- United States

- /

- Residential REITs

- /

- NYSE:EQR

Does Equity Residential Offer Opportunity After Recent Price Weakness in 2025?

Reviewed by Bailey Pemberton

If you own shares of Equity Residential or are thinking about adding it to your watchlist, you are probably wondering if now is a good time to buy, sell, or hold. With the stock closing recently at $63.3, it might look like the company is stuck in a holding pattern. After all, the stock is down 1.9% over the last week and off 5.3% for the month. Even looking back over the year, it has slipped 10.4%, missing out on some momentum that has lifted other corners of the market.

However, when you look at a broader timeframe, a different picture starts to emerge. Over the past three and five years, Equity Residential shares are up 14.6% and 37.4%, respectively. That kind of long-term performance reflects the company’s resilience and the relative strength of residential real estate even as interest rates and rental market dynamics shift. The market’s recent coolness toward the stock may reflect shifting risk appetites or new uncertainties around economic developments rather than anything fundamentally broken with Equity Residential’s business.

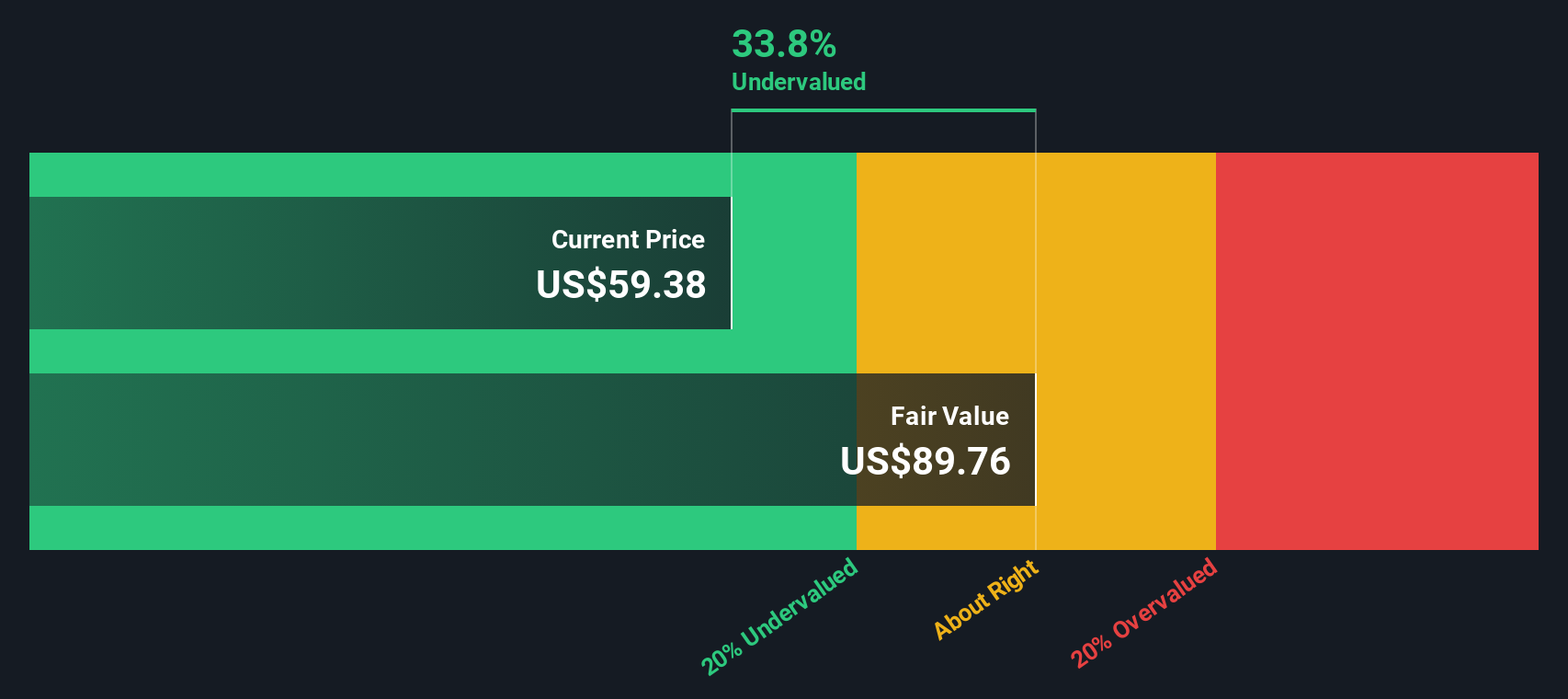

What about the company’s value today? This is where things get interesting. Based on six different valuation checks, Equity Residential is currently undervalued in four of them, resulting in a value score of 4. That positions it among companies that may be overlooked or underappreciated by the broader market. But are these standard checks actually enough to see the whole picture?

