- United States

- /

- Industrial REITs

- /

- NYSE:EGP

Does EastGroup Properties Offer Value After Latest Logistics Facility Acquisition in 2025?

Reviewed by Bailey Pemberton

- Wondering if EastGroup Properties is fairly priced, overvalued, or hiding an opportunity? You are not alone. Let’s unravel whether there’s value to be found.

- In the past month, shares have risen 2.8% and are up 11.2% year-to-date, showing steady performance even with a minor 1.7% dip over the last week.

- Recently, EastGroup Properties has attracted attention following its acquisition of a major logistics facility, expanding its footprint in a key growth market. This strategic move has fueled investor discussions about the company's long-term demand and stability.

- According to our valuation checks, EastGroup Properties scores just 1/6 for undervaluation. This means only one metric flags the stock as potentially underpriced. We will break down what this score means using a range of valuation methods and offer a smarter way to interpret valuation that you will not want to miss by the end of this article.

EastGroup Properties scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: EastGroup Properties Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model is a valuation method that estimates a company's intrinsic value by forecasting its future cash flows, in this case, adjusted funds from operations, and then discounting them back to their value today. This approach provides a forward-looking perspective on what the company is truly worth based on its future potential to generate cash.

EastGroup Properties' current Free Cash Flow stands at $408.17 million. Looking ahead, analysts have provided estimates for the next few years, projecting Free Cash Flow to reach $518.3 million by the end of 2028. For the years beyond, Simply Wall St extrapolates further growth, with forecasts continuing up to 2035 and showing a steady increase. All values remain below the billion-dollar mark, so they are best referenced in millions of dollars.

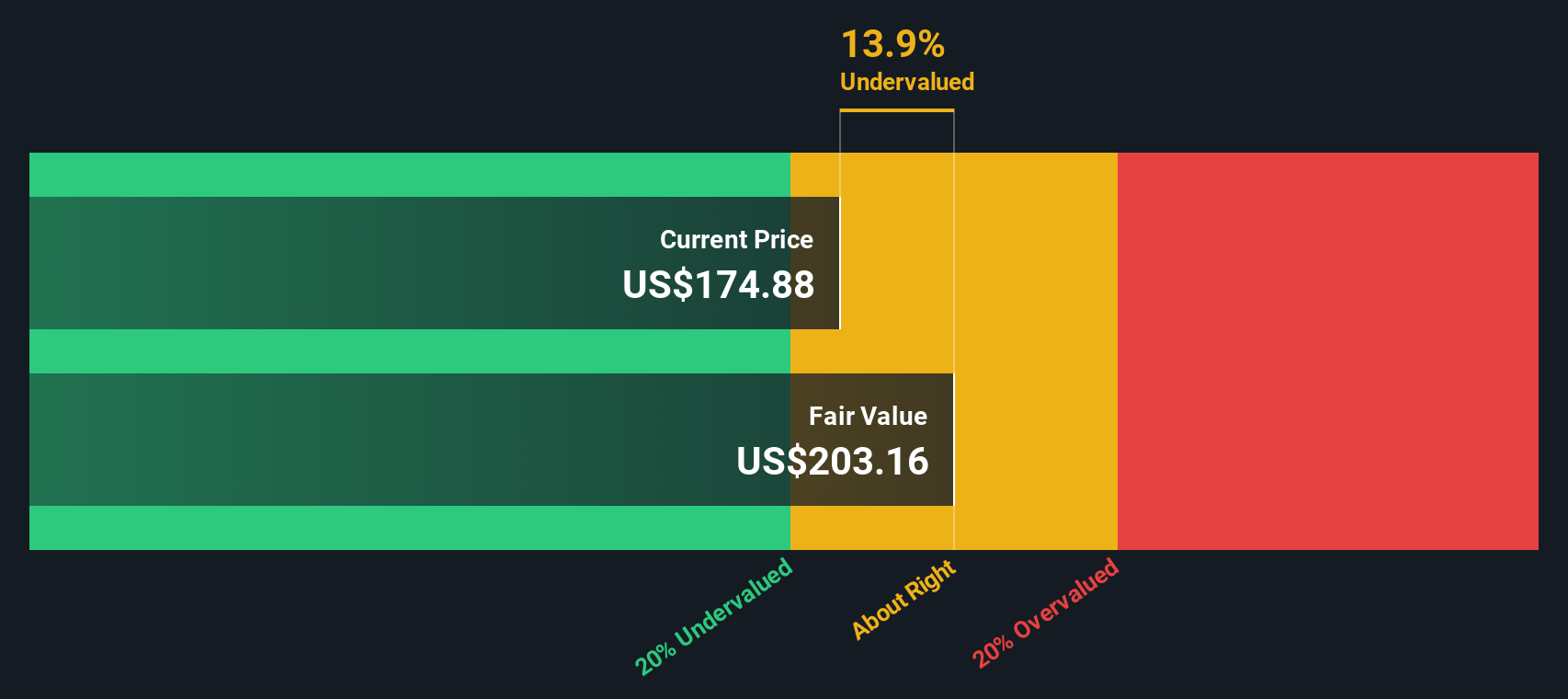

According to this DCF model, the estimated intrinsic value of EastGroup Properties comes to $216.24 per share. Given that this valuation calculation implies the stock is currently trading at an 18.6% discount, EastGroup Properties appears to be undervalued based on its projected cash flows and growth trajectory.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests EastGroup Properties is undervalued by 18.6%. Track this in your watchlist or portfolio, or discover 841 more undervalued stocks based on cash flows.

