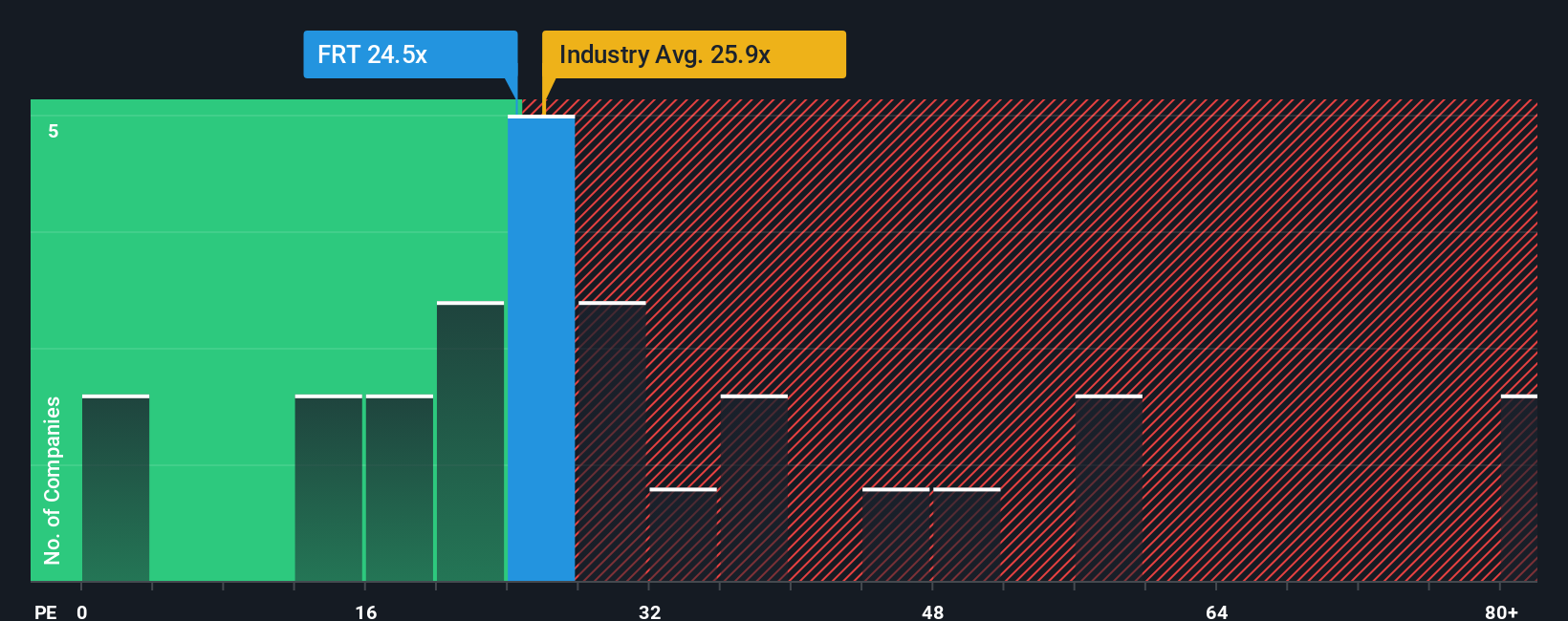

The price-to-earnings (PE) ratio is a fitting metric for valuing profitable companies like Federal Realty Investment Trust, as it directly relates the company’s stock price to its earnings power. It offers a straightforward comparison point for investors and helps signal whether the stock is currently expensive or cheap relative to its profits.

Growth outlook and risk profile are two of the key factors shaping what a “normal” or “fair” PE ratio should be. Companies with faster expected growth or lower risk typically trade at higher PE ratios, reflecting investors’ willingness to pay more for future earnings and stability. Slower growers or riskier companies should command lower multiples.

