- United States

- /

- Office REITs

- /

- NYSE:DEI

How Investors Are Reacting To Douglas Emmett (DEI) Surpassing Earnings Forecasts Ahead of Q3 2025 Results

Reviewed by Sasha Jovanovic

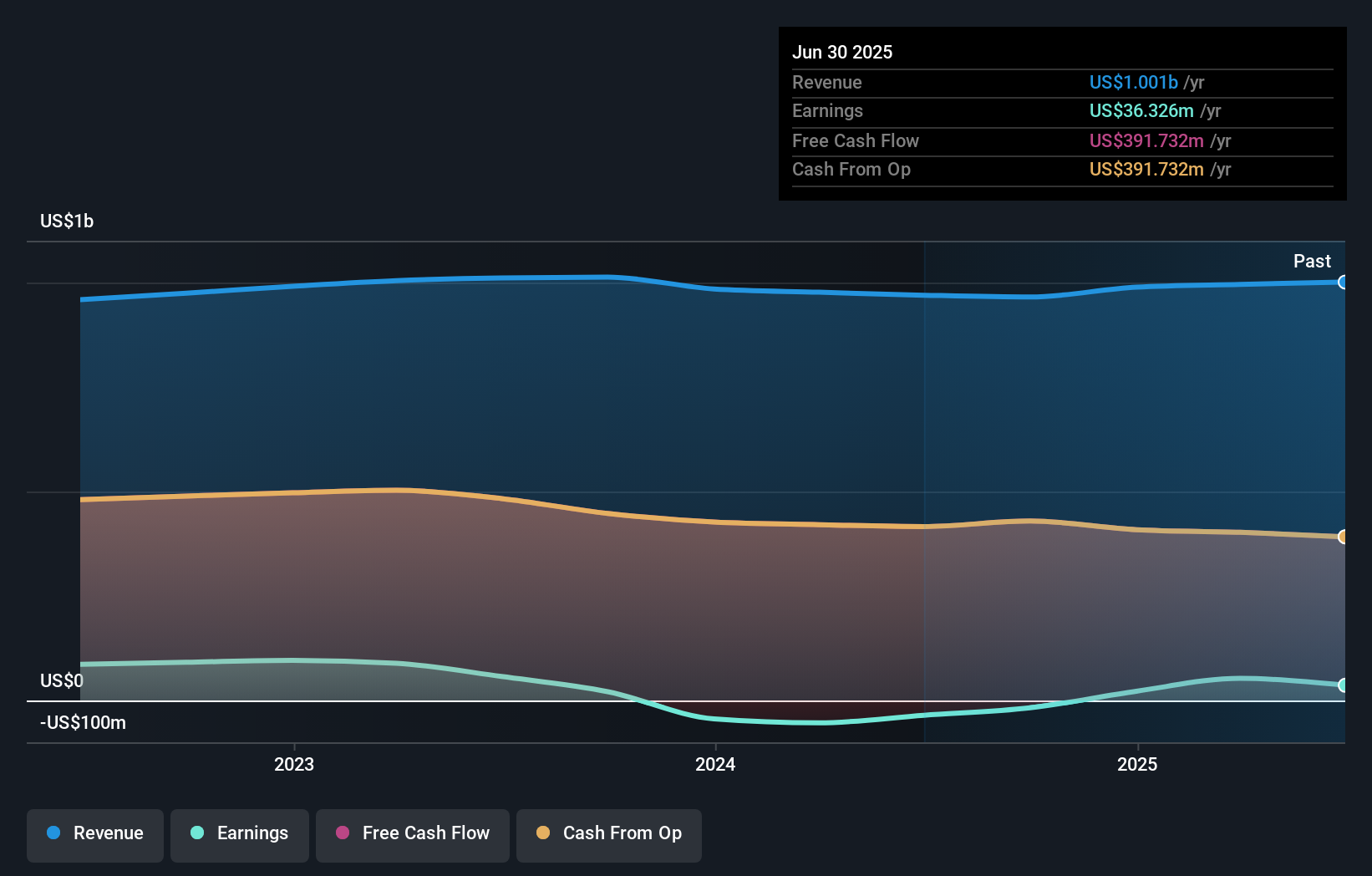

- Douglas Emmett, Inc. is set to report its Q3 2025 earnings on November 4, 2025, following a previous quarter in which both revenue and earnings surpassed analyst expectations.

- Recent financial outperformance has heightened anticipation around the upcoming results, reflecting increased investor attention toward Douglas Emmett’s operational momentum.

- We’ll explore how Douglas Emmett’s prior earnings beat shapes expectations for its upcoming results and the resulting investment outlook.

Rare earth metals are the new gold rush. Find out which 38 stocks are leading the charge.

Douglas Emmett Investment Narrative Recap

To invest in Douglas Emmett, I need to believe in a sustained rebound in office and residential real estate demand, especially in high-value markets, despite lingering uncertainties around tenant retention and near-term earnings. While the latest earnings beat signals positive operational execution and temporarily boosts sentiment, it does not materially change that the most immediate catalysts revolve around office occupancy stabilization, while the largest risk remains potential downward pressure from ongoing tenant losses and interest expense.

Among the company’s recent announcements, Douglas Emmett’s successful refinancing of around US$941 million in loans stands out. By extending maturities and securing a fixed interest rate, the company attempts to reduce the risk of near-term financing pressures, directly relevant amid higher interest costs, helping to support short-term financial stability even as operational headwinds persist.

However, despite these adjustments, there remains the issue of potential office tenant departures, a factor investors should watch closely as...

Read the full narrative on Douglas Emmett (it's free!)

Douglas Emmett's outlook forecasts $1.0 billion in revenue and $88.1 million in earnings by 2028. This scenario assumes a 1.1% annual revenue growth rate and a $66 million increase in earnings from the current level of $22.1 million.

Uncover how Douglas Emmett's forecasts yield a $16.86 fair value, a 30% upside to its current price.

Exploring Other Perspectives

All ten fair value estimates from the Simply Wall St Community place Douglas Emmett at US$16.86 per share, showing no variation across contributors. This consistency contrasts sharply with analyst consensus highlighting continued risks from tenant losses, which could weigh on future results even if expectations are currently aligned; consider how other investors are interpreting these challenges.

Explore another fair value estimate on Douglas Emmett - why the stock might be worth as much as 30% more than the current price!

Build Your Own Douglas Emmett Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Douglas Emmett research is our analysis highlighting 3 key rewards and 4 important warning signs that could impact your investment decision.

- Our free Douglas Emmett research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Douglas Emmett's overall financial health at a glance.

No Opportunity In Douglas Emmett?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Find companies with promising cash flow potential yet trading below their fair value.

- Outshine the giants: these 27 early-stage AI stocks could fund your retirement.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DEI

Douglas Emmett

Douglas Emmett, Inc. (DEI) is a fully integrated, self-administered and self-managed real estate investment trust (REIT), and one of the largest owners and operators of high-quality office and multifamily properties located in the premier coastal submarkets of Los Angeles and Honolulu.

Average dividend payer with slight risk.

Similar Companies

Market Insights

Community Narratives