- United States

- /

- Specialized REITs

- /

- NYSE:FCPT

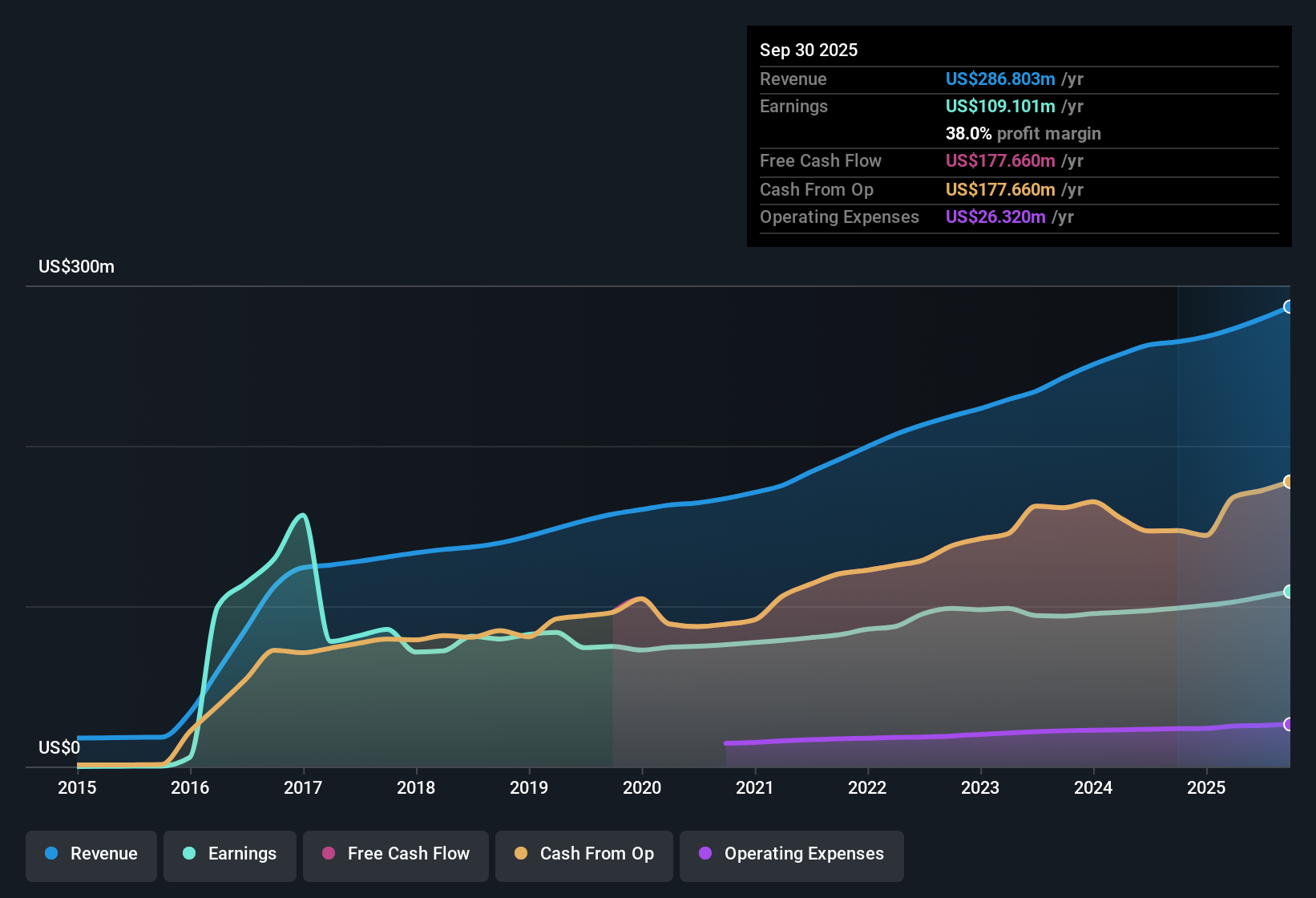

Four Corners Property Trust (FCPT) Margin Rises to 38%, Supporting Bullish Valuation Narratives

