- United States

- /

- Specialized REITs

- /

- NYSE:DLR

Does the Recent 10% Drop Signal Opportunity in Digital Realty Trust in 2025?

Reviewed by Bailey Pemberton

- Thinking about whether Digital Realty Trust is a good value buy? You are not alone, as plenty of investors are curious about what the numbers say at today's prices.

- The stock’s performance has turned downward this year, with shares dropping 10.6% so far in 2024 and more recently sliding 6.9% over the past week.

- Behind these recent moves, investor sentiment has been shaped by continuing interest in data centers, new partnerships in cloud infrastructure, and big headlines about the growth of artificial intelligence demanding more server space. These stories have kept volatility high while the market weighs the opportunities against macroeconomic uncertainty.

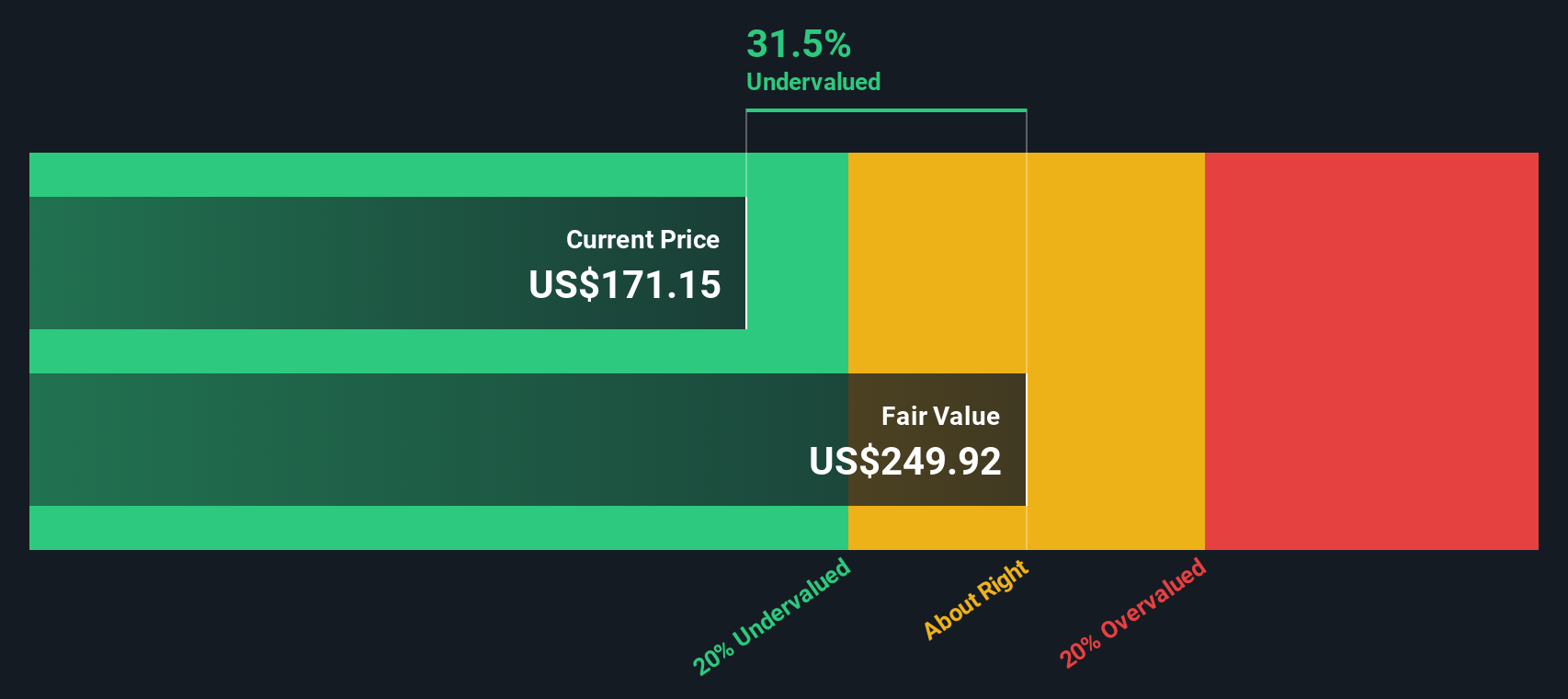

- Digital Realty Trust currently clocks a valuation score of 4 out of 6, meaning it is undervalued in four of the six valuation checks we run. Let’s break down what that means according to several valuation approaches and stay tuned to the end for a smarter way to judge whether the stock genuinely offers value.