In the next section, we will explore how each valuation approach weighs in on Equity Residential, and later, I will share a more holistic way to assess whether the stock deserves a place in your portfolio.

Why Equity Residential is lagging behind its peers

Approach 1: Equity Residential Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates a company's intrinsic value by projecting its future cash flows, here using adjusted funds from operations, and discounting them back to their value today. This approach provides a data-driven way to cut through market sentiment and focus on the underlying fundamentals.

For Equity Residential, the most recent twelve months’ Free Cash Flow stands at approximately $1.47 billion. Analysts have forecast annual free cash flow figures up to five years ahead, after which projections are extrapolated, with estimated free cash flow in 2035 reaching nearly $1.83 billion. All these projections are calculated in US dollars. The model employed here is the 2 Stage Free Cash Flow to Equity approach, which takes into account both the company's present fundamentals and its anticipated medium-term growth.

Based on this methodology, the DCF calculates a fair value for Equity Residential at $86.63 per share, about 26.9% above the recent share price of $63.3. This suggests the stock is notably undervalued according to projected future cash generation.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Equity Residential is undervalued by 26.9%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Equity Residential Price vs Earnings

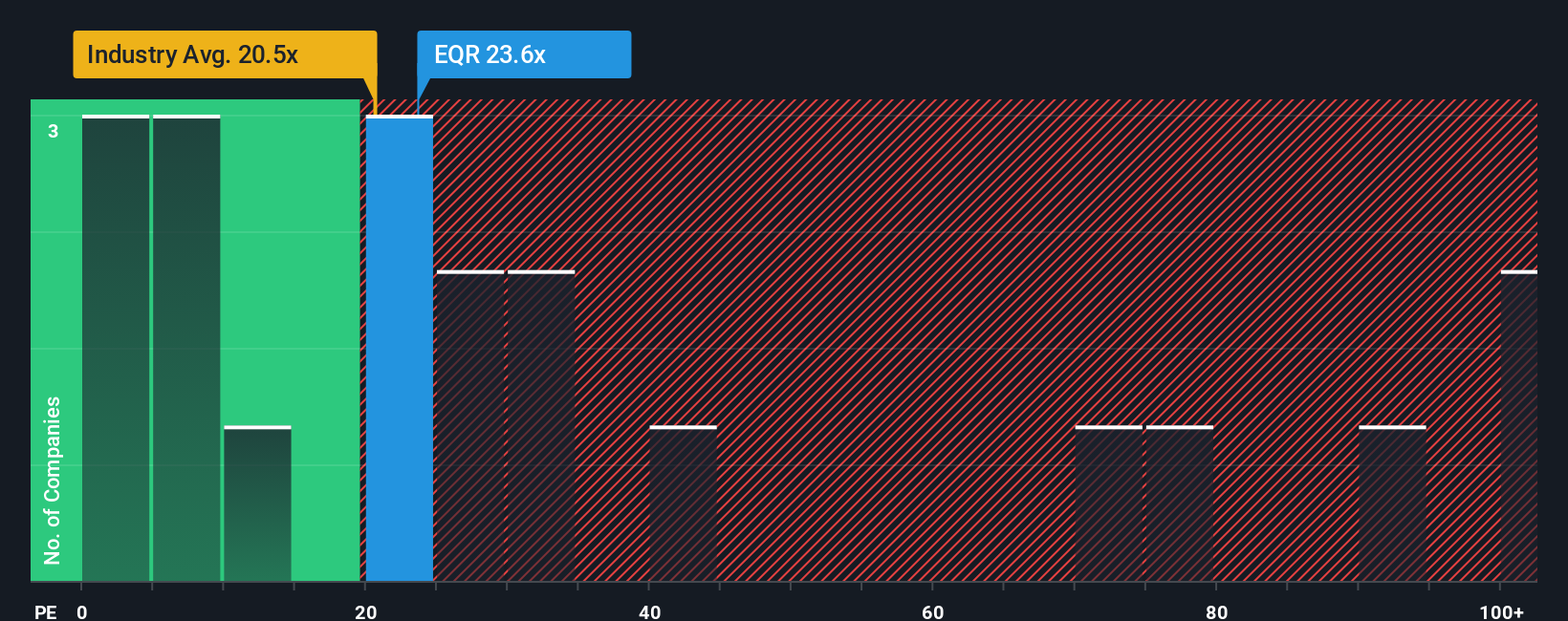

The Price-to-Earnings (PE) ratio is often a go-to valuation method for profitable companies because it reveals how much investors are willing to pay for each dollar of current earnings. For a business like Equity Residential, this multiple is particularly informative as it quickly captures market expectations for growth, profitability, and risk.

