- United States

- /

- Retail REITs

- /

- NYSE:FRT

Is Federal Realty a Bargain Amid 2025 Retail Real Estate Recovery?

Reviewed by Bailey Pemberton

Wondering whether it is time to buy, sell, or simply hold onto Federal Realty Investment Trust? You are not alone. With so many stocks on the move, it makes sense to pause and weigh your options, especially for a name with Federal Realty’s long-standing reputation. The stock closed at $99.41 recently, and while it has dipped mildly over the past month and year, with returns of -3.2% and -6.7% respectively, its performance over the longer haul stands out. The company recorded a solid 25.0% gain over the past three years and an impressive 56.4% climb across five years. Those numbers suggest there is more depth behind recent price swings than just short-term jitters.

Some of that momentum ties back to shifting market attitudes toward real estate investment trusts, as well as broader economic developments that have nudged investors toward reliable income and asset-backed plays. Despite a slight negative trajectory since the start of the year, Federal Realty’s underlying fundamentals remain a point of discussion and excitement for valuation watchers. The company currently boasts a valuation score of 5 out of 6, reflecting that it appears undervalued on almost every major metric that analysts care about.

But what does that really mean for your decision today? Let’s break down each of the major valuation approaches to see where Federal Realty stands. And stay tuned, after the numbers, we will look at an even smarter angle to understanding what this stock may be worth to you.

Why Federal Realty Investment Trust is lagging behind its peers

Approach 1: Federal Realty Investment Trust Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) method projects a company’s future adjusted funds from operations, then discounts those forecasts back to today to estimate what the business is worth right now. For Federal Realty Investment Trust, analysts drew from recent years’ results, estimating Free Cash Flow at $570.24 Million for the last twelve months. Analyst forecasts extend up to 2029, projecting an increase to $615.30 Million, with further growth beyond five years extrapolated by Simply Wall St’s models.