Approach 1: Digital Realty Trust Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates what a company is worth by forecasting future adjusted funds from operations (in this case, free cash flow) and discounting those future cash flows back to their value in today's dollars. For Digital Realty Trust, this valuation uses a "2 Stage Free Cash Flow to Equity" approach with cash flow figures based on adjusted funds from operations.

Currently, Digital Realty Trust generates $2.02 Billion in free cash flow. Analysts project this figure to grow significantly, with estimates reaching $3.70 Billion by 2029 and projections, including extrapolated data beyond analyst estimates, pointing even higher through 2035. These projections demonstrate consistent positive growth year over year in the company's cash generation.

Using this DCF approach, the estimated fair value per share is $236.58. Compared to today’s market price, this implies the stock is trading at a 33.1% discount to its calculated intrinsic value. In simple terms, this analysis suggests that the market is underestimating Digital Realty Trust's future earning potential.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Digital Realty Trust is undervalued by 33.1%. Track this in your watchlist or portfolio, or discover 879 more undervalued stocks based on cash flows.

Approach 2: Digital Realty Trust Price vs Earnings

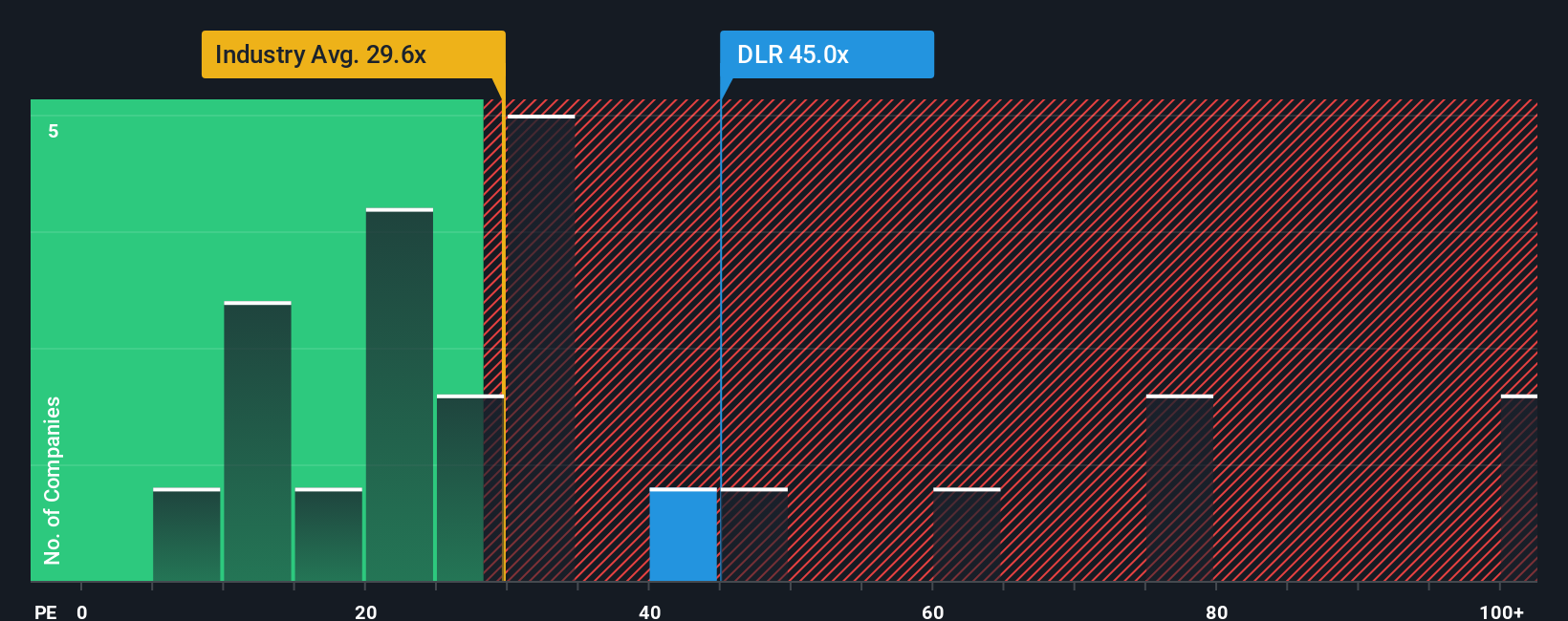

For profitable companies like Digital Realty Trust, the Price-to-Earnings (PE) ratio is a widely used metric because it shows how much investors are willing to pay for each dollar of earnings the company generates. The PE ratio makes it easier to gauge whether a stock looks expensive or cheap compared to both its industry and its growth prospects.

