- United States

- /

- Specialized REITs

- /

- NYSE:DLR

Is Digital Realty Attractively Priced After Recent Global Network Expansion and Stock Decline?

Reviewed by Bailey Pemberton

- Curious whether Digital Realty Trust is a deal or overpriced? You are not alone in wondering if now is the right time to buy, hold, or walk away.

- The stock has seen a tumultuous ride recently, dropping 10.8% over the past month and 16.2% over the past year, even as it reported a 57.1% return over three years.

- Much of this volatility has been fueled by shifting sentiment across the real estate and data center sectors, with investor attention focusing on Digital Realty’s role in powering the global digital economy. The company recently gained headlines for expanding its global network footprint and collaborating with cloud providers, adding new considerations to the ongoing evaluation of its shares.

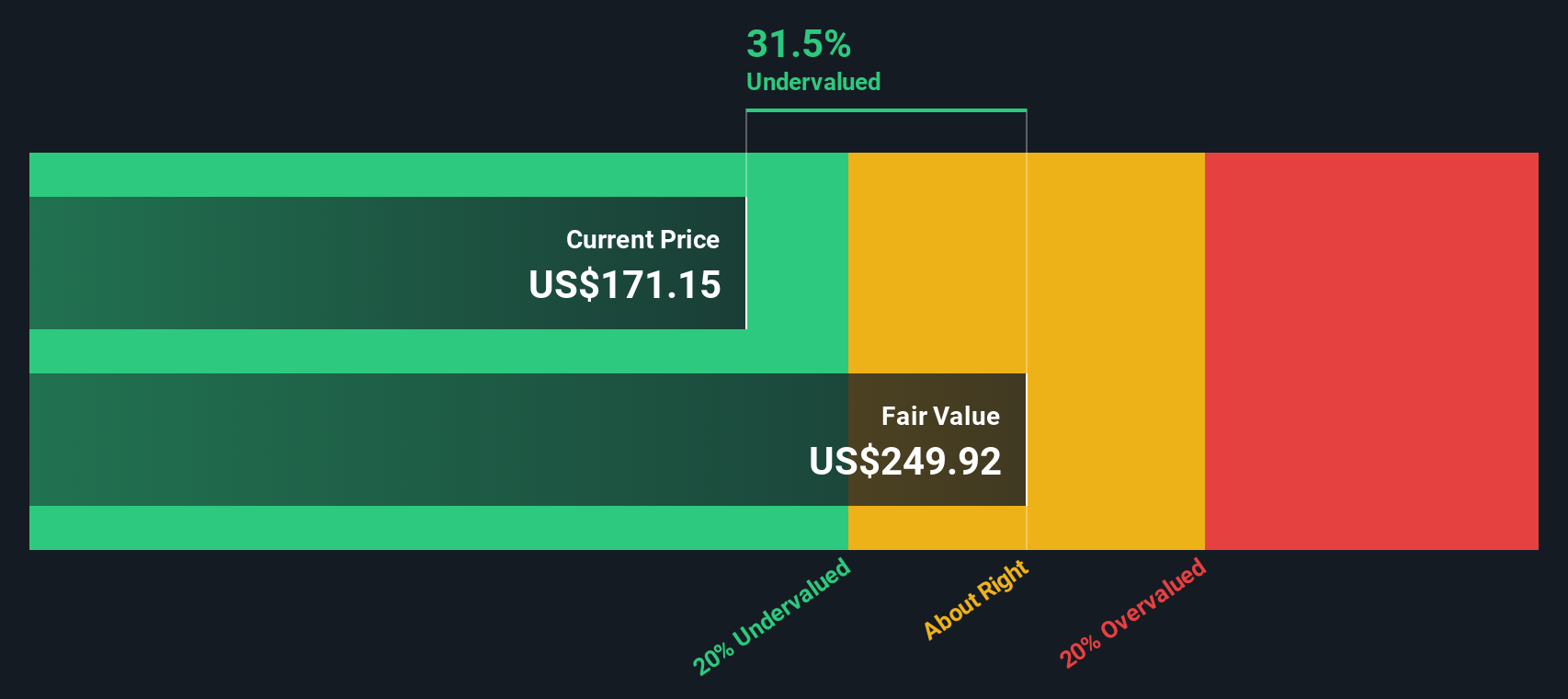

- According to our analysis, Digital Realty Trust earns a 3 out of 6 valuation score, ranking as undervalued in half of the key measures tracked. We will break down what this means using traditional methods, and later discuss a different way to approach valuation at the end of the article.

