- United States

- /

- Specialized REITs

- /

- NYSE:DLR

Digital Realty (DLR): One-Off Gain Drives Margin Surge, Raising Questions on Quality of Recent Earnings

Reviewed by Simply Wall St

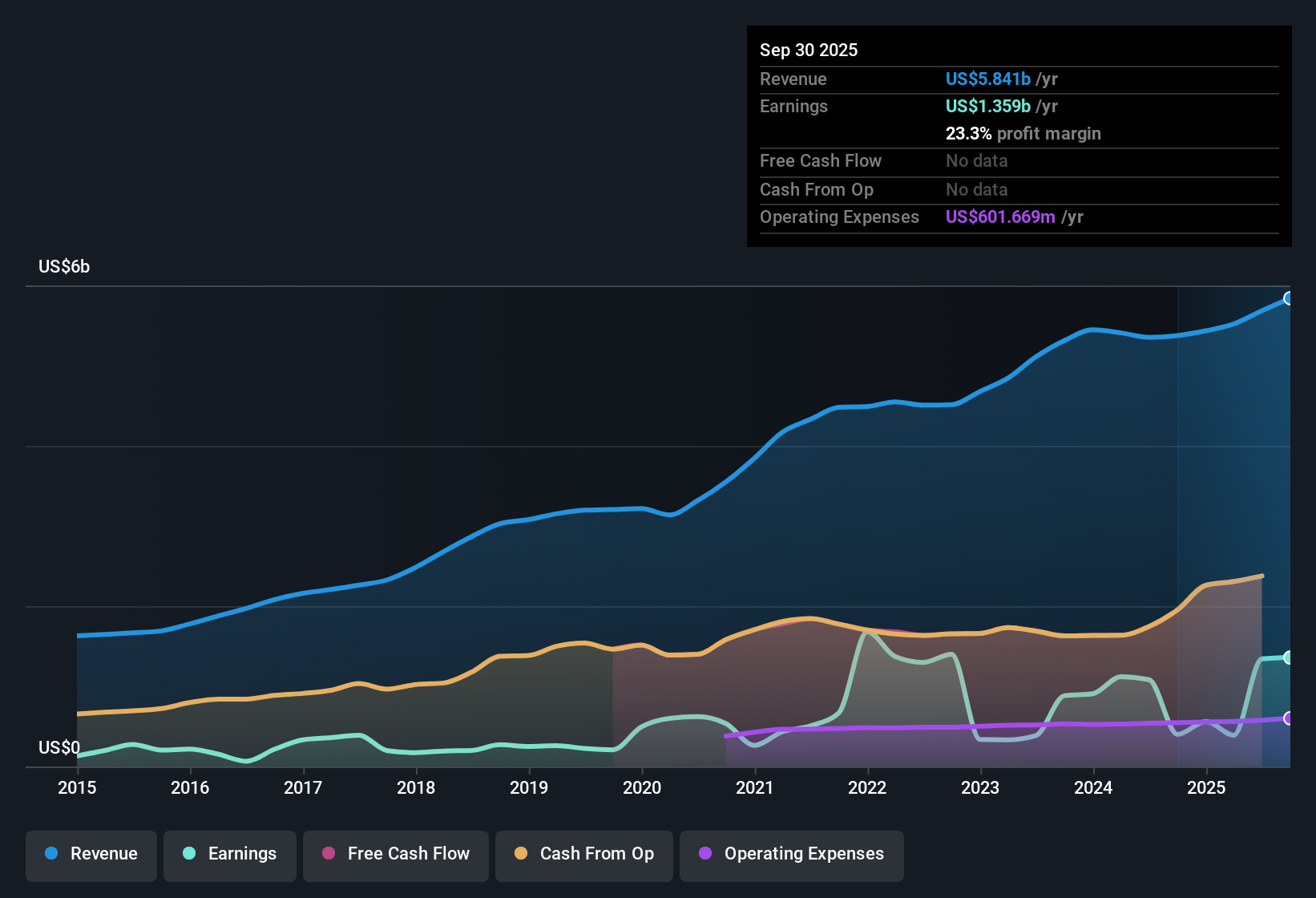

Digital Realty Trust (DLR) reported net profit margins of 23.5%, a substantial jump from last year’s 7.5%, with revenue growth projected at 10.8% per year, which is faster than the broader US market’s 10% average. Over the last year, earnings reflected a sharp acceleration, up 239.3% compared to the company’s 6.5% annualized growth rate over the past five years. However, the latest figure was boosted by a one-off gain of $1.0 billion. Investors are now weighing these headline results against a forecast for declining earnings, even as the company continues to post strong top-line growth.

See our full analysis for Digital Realty Trust.Now, let’s see how these figures measure up to the current narratives that shape expectations for Digital Realty Trust. Some common threads may hold, while other assumptions could be challenged by the numbers.

See what the community is saying about Digital Realty Trust

Sharp Margin Expansion Drives Mixed Outlook

- Net profit margins at 23.5% now stand more than triple last year’s 7.5%, but analyst forecasts expect these margins to decline to 13.2% within three years as one-off gains roll off and costs normalize.

- Analysts' consensus view emphasizes that strong demand for data center capacity and a record lease backlog could support revenue and profit growth.

- However, the steep projected drop in margins highlights skepticism about how much of these gains are sustainable, with analysts divided on whether DLR can keep earnings above $1.0 billion by 2028.

- This tension between headline profitability and future pressures is at the heart of ongoing debates about DLR’s fundamental strength.

- Despite these cross-currents, analysts see a substantial upside if DLR’s growth plays out as hoped. Dive into the full consensus case for the company’s multi-year trajectory. 📊 Read the full Digital Realty Trust Consensus Narrative.

Valuation Discount Doesn’t Tell The Whole Story

- Digital Realty’s share price of $179.28 trades not only below its consensus analyst target of $198.44 but is also under its DCF fair value estimate of $217.02, creating a headline discount despite a lofty 45x PE ratio that towers over the industry’s 29x.

