- United States

- /

- Office REITs

- /

- NYSE:ESRT

Empire State Realty Trust (ESRT): Assessing Valuation After New $210 Million Credit Facility Expands Financial Flexibility

Reviewed by Simply Wall St

Empire State Realty Trust recently finalized a $210 million amended credit agreement, providing the company with added flexibility for working capital and general corporate needs. This expanded facility is attracting new attention from investors.

See our latest analysis for Empire State Realty Trust.

After finalizing its amended credit agreement, Empire State Realty Trust’s share price has shown modest strength over the past week, but the momentum has faded compared to earlier in the year. The company has reported a notable 1-year total shareholder return of -37.4%. In the broader context, this credit facility reinforces stability, yet the stock’s recent drop underscores that investors are still weighing the outlook despite these positive moves.

If you’re curious where else fresh capital or big deals may be stirring up opportunity, now is the ideal time to broaden your search and discover fast growing stocks with high insider ownership

With shares trading at a significant discount to analyst price targets and still down sharply over the past year, the key question remains: is Empire State Realty Trust undervalued, or is the market accurately reflecting its future prospects?

Most Popular Narrative: 22.7% Undervalued

Empire State Realty Trust's fair value, based on the most followed narrative, is set notably higher than the last close price of $6.93, prompting questions about what could be driving this valuation gap.

Robust leasing momentum for modern, amenity-rich office space, evidenced by 16 consecutive quarters of positive leasing spreads, rising occupancy, and longer lease terms, positions ESRT to grow revenue and drive higher net operating income as companies continue to prioritize high-quality, sustainable urban workplaces. Ongoing portfolio modernization and demonstrated leadership in sustainability and energy efficiency strengthens ESRT's competitive position, enabling premium rents, attracting high-quality tenants, and supporting net margin expansion as tenants increasingly seek sustainable space and as operating costs are optimized.

Want to know the catalyst for this bullish price target? The narrative is built on the expectation of steady growth from leasing momentum and a profitability play that few competitors can match. The secret sauce? It hinges on a bold profit margin move and some surprising expectations for net earnings. Discover the full story behind these assumptions.

Result: Fair Value of $8.97 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent operating cost increases or a prolonged slowdown in tourism could challenge Empire State Realty Trust’s ability to meet bullish expectations.

Find out about the key risks to this Empire State Realty Trust narrative.

Another View: How Do Multiples Stack Up?

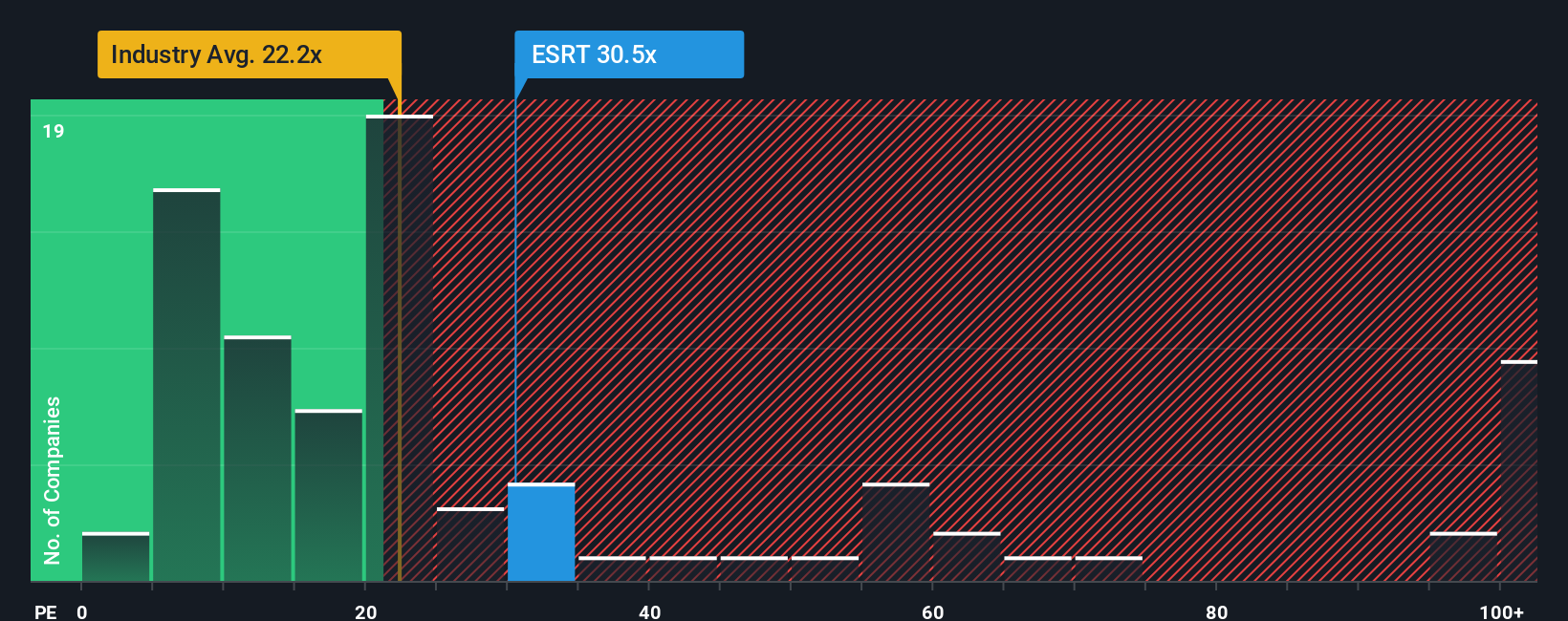

While the current narrative suggests Empire State Realty Trust may be undervalued, its price-to-earnings ratio tells a different story. Trading at 33.8x, the company's ratio is not only higher than the global industry average of 22.4x, but also stands above the fair ratio of 23.3x calculated for its profile. This means investors are paying a premium based on current earnings, which could indicate overvaluation and introduces valuation risk if the market starts expecting less.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Empire State Realty Trust Narrative

If you see things differently or want to dig into the data on your terms, it’s quick and easy to shape your own perspective in just a few minutes. Do it your way

A great starting point for your Empire State Realty Trust research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

Looking for More Smart Investment Ideas?

Don’t wait on the sidelines while others seize tomorrow’s opportunities. Use the Simply Wall Street Screener to spot hidden gems and shape your next move.

- Boost your portfolio with steady income by tapping into these 14 dividend stocks with yields > 3% with yields above 3% and proven reliability.

- Jump on the AI revolution and get ahead of the crowd with these 26 AI penny stocks, focusing on breakthrough innovations and rapid growth potential.

- Uncover companies the market may have overlooked by starting with these 933 undervalued stocks based on cash flows, featuring strong cash flows and attractive pricing.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Empire State Realty Trust might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ESRT

Empire State Realty Trust

Empire State Realty Trust, Inc. (NYSE: ESRT) is a NYC-focused REIT that owns and operates a portfolio of well-leased, top of tier, modernized, amenitized, and well-located office, retail, and multifamily assets.

Good value with slight risk.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success