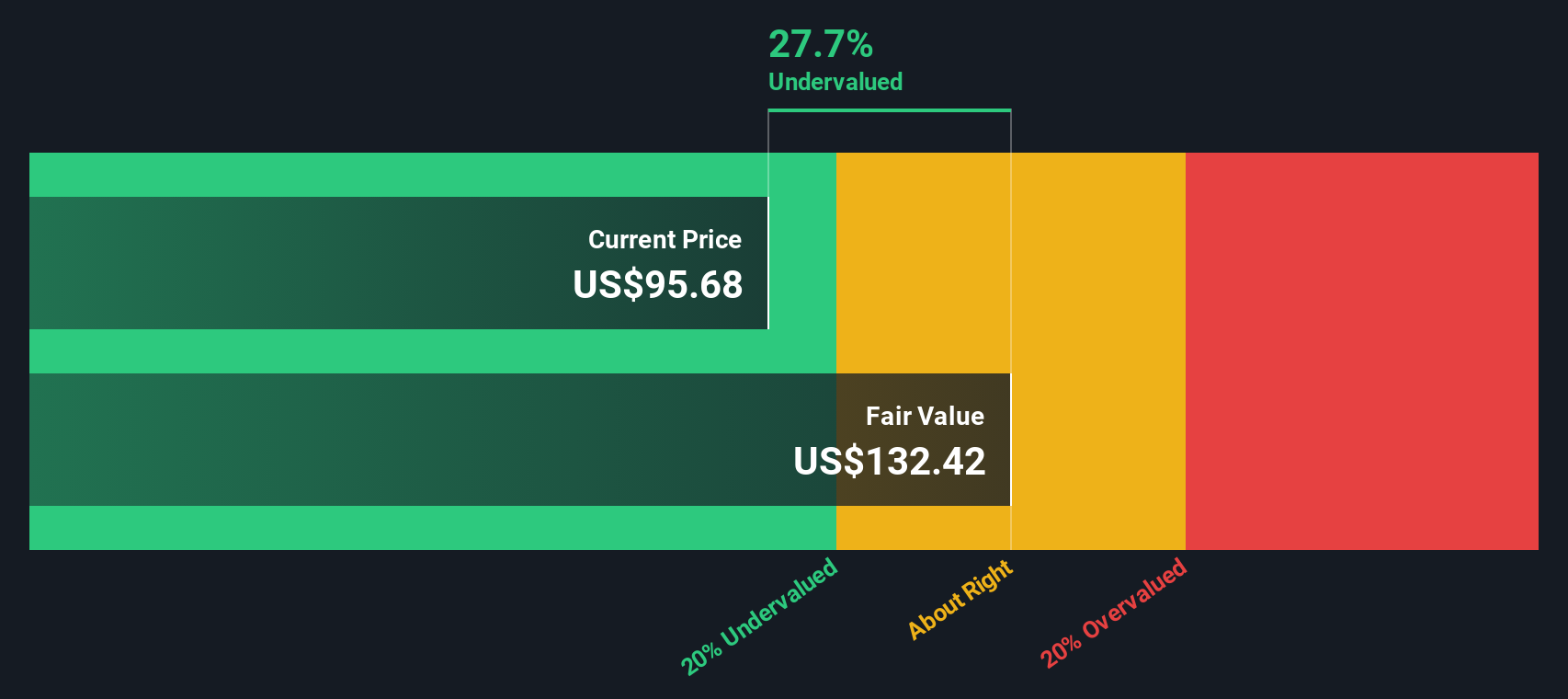

The DCF valuation uses these projected future cash flows to calculate a present value per share. Based on this approach, the intrinsic value of Federal Realty Investment Trust stock lands at $132.26, using the 2 Stage Free Cash Flow to Equity model. Compared to the recent share price of $99.41, this represents a 24.8 percent discount, implying that the stock is currently undervalued by the market.

This suggests that Federal Realty may be trading for less than its long-term business prospects indicate, at least according to the cash flow picture.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Federal Realty Investment Trust is undervalued by 24.8%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Federal Realty Investment Trust Price vs Earnings (PE)

For companies that are consistently profitable, the Price-to-Earnings (PE) ratio is often the go-to valuation tool. It provides a quick way to size up how much investors are willing to pay for a company's earnings, making it a practical yardstick when comparing profitable businesses like Federal Realty Investment Trust.

