- United States

- /

- Residential REITs

- /

- NYSE:ESS

Essex Property Trust (ESS): One-Off Gain Drives Margin Surge, Challenging Quality of Reported Earnings

Reviewed by Simply Wall St

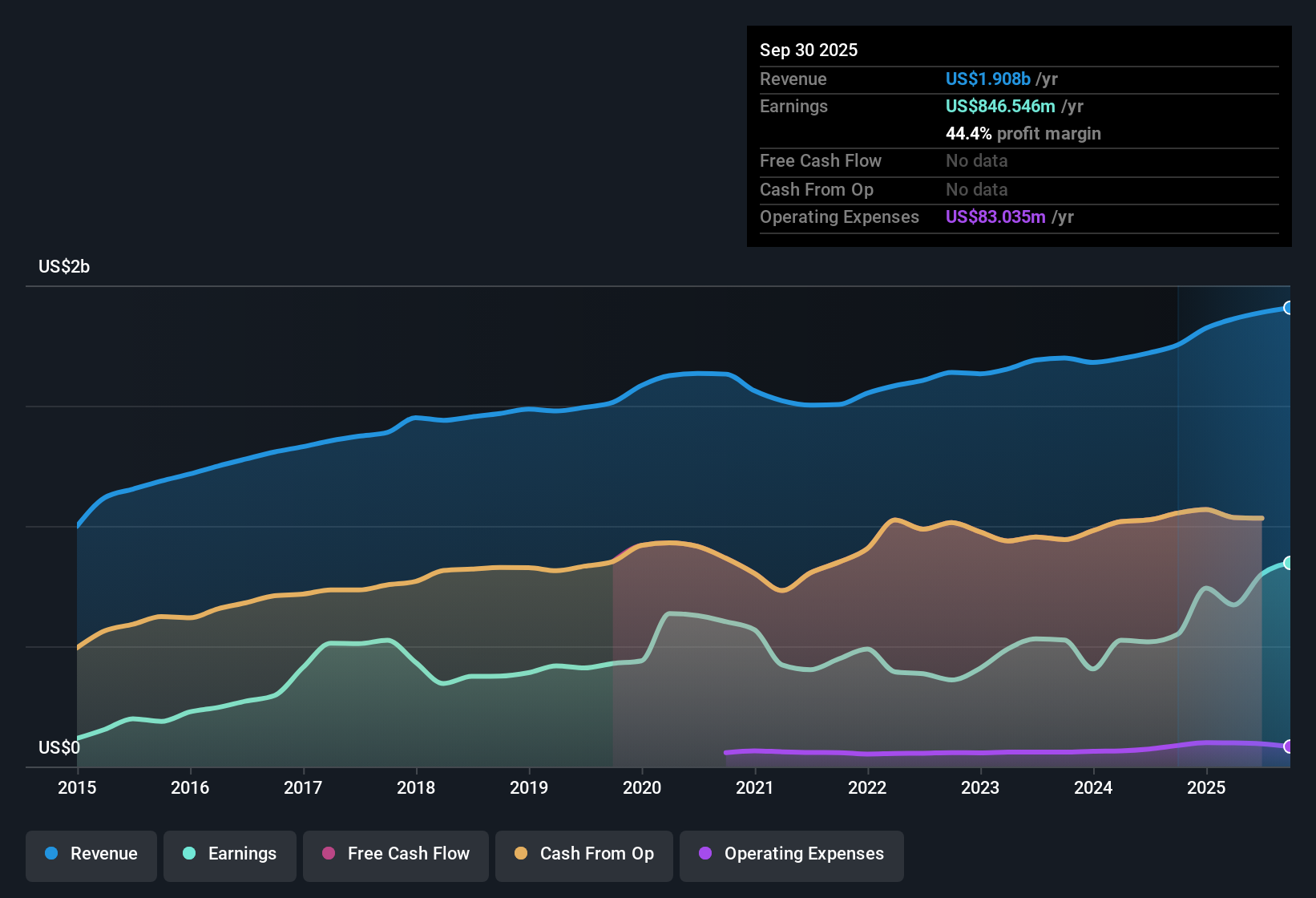

Essex Property Trust (ESS) posted standout numbers in its latest report, with earnings climbing 54.1% over the past year and averaging an annual growth rate of 10.5% over the last five years. Net profit margins surged to 44.3% this year, up from 31.4% last year. However, this jump was influenced by a $568.3 million one-off gain, which plays a key role in the comparison. As investors weigh the headline figures, attention is turning to both the quality of underlying profits and Essex’s favorable valuation, especially with earnings forecast to decline in the next three years.

