- United States

- /

- Specialized REITs

- /

- NYSE:EPR

EPR Properties (EPR): $56.9 Million One-Off Loss Reinforces Bearish Margin Narratives

Reviewed by Simply Wall St

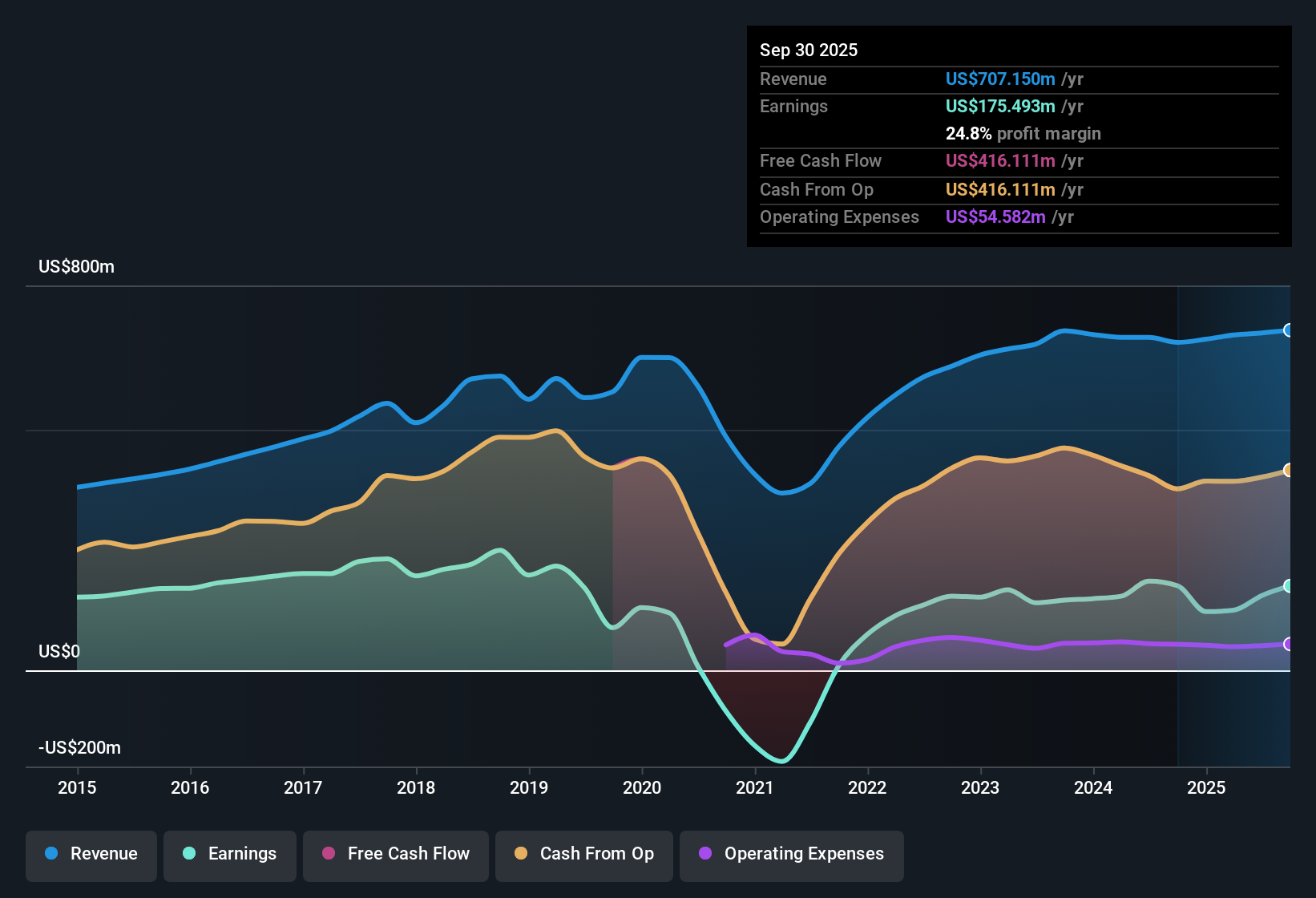

EPR Properties (EPR) reported net profit margins of 22.2%, down from 26.8% a year earlier, as negative earnings growth and a significant one-off loss of $56.9 million weighed on the bottom line. Revenue is expected to rise at just 2.5% per year, well below the broader US market’s 10.3% forecast. In a challenging environment, investors are left weighing the current margin pressures and non-recurring losses against the stock’s valuation, which currently sits below intrinsic estimates by discounted cash flow analysis.