Approach 1: Digital Realty Trust Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates a company's value by projecting future cash flows and then discounting those back to today to account for risk and the time value of money. For Digital Realty Trust, the model uses adjusted funds from operations as the cash flow metric, which reflects the company’s ability to generate real, recurring cash that could ultimately benefit shareholders.

According to the latest analysis, Digital Realty Trust generated $2.02 billion in free cash flow (FCF) over the last 12 months. Analyst estimates project steady growth, expecting annual FCF to reach $3.70 billion by the end of 2029. Beyond that, projections up to 2035 are extrapolated based on current growth trends, suggesting ongoing expansion in Digital Realty's core business.

By discounting these projected cash flows back to today, the model arrives at an estimated intrinsic value per share of $235.96. This implies the stock is currently trading at a 32.7% discount relative to its calculated value, indicating substantial room for upside under these assumptions.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Digital Realty Trust is undervalued by 32.7%. Track this in your watchlist or portfolio, or discover 927 more undervalued stocks based on cash flows.

Approach 2: Digital Realty Trust Price vs Earnings

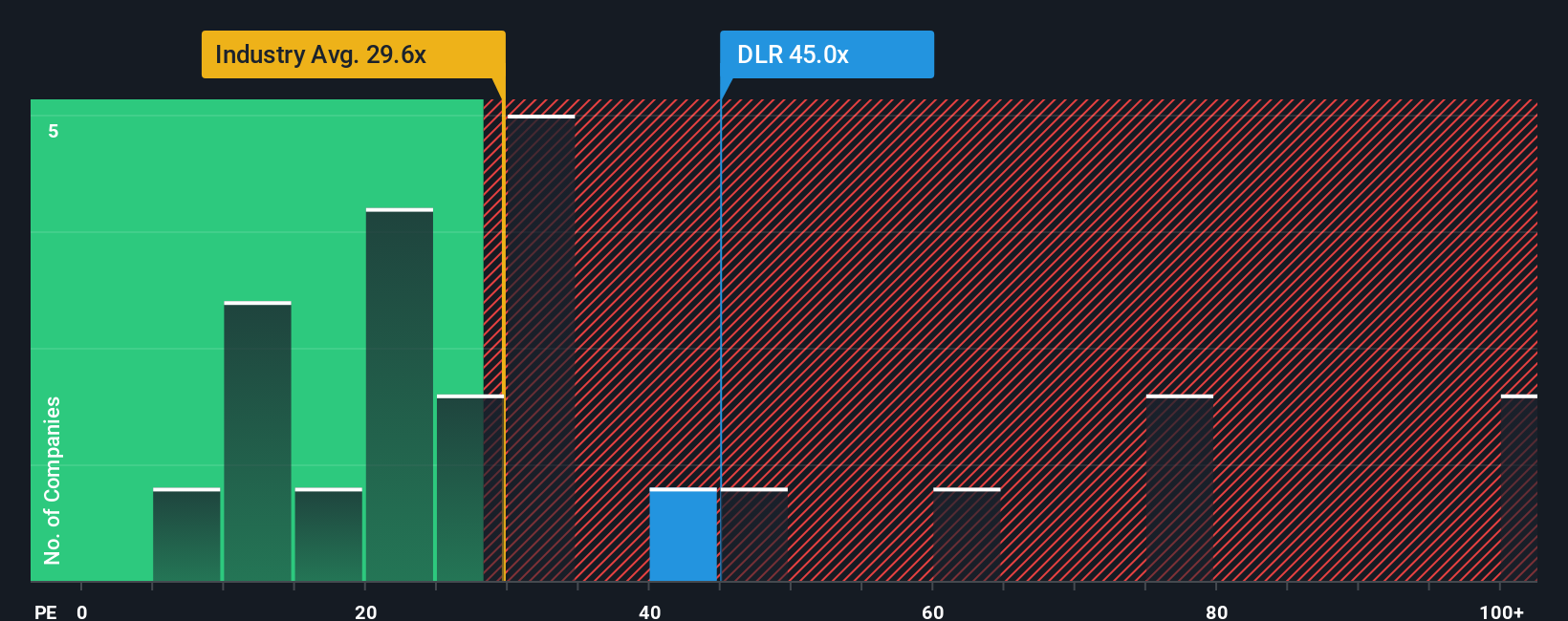

The price-to-earnings (PE) ratio is a practical tool for valuing profitable companies like Digital Realty Trust, since it highlights how much investors are willing to pay for each dollar of earnings. For established businesses with consistent profits, the PE ratio gives a direct window into market sentiment on future growth, risk, and profitability.