Approach 2: EastGroup Properties Price vs Earnings

The Price-to-Earnings (PE) ratio is widely regarded as a reliable metric for valuing profitable companies because it links a company’s market value with its actual earnings. It is particularly useful for investors wanting a clear sense of how much they are paying for each dollar of current profit.

However, understanding what qualifies as a "normal" or "fair" PE ratio is not always straightforward. Higher growth prospects and stronger financial stability often justify a higher PE, while greater risk or slower growth will usually push the ratio lower. As a result, an average PE will not fit every company.

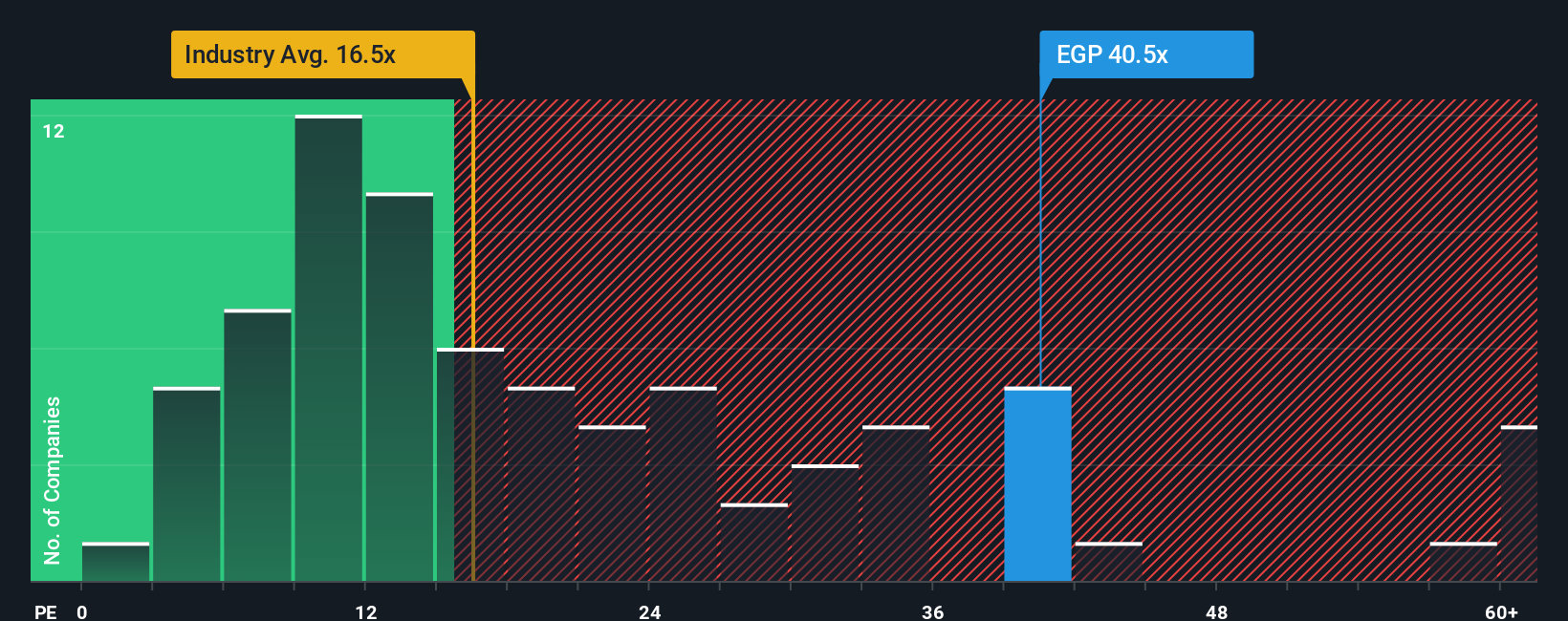

EastGroup Properties currently trades at a PE ratio of 37.7x. By comparison, the average PE ratio for its Industrial REITs industry is much lower at 17.2x, and the average of its closest peers stands at 28.4x. At first glance, this suggests EastGroup may be trading at a premium to the broader market and its direct competitors.