What counts as a “fair” PE often depends on a mix of growth expectations and perceived risks. In general, higher growth projections and lower risk can justify a higher PE, while slower growth or more uncertainty usually call for a lower multiple. At the time of writing, Digital Realty Trust trades on a PE ratio of 40x. This is notably higher than the industry average PE of 17x for Specialized REITs, but it is actually below the peer group average of 75x. This reflects how investors may be balancing company-specific prospects and wider market sentiment.

Simply Wall St’s proprietary “Fair Ratio” digs deeper by considering not just earnings or peer averages, but also factors like expected growth, profit margins, company size, and risk profile, all in the context of its industry. For Digital Realty Trust, the Fair Ratio stands at 27.9x, which is lower than both its current PE ratio and the peer average. The Fair Ratio approach offers a more tailored valuation benchmark because it anchors the comparison in fundamentals that actually drive investor returns, unlike simple peer or sector averages.

Comparing Digital Realty Trust's actual PE of 40x with its Fair Ratio of 27.9x, the stock currently trades at a higher multiple than what would be considered fair based on those fundamentals. This suggests the market is pricing in additional optimism or factors not captured in the Fair Ratio.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1405 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Digital Realty Trust Narrative

Earlier we mentioned that there is an even better way to understand valuation. Let's introduce you to Narratives, an innovative tool that brings together the story you believe about a company with your assumptions about its future performance. A Narrative is your own perspective on Digital Realty Trust: you combine your expectations for revenue growth, future profits, and margins into a simple story that backs up what you think the fair value should be.

Narratives link the company's story to a personalized financial forecast and then automatically generate a fair value estimate for you. Available on Simply Wall St’s Community page (used by millions of investors), creating a Narrative is easy and accessible for anyone looking to make smarter, story-driven decisions.

With Narratives, you can compare your calculated fair value to the current share price. If your story is more optimistic, you might see an opportunity to buy; if it is more cautious or factors in risks that others ignore, you might decide to stay away or sell. Narratives are always evolving, as they dynamically update when new data or earnings are released.

For example, some Digital Realty Trust investors believe strong AI and cloud demand will drive revenue growth and assign a fair value as high as $199 per share, while more cautious investors who are worried about overcapacity and debt see fair value as low as $110. This proves there are many valid perspectives on what the stock is truly worth.

For Digital Realty Trust, we make it straightforward for you with previews of two leading Digital Realty Trust Narratives:

- 🐂 Digital Realty Trust Bull Case

Fair Value: $199.19

Undervalued by: 20.6%

Revenue Growth Rate: 12.95%

- Analysts believe strong data center demand, AI and cloud trends, and expansion projects will drive steady revenue growth and long-term profitability.

- Sustainability efforts, such as green data centers and renewable energy initiatives, are expected to improve costs and market standing.

- The biggest risks include oversupply in certain U.S. markets, rising debt costs with higher interest rates, and competitive pressure impacting future margins.

- 🐻 Digital Realty Trust Bear Case

Fair Value: $110.45

Overvalued by: 43.7%

Revenue Growth Rate: 7%

- AI and cloud adoption fuels demand now, but headwinds such as rising interest rates, intense competition, and energy costs pose real risks to future profitability.

- Overcapacity is a concern, particularly if supply outpaces demand or if hyperscalers like Google or Amazon increasingly build their own data centers.

- Valuation appears stretched. If the company fails to deliver on growth projections or interest costs stay high, downside is likely.

Whichever story you believe, the key is to compare these perspectives to your own expectations and investment goals. Narratives let you see expert assumptions, but ultimately the most valuable investment thesis is the one you truly understand and can defend for yourself.

Do you think there's more to the story for Digital Realty Trust? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DLR

Digital Realty Trust

Digital Realty Trust, Inc. (“Digital Realty” or the “company”) owns, acquires, develops, and operates data centers through its operating partnership subsidiary, Digital Realty Trust, L.P.

Established dividend payer and good value.

Similar Companies

Market Insights

Community Narratives