What constitutes a “normal” or “fair” PE depends on several factors. Faster growth rates and lower perceived risks can justify higher PE ratios, while slower growth or added uncertainty tend to push the desirable multiple down. For context, Digital Realty Trust currently trades at a PE of 40.17x, which is higher than both the industry average for Specialized REITs at 17.05x and also above its peer average of 34.29x.

This is where Simply Wall St’s proprietary “Fair Ratio” comes in. The Fair Ratio, standing at 27.99x for Digital Realty Trust, is calculated using a more comprehensive set of factors than peer or industry comparisons alone. It looks not only at earnings growth and profit margins, but also the company’s industry, its market capitalization, and the risks involved. This approach gives a much more tailored benchmark for fair value.

Comparing Digital Realty Trust’s actual PE multiple (40.17x) to its Fair Ratio (27.99x), the stock appears overvalued on an earnings basis. This suggests the current price may reflect investor optimism or other factors not fully captured by just fundamental performance.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1433 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Digital Realty Trust Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is simply your own story about a company, built from your best guesses on its future growth and profitability, and the fair value you believe is reasonable. Narratives help make sense of the financial numbers by linking them to the real-life business context, connecting what you believe about Digital Realty Trust's future to a clear financial forecast and an actionable fair value estimate.

On Simply Wall St’s Community page, Narratives offer an approachable tool that millions of investors use to summarize and update their perspectives without complicated models. As new news or earnings emerge, Narratives update dynamically, keeping your view current. Narratives can make buy or sell decisions clearer: you compare your Fair Value (your Narrative’s estimate) to the current stock Price.

For example, some investors see Digital Realty Trust riding the AI and cloud wave with robust revenue growth and assign a fair value above $199 per share, while others focus on competition and rising interest rates and set their fair value closer to $110. These are two perspectives and two different decisions, all driven by individual Narratives.

For Digital Realty Trust, here are previews of two leading Digital Realty Trust Narratives:

- 🐂 Digital Realty Trust Bull Case

Fair Value: $199.19

Current Price is approximately 20.2% below this fair value

Expected Revenue Growth: 12.96%

- Strong demand for data center capacity, a record backlog of uncommenced leases, and a new $10 billion hyperscale fund are expected to drive robust future revenue and earnings growth.

- Sustainability initiatives, such as green data centers and increased use of renewable energy, may enhance cost savings and strengthen market positioning.

- Main risks include rapid U.S. expansion possibly outpacing demand, volatility in capital markets and financing costs, intensified competition, and possible delays in customer decision-making that could slow leasing momentum.

- 🐻 Digital Realty Trust Bear Case

Fair Value: $110.45

Current Price is approximately 43.9% above this fair value

Expected Revenue Growth: 7%

- Growth in AI and cloud computing creates ongoing demand for data centers, yet Digital Realty faces significant risks from rising interest rates, high leverage, and intense competition from both peers and large hyperscale cloud providers.

- Stock is considered fairly valued to slightly undervalued if benchmarked on P/FFO, supported by solid long-term prospects in AI and interconnection. Future upside may be limited if interest rates remain high and supply outpaces demand.

- Potential reasons to sell include the risk of overvaluation if P/FFO expands without matched growth, rising debt costs eroding cash flow, slowing demand or customer concentration, and execution risks on expansion and innovation plans.

Do you think there's more to the story for Digital Realty Trust? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DLR

Digital Realty Trust

Digital Realty Trust, Inc. (“Digital Realty” or the “company”) owns, acquires, develops, and operates data centers through its operating partnership subsidiary, Digital Realty Trust, L.P.

Established dividend payer with proven track record.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Q3 Outlook modestly optimistic

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success