- United States

- /

- Industrial REITs

- /

- NYSE:EGP

EastGroup Properties (EGP): Valuation Insights Following Strong Q3 Earnings and Upbeat Outlook

Reviewed by Simply Wall St

EastGroup Properties (EGP) just posted third-quarter earnings growth and shared upbeat guidance, signaling ongoing strength. The company’s consistent results and dividend reliability have also drawn positive attention from analysts and investors alike.

See our latest analysis for EastGroup Properties.

EastGroup Properties’ share price has climbed 8.5% over the last 90 days, supported by upbeat quarterly results, a rising dividend track record, and recent technical signals that suggest bullish momentum. The company’s 6.1% total shareholder return over the past year reflects a steady long-term growth trend.

If you’re curious about what other fast-climbing companies with strong management are out there, broaden your horizon and discover fast growing stocks with high insider ownership

But with the share price near all-time highs and analysts raising targets, the key question remains: is EastGroup Properties trading at a discount to its intrinsic value, or is the market already pricing in all that future growth?

Most Popular Narrative: 8.5% Undervalued

EastGroup Properties’ most-followed narrative estimates a fair value that is meaningfully above the latest close, setting the stage for deeper debate over what is fueling this optimism and how the company’s earnings momentum might play out. Investors may want to look closer at the fundamental catalysts supporting this premium over the current price.

Structural US population growth and migration to Sunbelt markets continues to underpin robust demand for modern industrial/logistics properties. This directly benefits EastGroup's core portfolio and positions the company for sustained revenue and NOI growth as these regions outpace national averages.

There is more beneath the surface. This narrative pins its high valuation on ambitious growth assumptions, powerful regional trends, and a margin outlook that stands out in the sector. Which financial levers are set to transform fair value? Follow the numbers to uncover the full forecast that is building this bullish case.

Result: Fair Value of $191.89 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing tenant caution and region-specific headwinds could challenge EastGroup’s growth story, particularly if leasing or pricing trends lose momentum.

Find out about the key risks to this EastGroup Properties narrative.

Another View: Valuation by Multiples

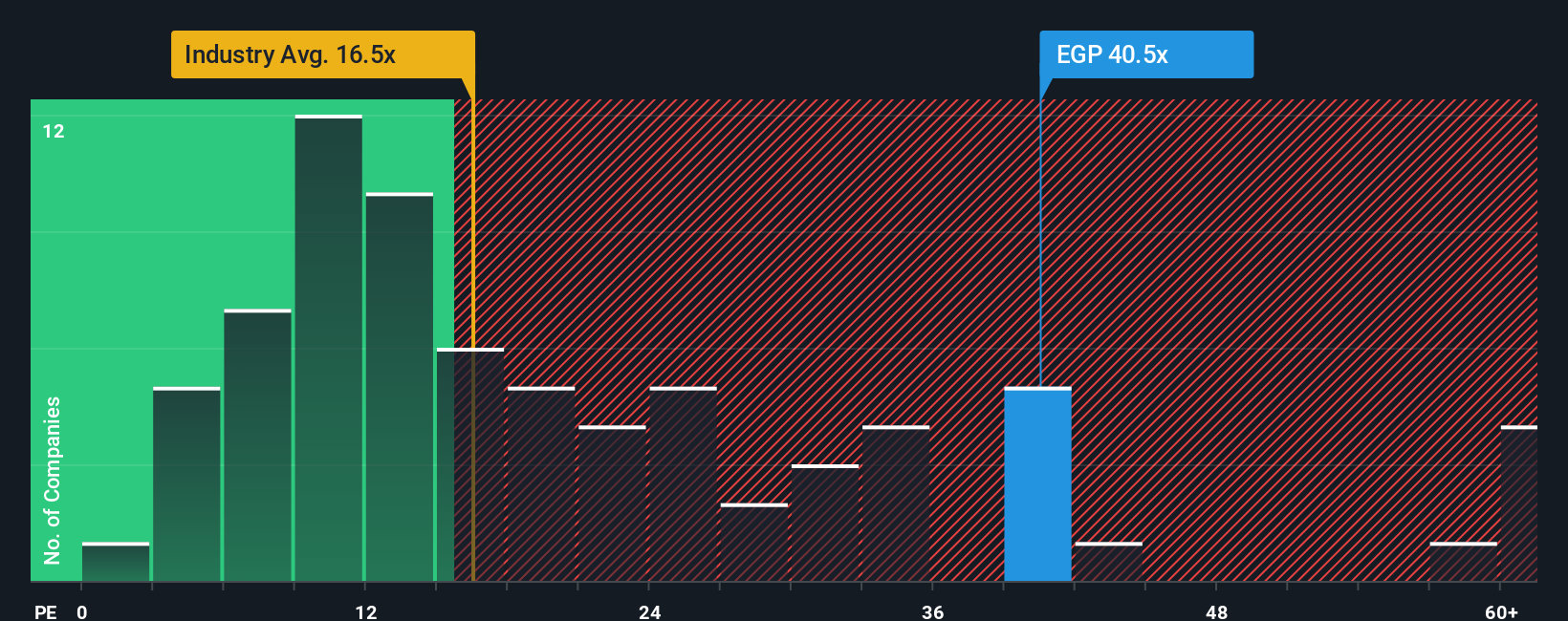

When we look through the lens of the commonly used price-to-earnings ratio, EastGroup’s shares trade at 37.7x, well above the industry average of 17.1x and the peer average of 28.8x. While the company’s growth and consistency are impressive, this premium price tag raises questions about valuation risk compared to sector norms. Is the market rewarding reliability, or just overpaying for it?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own EastGroup Properties Narrative

Of course, if you see things differently or want to run the numbers yourself, it only takes a few minutes to build your own EastGroup Properties outlook. Do it your way

A great starting point for your EastGroup Properties research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Don’t let an opportunity slip by. Take control of your financial future and find unique, data-driven stock picks built for your goals and interests on Simply Wall Street.

- Cement your portfolio’s income potential by evaluating these 24 dividend stocks with yields > 3% yielding above 3% and offering steady returns beyond just capital gains.

- Ride the next tech wave and back breakthrough innovators by sizing up these 26 AI penny stocks at the forefront of artificial intelligence revolutions.

- Capture tomorrow’s standout value by zeroing in on these 848 undervalued stocks based on cash flows that remain overlooked despite strong cash flows and growing fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if EastGroup Properties might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:EGP

EastGroup Properties

EastGroup Properties, Inc. (NYSE: EGP), a member of the S&P Mid-Cap 400 and Russell 2000 Indexes, is a self-administered equity real estate investment trust focused on the development, acquisition and operation of industrial properties in high-growth markets throughout the United States with an emphasis in the states of Texas, Florida, California, Arizona and North Carolina.

Established dividend payer with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives