- United States

- /

- Specialized REITs

- /

- NYSE:DLR

Digital Realty Trust (DLR): Evaluating Valuation Following Record Earnings and Upgraded Outlook on AI-Fueled Demand

Reviewed by Simply Wall St

Digital Realty Trust (DLR) just posted a standout quarter, with record funds from operations and a higher full-year outlook. The company is seeing steady momentum as demand for data center services, especially around artificial intelligence, continues to grow.

See our latest analysis for Digital Realty Trust.

After a steady stretch for most of the year, Digital Realty Trust’s share price has only nudged higher, up about 1% year-to-date. However, that small move masks an impressive three-year total shareholder return of nearly 97%. With this quarter’s earnings beat and a raised outlook, momentum appears to be building on the back of persistent AI demand and major leasing wins.

If the surge in data center demand has you curious, now’s the perfect time to discover See the full list for free.

But with shares already near all-time highs, can investors still find value in Digital Realty Trust, or has Wall Street already anticipated the next phase of AI-fueled growth?

Most Popular Narrative: 9.3% Undervalued

Digital Realty Trust’s widely followed narrative signals that the stock has room to run, with a fair value estimate well above the recent closing price. The premium placed by market watchers sets up a clash between strong headline demand and what is already priced in.

"The successful formation of Digital Realty's first U.S. hyperscale fund is expected to fuel future growth with up to $10 billion in investments, leading to enhanced revenue and returns through fees, highlighting its significant potential impact on long-term earnings sustainability."

Want to know the growth blueprint behind this high valuation? The key element of this narrative is record-breaking earnings and a future profit multiple usually associated with tech leaders. Interested in which bold financial projections support that price target? Dive deeper to see the surprising numbers that drive this fair value calculation.

Result: Fair Value of $197.70 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, rapid data center expansion could overshoot actual demand, and shifting interest rates may add pressure to future profit margins.

Find out about the key risks to this Digital Realty Trust narrative.

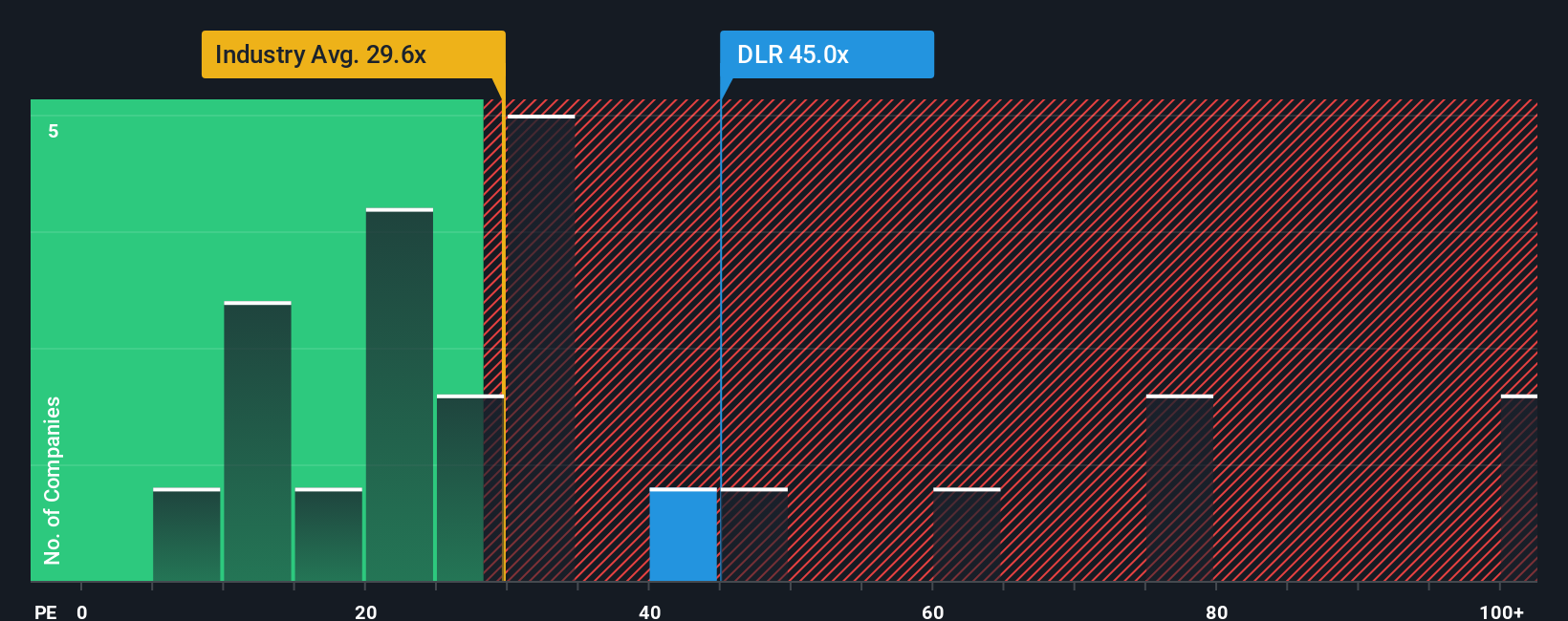

Another View: Market Multiples Tell a Different Story

Taking a look at valuation ratios, Digital Realty Trust trades at a lofty price-to-earnings ratio of 45.3x, noticeably higher than both its industry peers at 27.9x and its fair ratio of 30.8x. This premium suggests the market is betting heavily on future growth, but it also leaves little margin for error. Could this optimism set up a valuation risk ahead?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Digital Realty Trust Narrative

If you’re looking for a fresh perspective or want to conduct your own research, it's easy to build your own narrative in just minutes. Do it your way.

A great starting point for your Digital Realty Trust research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Unlock even more potential for your portfolio and don't let these compelling trends pass you by. Take the lead and target growth, value, and innovation today.

- Capture rapid growth in the AI sector by evaluating breakthrough opportunities with these 27 AI penny stocks shaping tomorrow's technology landscape.

- Zero in on undervalued gems positioned for a rebound by analyzing these 877 undervalued stocks based on cash flows showing strong cash flow potential and attractive price points.

- Capitalize on the future of computing by researching these 28 quantum computing stocks moving the needle in this revolutionary field.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DLR

Digital Realty Trust

Digital Realty Trust, Inc. (“Digital Realty” or the “company”) owns, acquires, develops, and operates data centers through its operating partnership subsidiary, Digital Realty Trust, L.P.

Established dividend payer with proven track record.

Similar Companies

Market Insights

Community Narratives