A company expecting rapid earnings growth or able to deliver stable, low-risk profits will usually trade at a higher PE ratio, while riskier or lower-growth firms trade lower. At the moment, Equity Residential trades at 23.9x earnings. This is higher than the Residential REITs industry average of 20.5x, but notably below the peer group average of 41.9x.

Simply Wall St's proprietary Fair Ratio for Equity Residential is 27.6x. The Fair Ratio is designed to be a step above standard industry or peer comparisons. It calculates what would be a justifiable PE multiple given Equity Residential's specific growth outlook, profitability, market cap, and risk factors. This makes it a more holistic benchmark tailored to the company's actual prospects.

Since Equity Residential's current PE of 23.9x sits just below its Fair Ratio of 27.6x, the shares appear slightly undervalued from this standpoint.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Equity Residential Narrative

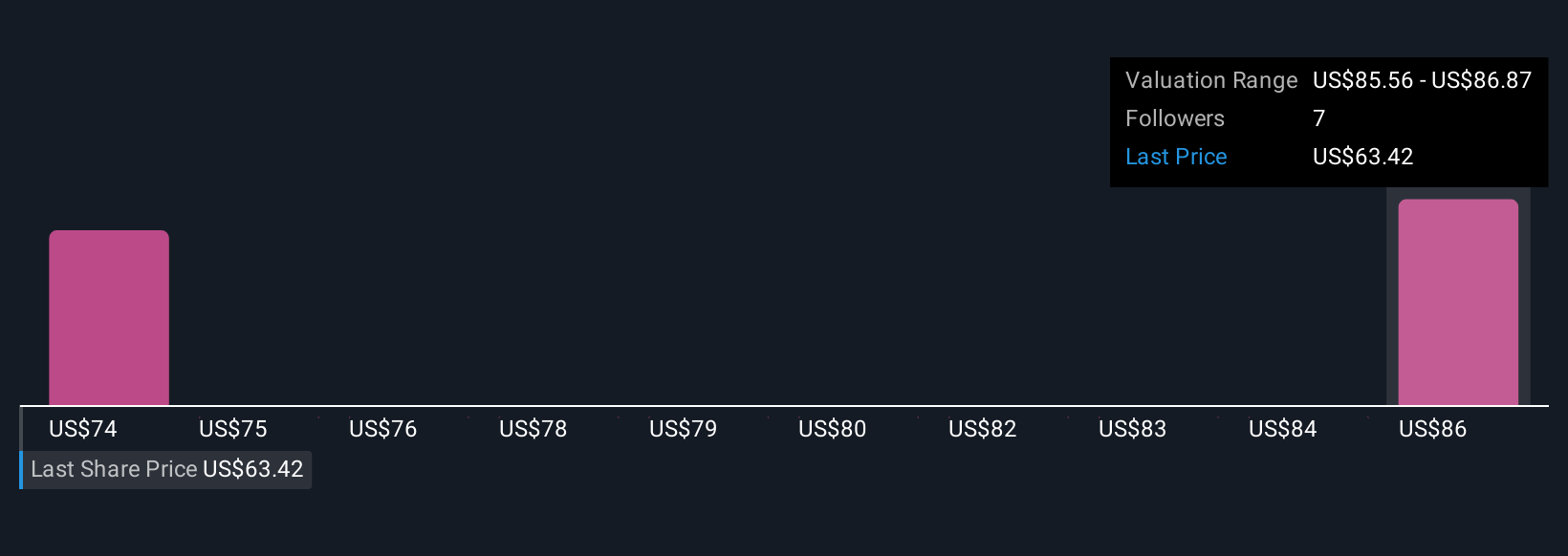

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is simply your story about a company: how you see its future, what you expect for its growth, risks, or turning points, and how those beliefs connect to financial forecasts and a fair value. Narratives go beyond just the numbers and ratios, allowing you to capture your perspective on a company by linking its business story, your estimates for future revenue or margins, and a price you believe is justified.

On Simply Wall St’s Community page, millions of investors use Narratives as an accessible tool to clarify their investment thinking and directly compare their own fair value estimates with today's share price. This helps answer the simple question: is Equity Residential a buy or a sell, right now? Narratives update automatically when fresh news or earnings are released, making sure your view always reflects the latest market realities.

For example, on Equity Residential, some investors are very optimistic, forecasting a fair value as high as $81.0 based on strong urban rental demand and technology-driven efficiencies. Others have a much more cautious story, with a low fair value of $66.0 citing regulatory risks and affordability pressures.

Do you think there's more to the story for Equity Residential? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Equity Residential might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:EQR

Equity Residential

Equity Residential is committed to creating communities where people thrive.

Very undervalued established dividend payer.

Similar Companies

Market Insights

Community Narratives