Reviewed by Simply Wall St

Four Corners Property Trust (FCPT) delivered a net profit margin of 38%, up from 37.3% last year, with earnings growth of 10.5% for the past year, outpacing its 5-year average growth rate of 6.2% per annum. Profits have climbed steadily at 6.2% annually over five years. Revenue is forecast to grow 7.4% per year and earnings are projected to increase at 10.4% per year, trailing the broader US market’s expectations. Investors may take note that FCPT shows an appealing earnings and dividend profile, yet its financial position remains a point of caution.

See our full analysis for Four Corners Property Trust.The next section puts FCPT’s numbers side by side with the major market narratives, highlighting where consensus might be confirmed or upended.

See what the community is saying about Four Corners Property Trust

Net Lease Model Drives Strong Margin Outlook

- Analysts expect profit margins to rise from 37.9% currently to 41.8% over the next three years, pointing to higher efficiency and stable operating leverage as acquisitions and asset mix evolve.

- According to the analysts' consensus view, FCPT’s portfolio strategy emphasizes steady, inflation-resistant rental revenue and defensive sector exposure.

- This profile aligns with a steady marginal improvement as seen in the projections for margin expansion, supporting both predictable cash flow and growth potential.

- Consensus narrative notes that expanding into essential service properties and reducing tenant concentration is viewed as lowering earnings volatility. This could help maintain or improve these margin levels despite shifting industry headwinds.

- For a deeper dive on how analysts see FCPT’s path forward, bullish investors say the balanced portfolio and strong cash flow outlook could push margins even higher. See the full narrative for more insights. 📊 Read the full Four Corners Property Trust Consensus Narrative.

Sector Concentration Adds Risk to Growth Profile

- 66% of FCPT’s rental income depends on casual dining tenants, making it susceptible to changing consumer habits and potential declines in physical dining demand as digital and delivery models gain ground.

- Consensus narrative raises caution that, despite diversification efforts, heavy sector exposure could bring volatility if even one key tenant class faces secular or macroeconomic challenges.

- What’s surprising is that, while the company is diversifying, this single-sector exposure remains a concern for both revenue stability and portfolio value, especially in the context of rising inflation and regulatory pressure.

- Bears argue that margins and growth projections could come under pressure if sector-specific disruptions or market slowdowns affect occupancy rates more than expected.

Fair Value Gap Versus Analyst and DCF Benchmarks

- FCPT shares currently trade at $23.45, below both the analyst price target of $29.00 and the DCF fair value of $46.12. This indicates a potentially attractive upside depending on investors’ trust in long-term forecasts.

- Consensus narrative points out that the stock’s price-to-earnings ratio of 22.5x is not only lower than the US Specialized REITs average (26.6x) but also significantly below the 32.5x ratio needed to hit analyst targets by 2028.

- This discount suggests that current market pricing either discounts FCPT’s growth forecasts or overweights concerns about sector concentration and financial resilience.

- Consensus view is that if FCPT meets these ambitious profit margin and earnings targets, the current price could offer a value entry. Yet the gap underscores the importance of tracking actual versus expected growth.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Four Corners Property Trust on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a unique take on these figures? Share your perspective and build your own narrative in just minutes. Do it your way

A great starting point for your Four Corners Property Trust research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

FCPT’s heavy reliance on a single sector and ongoing concerns about its financial strength could expose investors to more volatility during downturns.

If you prefer companies that stand out for healthier balance sheets and stronger fundamentals, check out solid balance sheet and fundamentals stocks screener (1981 results) to find resilient options built for long-term confidence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:FCPT

Four Corners Property Trust

FCPT is a real estate investment trust primarily engaged in the ownership, acquisition and leasing of restaurant and retail properties.

6 star dividend payer and undervalued.

Similar Companies

Market Insights

Community Narratives