- Consensus narrative weighs the prospects for revenue and margin compression.

- The current valuation discount could look justified if earnings fall at the forecast 5.5% annual rate, making the present premium multiple hard to defend for skeptics.

- Bullish arguments rest on continued strong leasing from cloud and AI customers along with strategic expansion, supporting the case for a premium, but falling margins remain the key concern for value-focused investors.

Analyst Price Target Signals Room To Run

- The current share price of $179.28 sits 10.7% below the analyst consensus price target of $198.44, which itself assumes a premium valuation at 90.9x forward PE on 2028 earnings, well above current industry norms.

- Consensus narrative flags that analysts expect revenue to hit $7.9 billion and earnings to stabilize near $1.0 billion by 2028.

- This bullish stance is not unanimous, as the range of analyst forecasts shows significant disagreement, from as high as $1.3 billion in earnings to as low as $423 million. If growth underwhelms, the current price could look less attractive in retrospect.

- The implied upside is rooted in rapid fundamental growth, but the wide forecast range means certainty is elusive even for seasoned bulls.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Digital Realty Trust on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

View the data through a new lens. Take a couple of minutes to shape your perspective and add your own narrative. Do it your way

A great starting point for your Digital Realty Trust research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

See What Else Is Out There

Despite impressive top-line growth, Digital Realty Trust faces skepticism over its premium valuation and vulnerability to falling margins, as earnings are expected to decline.

If you want to sidestep these valuation headwinds, check out these 869 undervalued stocks based on cash flows to focus on stocks trading at compelling discounts with stronger fundamentals underpinning future returns.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DLR

Digital Realty Trust

Digital Realty Trust, Inc. (“Digital Realty” or the “company”) owns, acquires, develops, and operates data centers through its operating partnership subsidiary, Digital Realty Trust, L.P.

Established dividend payer with proven track record.

Similar Companies

Market Insights

Community Narratives