- United States

- /

- Specialized REITs

- /

- NYSE:FPI

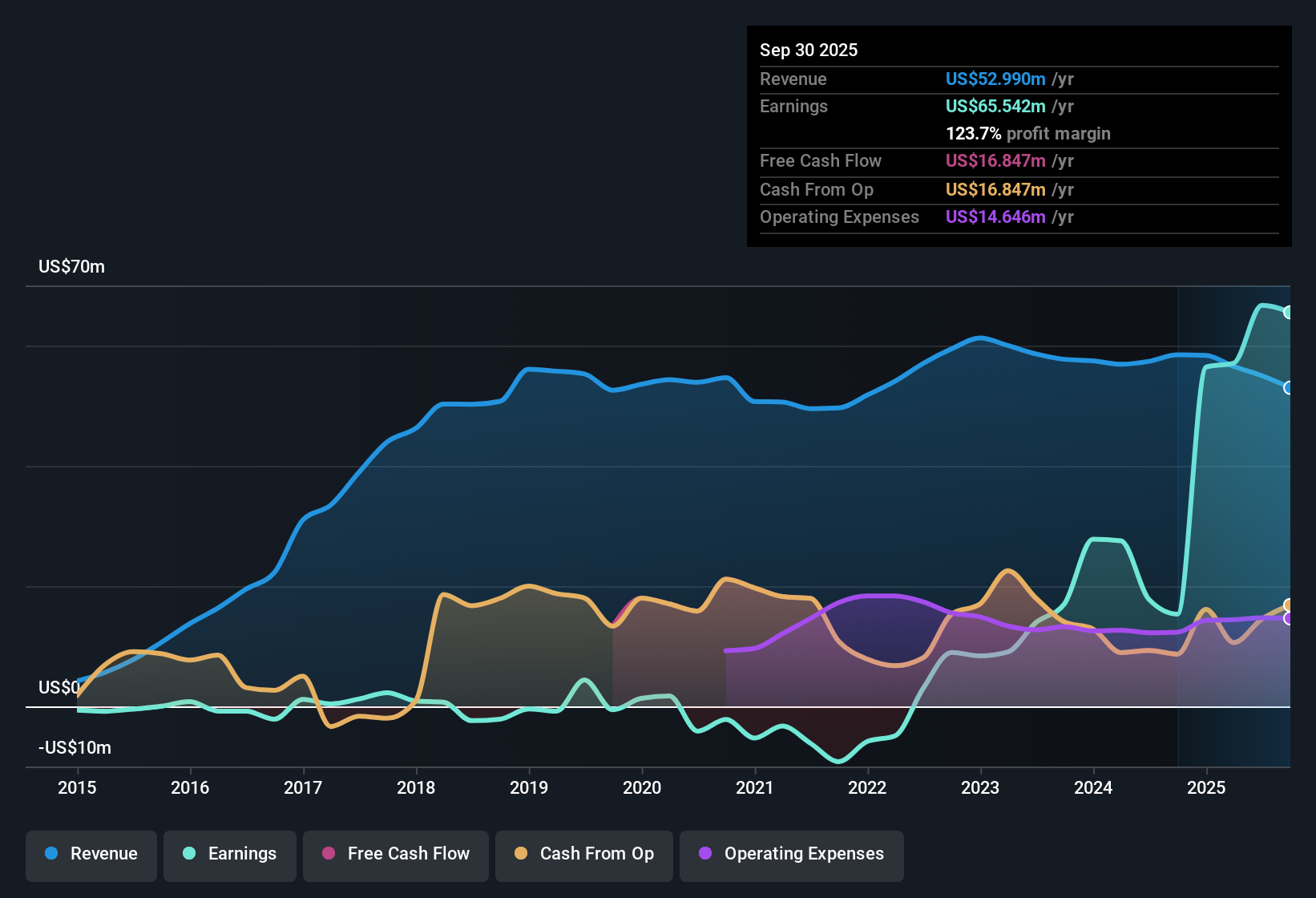

Farmland Partners (FPI) Profit Surge Driven by $61.6M One-Off Gain Fuels Investor Skepticism

Reviewed by Simply Wall St

Farmland Partners (FPI) reported net profit margins of 31%, higher than last year, as the company turned profitable over a five-year period that saw annual earnings growth of 73.3%. The most recent year’s earnings growth surged to 275.5%, but much of this was due to a one-off gain of $61.6 million. This suggests the extraordinary spike is not likely to recur. With the stock trading at a Price-to-Earnings Ratio of 6.8x, far below industry and peer averages, investors may see compelling relative value. However, forward-looking forecasts predict a 50.2% annual earnings decline over the next three years.