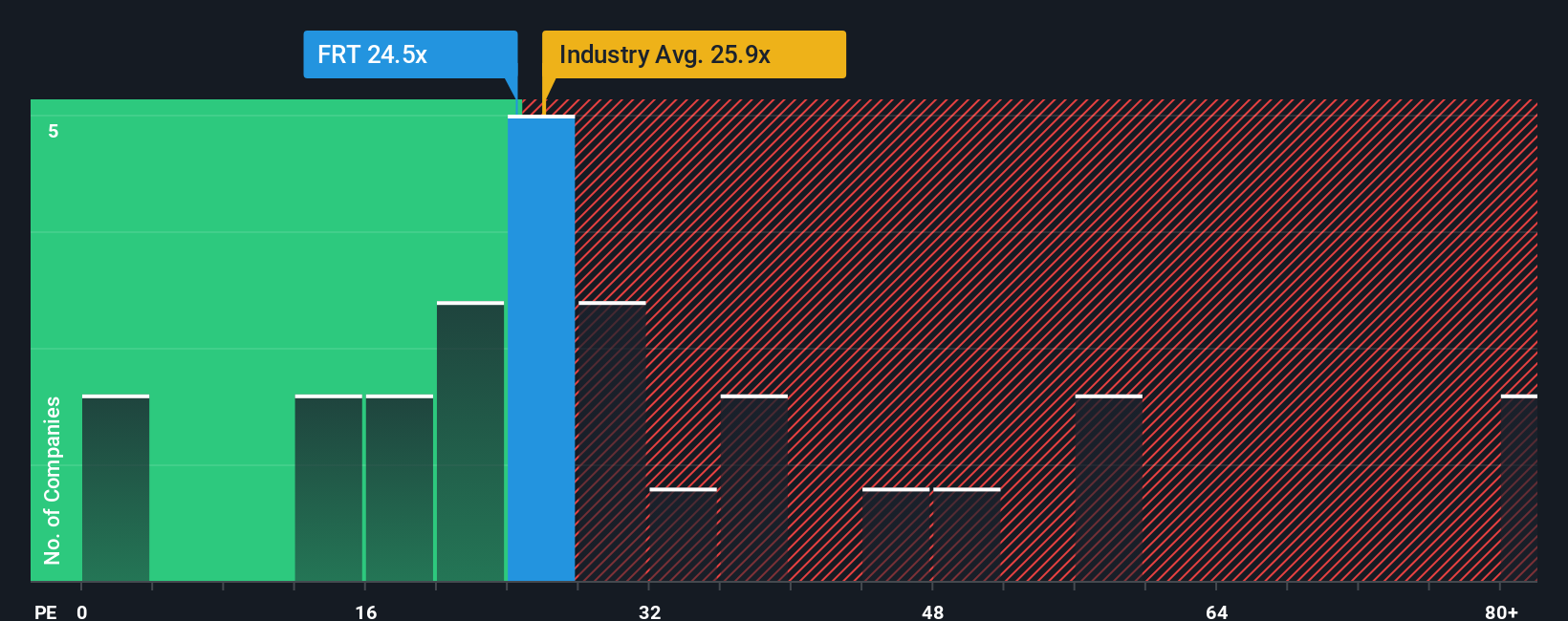

Interpreting the PE ratio requires context. Higher ratios are usually justified for companies with stronger growth prospects or lower risk, while lower ratios may reflect market caution or lower growth expectations. Federal Realty currently trades at a PE ratio of 25.5x. For comparison, the average PE ratio among its peers is 30.6x, and the industry average for Retail REITs sits at about 26.0x. This puts Federal Realty slightly below both.

Instead of relying solely on raw averages, Simply Wall St introduces the "Fair Ratio," which calculates what the PE should be for Federal Realty based on factors such as its earnings growth, profit margins, broader industry trends, market cap, and specific business risks. This gives investors a more nuanced benchmark tailored to the company's true prospects rather than just how it stacks up against the crowd. Federal Realty's Fair Ratio comes in at 30.7x, notably above its current 25.5x PE. This spread suggests that the stock may be undervalued, as the current market price does not fully reflect its underlying strengths and growth profile.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Federal Realty Investment Trust Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. A Narrative is your personal story about a company, connecting the dots between what is happening in the real world and what you believe might happen financially, such as future revenue growth, profit margins, and what the shares should really be worth.

This approach goes beyond just looking at ratios or analyst targets by letting you write your own perspective and pair it with your own financial forecasts. Narratives link your unique outlook for Federal Realty Investment Trust directly to a fair value, making it easy to see if the current price is above or below what you consider the company’s true worth to be.

On Simply Wall St’s Community page, millions of investors are already using Narratives to share, update, and compare their views as new information, such as breaking news or quarterly results, emerges. By creating or following a Narrative, you can see at a glance whether it is time to buy, sell, or wait, informed by live updates and the wisdom of the crowd.

For example, the most optimistic investor currently sees fair value at $137.00 based on strong mixed-use expansion, while the most cautious sets it at just $100.00 in light of margin pressures and revenue risks.

Do you think there's more to the story for Federal Realty Investment Trust? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:FRT

Federal Realty Investment Trust

Federal Realty is a recognized leader in the ownership, operation and redevelopment of high-quality retail-based properties located primarily in major coastal markets and select underserved regions with strong economic and demographic fundamentals.

6 star dividend payer and undervalued.

Similar Companies

Market Insights

Community Narratives