- United States

- /

- Office REITs

- /

- NYSE:DEI

Douglas Emmett (DEI) Profitability Hinges on $47.2M One-Off Gain, Raising Earnings Quality Questions

Reviewed by Simply Wall St

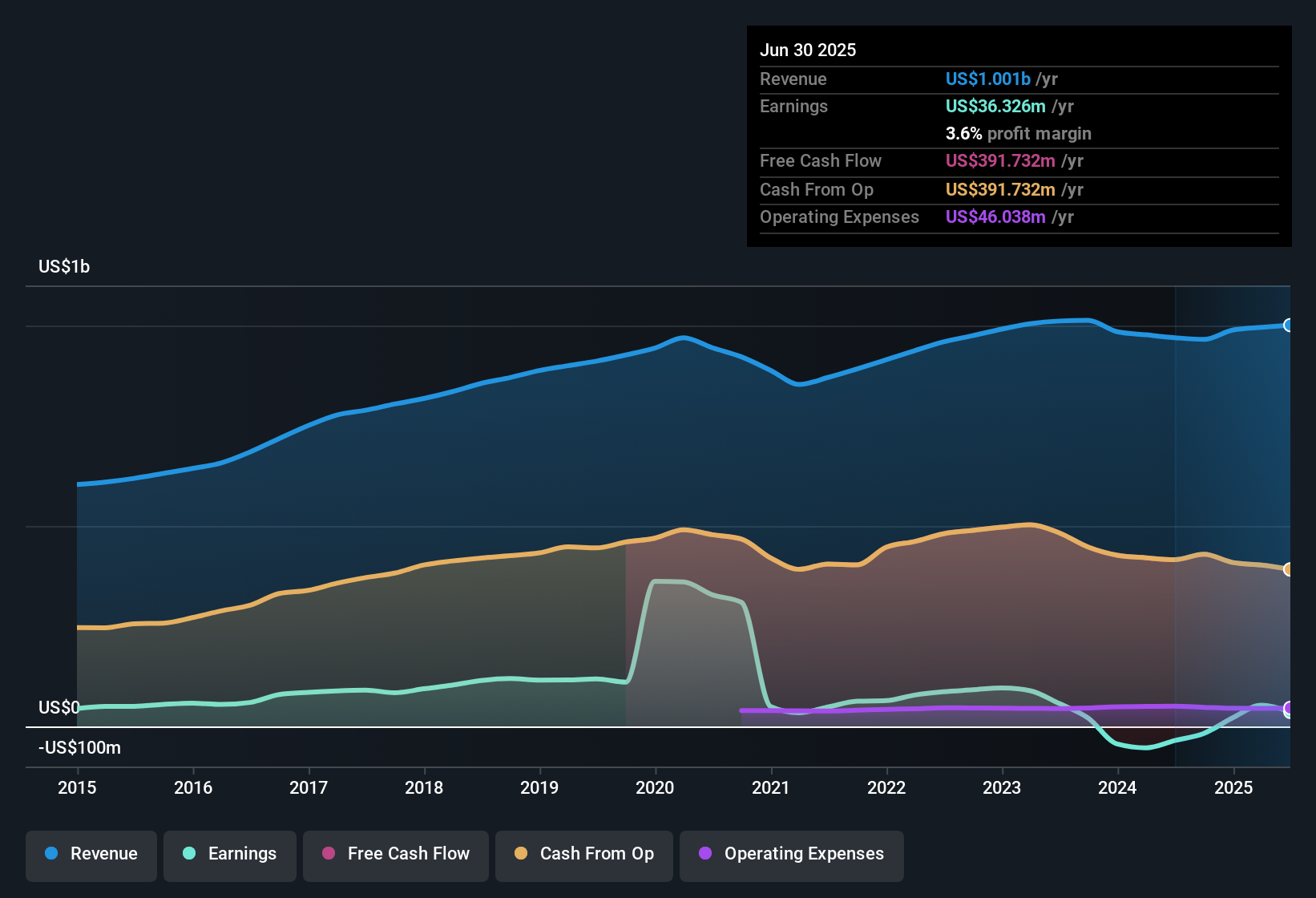

Douglas Emmett (DEI) turned a profit in the most recent year, aided by a substantial one-off gain of $47.2 million that helped lift its net profit margin. Yet, beneath this headline result, the company’s earnings have trended down sharply. Earnings declined 42.8% annually over the past five years and are forecast to fall by a further 87.4% per year over the next three years, with revenue only expected to grow at 2.5% per year. Investors may see value potential as shares change hands at $12.23, well below analyst fair value and target estimates, but the results highlight an ongoing tension between cheapness on paper and persistent operational challenges.

See our full analysis for Douglas Emmett.The next section takes these results and measures them up against the main narratives driving debate around Douglas Emmett. Let’s see where the numbers confirm or contradict the stories in play.

See what the community is saying about Douglas Emmett

Profit Margin Lift Hinges on $47.2 Million Gain

- The recent improvement in Douglas Emmett's net profit margin was primarily driven by a one-time non-recurring gain of $47.2 million, rather than recurring business performance.

- Analysts' consensus view anticipates that redevelopment of the Studio Plaza property and joint ventures at Wilshire and Westwood Boulevards could improve long-term margins and stabilize income.

- The sustainability of these efforts will depend on boosting recurring earnings, as the current margin strength is not rooted in ongoing operations.

- Occupancy improvements and stable debt costs are expected catalysts. However, the reliance on non-recurring gains leads critics to question margin durability for the next cycle.

- See what’s at stake for Douglas Emmett’s story as analysts weigh the sustainability of these profit margins. 📊 Read the full Douglas Emmett Consensus Narrative.

PE Ratio Far Exceeds Industry Norms

- Douglas Emmett trades at a price-to-earnings ratio of 56.4x, significantly higher than the office REIT peer average of 39.5x and the broader industry at 22.3x.

- Analysts’ consensus narrative acknowledges the valuation disconnect.

- While the stock appears "cheap" to some on a discounted cash flow or price target basis, it remains expensive relative to profits actually produced in recent years.

- This dynamic challenges bullish arguments that point only to headline price discounts, since the company’s premium PE outweighs typical value investor standards.

Revenue Growth Lags Market, Occupancy Risks Loom

- Future annual revenue growth is forecast at only 2.5% for Douglas Emmett, noticeably below the 10.5% average expected across the US market.

- Analysts’ consensus narrative underscores that lower office occupancy following the loss of key tenants and increased interest expense are likely to keep revenue and income growth below industry trends.

- Guidance signals negative net income per share into 2025 and muted expected impact from new joint ventures.

- Bearish analysts argue that continued challenges in office absorption and legislative risks to residential properties may further drag on revenue recovery.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Douglas Emmett on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Does the data tell you a different story? Share your take in just a few minutes to shape your own narrative. Do it your way

A great starting point for your Douglas Emmett research is our analysis highlighting 3 key rewards and 4 important warning signs that could impact your investment decision.

See What Else Is Out There

While Douglas Emmett’s margins depend on one-off gains, persistent high valuation multiples and sluggish growth projections point to ongoing business challenges.

If you’re searching for more reliable performers, use stable growth stocks screener (2074 results) to uncover companies that consistently grow earnings and revenue, even when others struggle.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DEI

Douglas Emmett

Douglas Emmett, Inc. (DEI) is a fully integrated, self-administered and self-managed real estate investment trust (REIT), and one of the largest owners and operators of high-quality office and multifamily properties located in the premier coastal submarkets of Los Angeles and Honolulu.

Average dividend payer with slight risk.

Similar Companies

Market Insights

Community Narratives