See our full analysis for Farmland Partners.Next, we'll see how these headline results compare to the market narratives and consensus views driving sentiment around FPI.

See what the community is saying about Farmland Partners

Price-to-Earnings Gap Widens Against Peers

- Farmland Partners is trading at a Price-to-Earnings Ratio of 6.8x, placing it not only far below the US specialized REIT industry average of 26.2x but also under its peer group’s 21.4x. This suggests a discounted valuation relative to other real estate operators.

- Analysts' consensus view highlights a tension: while the company’s current multiple looks cheap, the case for upside depends on whether future declines in revenue and earnings, forecasted at negative 11.1% and negative 50.2% annually respectively, are already reflected in today’s price or if the market is correctly cautious given those falling numbers.

- Consensus narrative points to the company’s record of profit growth as supportive of value. However, the deeply discounted multiple signals that investors remain unconvinced about the durability of those profits beyond last year’s non-recurring gain.

- The share price at $10.31 stands roughly 18.7% below the single allowed analyst target of $12.50, showing both potential upside and skepticism about the business sustaining recurring profitability away from extraordinary items.

Looking at these tradeoff themes, some investors may weigh the near-term risks against discounted valuation when making their judgment. See how the latest consensus view stacks up by reading the full analyst breakdown. 📊 Read the full Farmland Partners Consensus Narrative.

Asset Dispositions and Buybacks Limit Growth Paths

- Recent corporate actions, including limited new acquisitions combined with heightened asset dispositions and stock buybacks, signal a clear tilt away from expansion and instead focus on recycling capital and supporting the share price.

- According to the analysts' consensus view, this strategy boosts cash flow and may help margins, but it reduces recurring rental streams and contributes to negative revenue growth projections, which are pegged at negative 11.1% annually over the next three years.

- The consensus narrative flags that while these moves insulate margins in the short term, they increase reliance on fewer properties and risk shrinking the overall revenue base over time.

- This shift makes long-term returns more dependent on stable portfolio assets and less on growth from external acquisitions or higher rental volumes.

Regional and Regulatory Exposures Remain a Drag

- Regulatory-driven water scarcity in California has forced significant write-downs, about 50%, on key specialty crop farmland. This underscores how much asset value depends on geographic and legal variables outside the company’s control.

- The consensus narrative acknowledges these risks, noting that while Farmland Partners' portfolio focus on the Midwest and Illinois brings stability, it raises vulnerability to region-specific headwinds such as commodity price changes and weather, and may constrain future diversification.

- Consensus view further notes that global crop shifts, such as rising walnut production in China, have triggered domestic asset write-downs and expose the business to volatility not easily managed through active farm or rental income strategies.

- As a result, short-term profitability may mask significant longer-term risk embedded in the underlying asset base and cash flows if regulatory or crop-related challenges persist.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Farmland Partners on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Notice something others may have missed? Take a couple of minutes to shape your perspective into a personal narrative. Do it your way.

A great starting point for your Farmland Partners research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

See What Else Is Out There

Farmland Partners faces shrinking recurring revenues, a heavy reliance on one-off gains, and negative earnings forecasts. These factors highlight unstable growth prospects for investors.

If consistency and reliability are your priorities, use stable growth stocks screener (2110 results) to discover companies delivering steady earnings and revenue expansion regardless of market conditions.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:FPI

Farmland Partners

An internally managed real estate company that owns and seeks to acquire high-quality North American farmland and makes loans to third-party farmers (both tenant and non-tenant) and landowners secured by farm real estate and/or other agricultural related assets.

Good value with proven track record.

Similar Companies

Market Insights

Community Narratives