See our full analysis for EPR Properties.Now, let’s see how the latest earnings numbers compare to the most widely held narratives for EPR Properties. In some cases, these results may confirm what the market expects, while in others, they may challenge prevailing views.

See what the community is saying about EPR Properties

Profit Margins Projected to Rebound Sharply

- Analysts expect net profit margins to climb from 22.2% today to 32.5% over the next three years, even though recent results reflect lower margins and negative earnings growth year-over-year.

- According to the analysts' consensus view, this strong margin recovery is anchored in:

- EPR’s strategy to diversify away from cinemas and expand into high-demand experiential categories like wellness, Eat & Play, and attractions. Management claims this approach is driving higher occupancy and rental income, supporting the margin improvement outlook.

- Ongoing asset recycling initiatives, including selling underperforming properties and reinvesting in higher-yield segments, also align with consensus expectations for operational leverage to kick in. This could offset one-off losses and help sustain margin expansion.

- Recent analyst narratives note that this margin uplift is one of the key catalysts needed to justify the price target of $58.35, relative to the current share price of $48.97, suggesting some upside if execution matches projections.

- To see exactly how analysts tie these margin and demand trends to EPR’s future story, check the full consensus narrative for more insights. 📊 Read the full EPR Properties Consensus Narrative.

Dividend Stability Under Scrutiny as Risks Remain

- One of the top risks identified is ongoing uncertainty around the sustainability of EPR’s dividend, due to a combination of weakened profit growth, exposure to struggling theater tenants, and the outsized $56.9 million one-off loss hitting recent earnings quality.

- Critics highlight, from a consensus narrative perspective:

- Despite management describing the dividend as “well-covered” in filings and pointing to a conservative balance sheet, recent margin compression and continued reliance on external funding (including bond offerings and at-the-market equity) challenge the perception of income stability if market conditions worsen or tenant credit issues resurface.

- Bears argue that heightened capital expenditure requirements, driven by ESG upgrades and aging, specialized properties, could pressure operating cash flows further. This raises questions about the reliability of future payouts even if near-term distributions are maintained.

Valuation Discount Versus Peers, but Premium to Industry

- EPR's price-to-earnings ratio stands at 24x, which is above the peer average of 23.8x but still below the broader US Specialized REITs industry average of 26.2x. The current share price of $48.97 is well below its DCF fair value of $104.17 per share.

- Analysts’ consensus view notes that:

- The market appears to be acknowledging near-term risks by pricing EPR at a modest discount to sector peers, even as its long-term growth strategy and expected margin rebound theoretically warrant a higher multiple based on consensus forecasts.

- The small 3.4% gap between the current share price and the analyst price target of $58.35 signals that, while there is some room for upside, most analysts see the stock as fairly valued at present and are waiting for clearer evidence of sustainable profit expansion before rerating the shares meaningfully higher.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for EPR Properties on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a different angle on the figures? Put your own spin on the data and shape your view in just a few minutes. Do it your way

A great starting point for your EPR Properties research is our analysis highlighting 1 key reward and 4 important warning signs that could impact your investment decision.

See What Else Is Out There

Ongoing dividend uncertainty and profit margin pressures highlight EPR Properties’ vulnerability to tenant struggles and earnings volatility.

If reliable payouts and stronger income stability matter to you, check out these 2003 dividend stocks with yields > 3% to find companies delivering consistent dividends with healthier fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if EPR Properties might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:EPR

EPR Properties

EPR Properties (NYSE: EPR) is the leading diversified experiential net lease real estate investment trust (REIT), specializing in select enduring experiential properties in the real estate industry.

Established dividend payer and good value.

Similar Companies

Market Insights

Community Narratives