See our full analysis for Essex Property Trust.Next up, we’ll see how these results hold up against the broader market narratives. Some expectations may be confirmed, while others will face tough questions.

See what the community is saying about Essex Property Trust

Profit Margins Set to Shrink from Today’s Peak

- Analysts expect Essex’s profit margin to fall from 42.4% today to 20.9% in three years, even though margins are currently near decade highs following this year’s one-off gain.

- According to the consensus view of analysts, the outlook reflects ongoing headwinds in core West Coast markets. While limited new apartment supply and strong demand trends help stabilize revenue, Essex’s heavy reliance on California and Seattle assets means growth will remain exposed to local regulation and potential economic downturns.

- Analysts note ongoing demographic support for occupancy and rents; however, recent slow rent growth in Southern California—which accounts for 40% of Essex’s portfolio—signals risks to sustained profitability.

- It is notable that, despite the current high margin, analysts anticipate further pressure as Essex phases out higher-yielding investments and encounters more competition along with stricter regulation in its key urban markets.

- To see how analysts weigh both upside and risk as margins adjust, check the balanced narrative in full. 📊 Read the full Essex Property Trust Consensus Narrative.

Growth Outlook Trails Broader Market

- Revenue is projected to grow at just 2.9% annually over the next three years, well below the expected 10.3% per year for the US market. Earnings are forecast to decline by -22.4% per year during the same period.

- The consensus narrative underscores that, although Essex’s strategy favors capital allocation to stabilized, high-occupancy apartments in tech-centric areas, the lack of diversification continues to be a risk—recent underperformance in key geographies demonstrates this vulnerability.

- Some analysts argue that ongoing softness in Los Angeles and increased exposure to local supply and demand cycles will limit potential growth, particularly as Essex shifts away from higher-margin structured finance and refocuses on core real estate assets.

- From a consensus perspective, compressed cap rates and strong competition for acquisitions in Northern California, where yields are in the low-to-mid 4% range, could constrain future returns relative to more diversified REIT peers.

Valuation Remains Supportive Despite Softer Projections

- Essex’s Price-to-Earnings ratio of 19x is notably below the peer average of 50.8x and the North American Residential REITs industry average of 24.4x. The current share price of $249.82 is about 28% below the DCF fair value estimate of $347.22.

- The analysts’ consensus narrative acknowledges that while earnings are expected to decline and future profit margins are set to compress, valuation metrics and a current price about 16% below their $291.11 price target provide support for a positive longer-term case for income and value-focused investors.

- The ongoing discount to fair value offers a cushion for investors focused on yield and capital protection, while also recognizing potential regulatory and economic volatility.

- Consensus further highlights that income-oriented investors remain attracted to Essex’s dividend and track record, despite concerns about near-term earnings declines and compressed margins compared to industry averages.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Essex Property Trust on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Think you interpret the data another way? Take just a few moments to build your perspective into a narrative of your own. Do it your way.

A great starting point for your Essex Property Trust research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

See What Else Is Out There

Essex’s reliance on concentrated markets means its earnings and revenue growth are expected to lag well behind diversified peers, with profitability facing new headwinds.

If you want steadier expansion and fewer surprises, use stable growth stocks screener (2095 results) to spot companies with consistent results regardless of market shifts or location risk.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Essex Property Trust might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ESS

Essex Property Trust

An S&P 500 company, is a fully integrated real estate investment trust (REIT) that acquires, develops, redevelops, and manages multifamily residential properties in selected West Coast markets.

Undervalued established dividend payer.

Similar Companies

Market Insights

Community Narratives