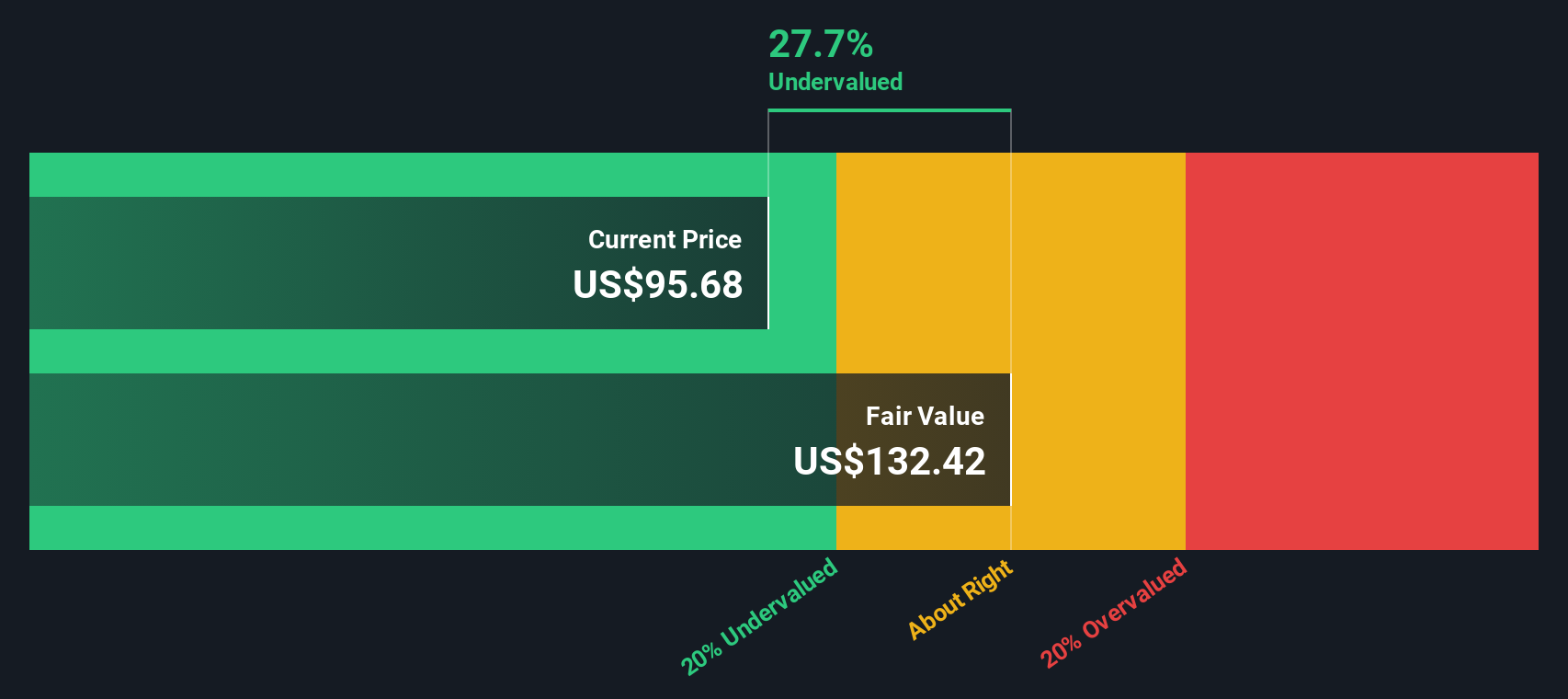

Right now, Federal Realty’s PE ratio is 24.6x, which is a bit below the Retail REITs industry average of 25.5x and well below the peer group average of 30x. While comparing to these benchmarks is useful, the Fair Ratio developed by Simply Wall St is more insightful. This proprietary metric takes into account not just industry averages and peer sets, but also the company’s expected earnings growth, profit margins, market cap, and risk profile to estimate what multiple the stock should command in a balanced market.

For Federal Realty, the Fair Ratio stands at 29.8x. Since its current PE of 24.6x is notably lower than this figure, the evidence points to the stock being undervalued relative to where its fundamentals and prospects suggest it should trade.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1406 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Federal Realty Investment Trust Narrative

Earlier we mentioned that there's an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is your personalized investment story. It is where you build your own view on a company by combining what you believe about its future (like revenue, earnings, and margins) with what you see in the numbers, producing your unique estimate of fair value.

Unlike traditional analysis that only looks at past results or one-size-fits-all models, Narratives connect your outlook on Federal Realty's business, strategy, and industry trends directly to dynamic financial forecasts. This turns your convictions, such as growth in mixed-use retail or how rising interest rates may affect profitability, into a tangible estimate of the company's worth.

Narratives are available on Simply Wall St's Community page, where millions of investors can easily create or explore a range of perspectives. They make investment decisions smarter by allowing you to instantly compare Fair Value (based on your Narrative) with today's price, helping you decide if it's time to buy, sell, or hold.

Best of all, Narratives update in real time as new earnings results or news are released. For example, the most optimistic investors currently value Federal Realty as high as $137 per share, while the most cautious see fair value at just $100. Your Narrative determines where you land.

Do you think there's more to the story for Federal Realty Investment Trust? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:FRT

Federal Realty Investment Trust

Federal Realty is a recognized leader in the ownership, operation and redevelopment of high-quality retail-based properties located primarily in major coastal markets and select underserved regions with strong economic and demographic fundamentals.

6 star dividend payer and undervalued.

Similar Companies

Market Insights

Community Narratives