- United States

- /

- Office REITs

- /

- NYSE:ESRT

Will Empire State Realty Trust's (ESRT) New Credit Facility Reshape Its Financial Flexibility Strategy?

Reviewed by Sasha Jovanovic

- On November 14, 2025, Empire State Realty Trust entered into an amended and restated credit agreement for a US$210 million senior unsecured term loan facility with an option to increase the total amount to US$310 million, extending debt maturity to January 2029 and allowing for flexible repayment terms.

- This enhanced financial flexibility and liquidity could support ongoing operational needs or future investments, positioning the company to better respond to market opportunities or challenges.

- We'll explore how added borrowing capacity and improved debt structure could affect Empire State Realty Trust's investment narrative and financial outlook.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 27 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

Empire State Realty Trust Investment Narrative Recap

To be a shareholder in Empire State Realty Trust, you'd need to believe in the ongoing demand for high-quality Manhattan office and observation properties, and in management's ability to adapt amid sector headwinds. The recent amended credit agreement meaningfully strengthens ESRT's liquidity and flexibility, which should support its capital needs, but does not substantially change the short-term focus on driving office leasing and tackling persistent expense pressures.

Among recent announcements, the expanded lease with Gerson Lehrman Group at One Grand Central Place stands out. Large tenants choosing to grow their footprint underline leasing momentum, a key catalyst, yet also spotlight the importance of maintaining strong occupancy in a challenged office market. In contrast, investors should be especially mindful that while new debt facilities offer flexibility, the pressure from ongoing increases in operating expenses continues to...

Read the full narrative on Empire State Realty Trust (it's free!)

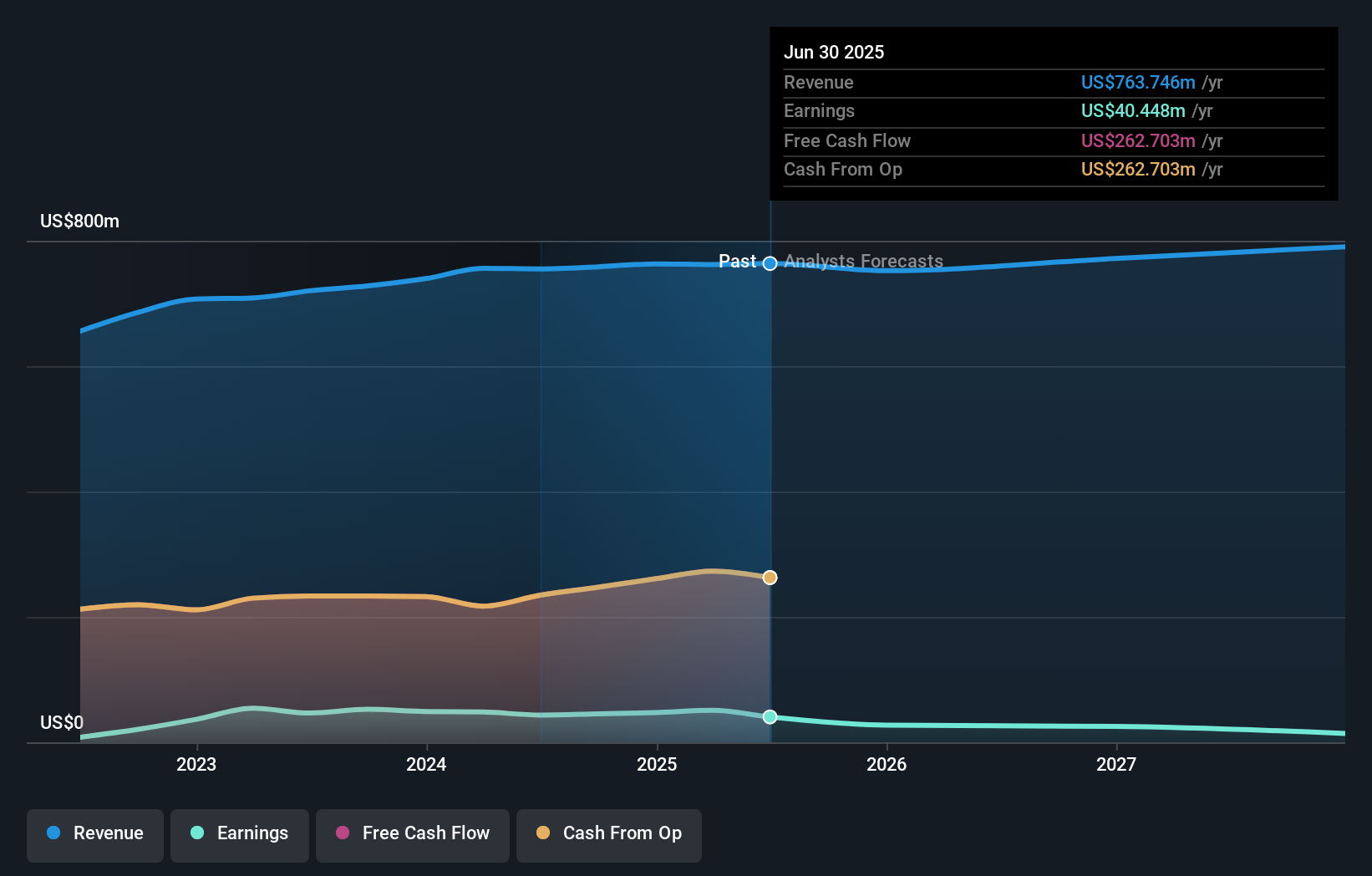

Empire State Realty Trust is projected to generate $797.6 million in revenue and $13.7 million in earnings by 2028. This outlook reflects an annual revenue growth rate of 1.5% and a decrease in earnings by $26.7 million from the current $40.4 million.

Uncover how Empire State Realty Trust's forecasts yield a $8.97 fair value, a 33% upside to its current price.

Exploring Other Perspectives

Only one community member from Simply Wall St placed fair value for ESRT at US$8.97 per share. While analyst consensus focuses on the benefits of increased borrowing capacity, community viewpoints may weigh ongoing risks such as rising expenses differently, making it worthwhile to compare several perspectives.

Explore another fair value estimate on Empire State Realty Trust - why the stock might be worth just $8.97!

Build Your Own Empire State Realty Trust Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Empire State Realty Trust research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

- Our free Empire State Realty Trust research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Empire State Realty Trust's overall financial health at a glance.

Contemplating Other Strategies?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Empire State Realty Trust might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ESRT

Empire State Realty Trust

Empire State Realty Trust, Inc. (NYSE: ESRT) is a NYC-focused REIT that owns and operates a portfolio of well-leased, top of tier, modernized, amenitized, and well-located office, retail, and multifamily assets.

Good value with slight risk.

Similar Companies

Market Insights

Community Narratives