This is where Simply Wall St’s proprietary “Fair Ratio” comes in. Unlike traditional benchmarks, the Fair Ratio incorporates a company’s future earnings growth, profit margins, industry, market cap, and risk profile to establish a uniquely tailored expectation for the PE ratio. For EastGroup Properties, the calculated Fair Ratio is 34.8x. This approach provides a more personalized benchmark and reflects the specific characteristics driving value for this company.

Comparing EastGroup’s current PE of 37.7x to its Fair Ratio of 34.8x shows a slight premium, but the difference is less than 0.10. This indicates the stock’s valuation is about right relative to its unique profile and underlying growth.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1411 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your EastGroup Properties Narrative

Earlier, we alluded to a smarter way to think about valuation, so let’s introduce you to Narratives. This simple yet powerful concept goes beyond formulas and ratios. A Narrative is your own story or thesis about a company, tying together your beliefs about its business prospects, future results, and what you think it is really worth. Narratives connect the dots from the company's real-world outlook to forward-looking forecasts and ultimately to a Fair Value estimate, making your investing decisions more personal and insightful.

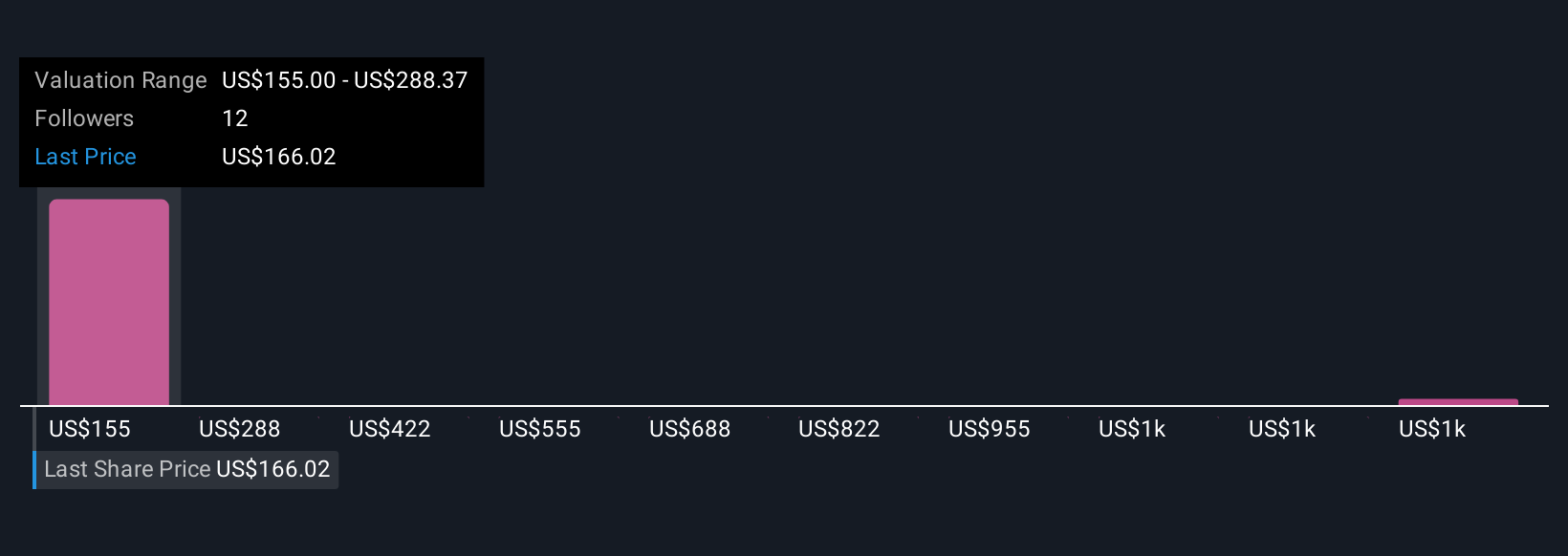

With Simply Wall St’s platform, Narratives are accessible and intuitive to use. Millions of investors already discuss theirs on the Community page. Narratives help you decide when a stock like EastGroup Properties is a buy or a sell by comparing your Fair Value with the current share price, and they update automatically as fresh news or earnings results come in, so your thesis stays relevant. For example, one investor might build a Narrative around bullish Sunbelt growth, robust financials, and set a fair value near the current high analyst target. Another may focus on regulatory risks and slow leasing in certain regions and opt for the lowest target. With Narratives, you make sense of the numbers in a way that fits your own view of the company’s future.

Do you think there's more to the story for EastGroup Properties? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if EastGroup Properties might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:EGP

EastGroup Properties

EastGroup Properties, Inc. (NYSE: EGP), a member of the S&P Mid-Cap 400 and Russell 2000 Indexes, is a self-administered equity real estate investment trust focused on the development, acquisition and operation of industrial properties in high-growth markets throughout the United States with an emphasis in the states of Texas, Florida, California, Arizona and North Carolina.

Established dividend payer with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives