- United States

- /

- Real Estate

- /

- NYSE:FPH

Five Point Holdings'(NYSE:FPH) Share Price Is Down 61% Over The Past Three Years.

Five Point Holdings, LLC (NYSE:FPH) shareholders should be happy to see the share price up 22% in the last month. But that is small recompense for the exasperating returns over three years. In that time, the share price dropped 61%. So it is really good to see an improvement. While many would remain nervous, there could be further gains if the business can put its best foot forward.

See our latest analysis for Five Point Holdings

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

During five years of share price growth, Five Point Holdings moved from a loss to profitability. That would generally be considered a positive, so we are surprised to see the share price is down. So given the share price is down it's worth checking some other metrics too.

Revenue is actually up 29% over the three years, so the share price drop doesn't seem to hinge on revenue, either. It's probably worth investigating Five Point Holdings further; while we may be missing something on this analysis, there might also be an opportunity.

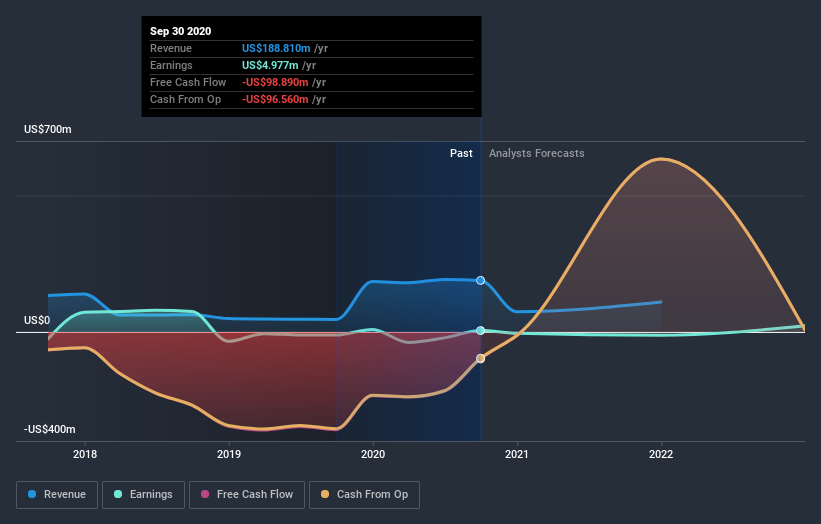

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

We know that Five Point Holdings has improved its bottom line lately, but what does the future have in store? This free report showing analyst forecasts should help you form a view on Five Point Holdings

A Different Perspective

The last twelve months weren't great for Five Point Holdings shares, which cost holders 19%, while the market was up about 26%. Of course the long term matters more than the short term, and even great stocks will sometimes have a poor year. However, the loss over the last year isn't as bad as the 17% per annum loss investors have suffered over the last three years. We would want clear information suggesting the company will grow, before taking the view that the share price will stabilize. It's always interesting to track share price performance over the longer term. But to understand Five Point Holdings better, we need to consider many other factors. Consider risks, for instance. Every company has them, and we've spotted 1 warning sign for Five Point Holdings you should know about.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

If you’re looking to trade Five Point Holdings, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About NYSE:FPH

Five Point Holdings

Designs, owns, and develops mixed-use planned communities in Orange County, Los Angeles County, and San Francisco County.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth